Prøve GULL - Gratis

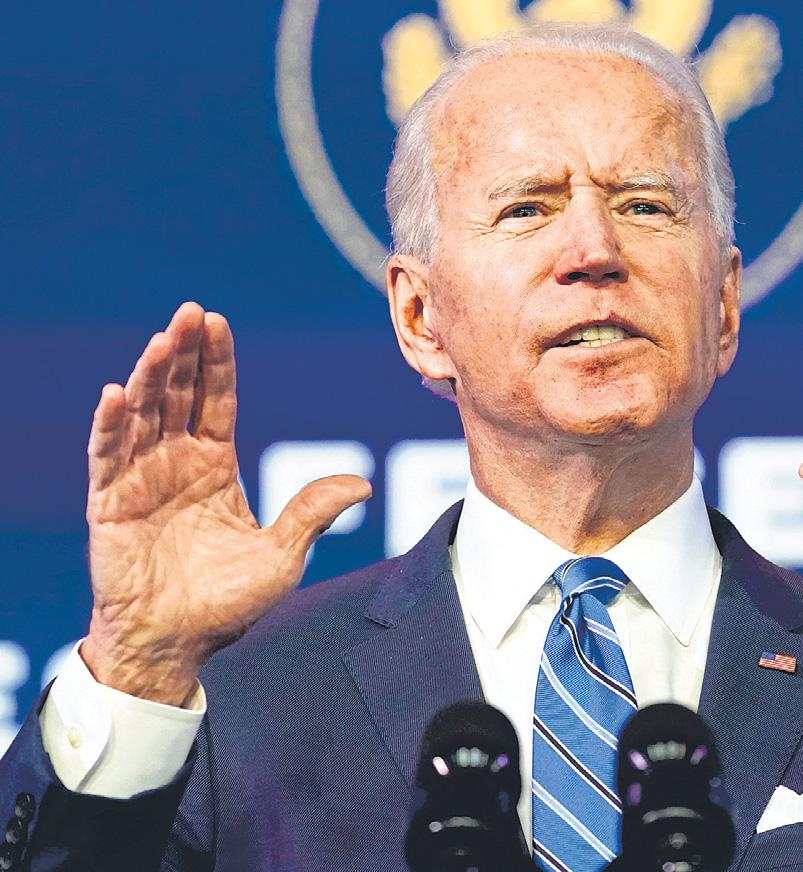

Why Bidenomics did not deliver in spite of its working class focus

Mint Mumbai

|December 10, 2024

Joe Biden's policies failed to recognize the changed nature of the US economy and so they were unable to achieve their aims

As US president, Joe Biden charted a new economic path for the Democrats by siding unabashedly with the working class and introducing a wide range of industrial policies to reinvigorate US manufacturing, reshore supply chains and promote the green transition. Most of these new policies made economic sense, and like many other progressives, I thought they made political sense as well. What, then, accounts for Vice-President Kamala Harris's disappointing electoral performance, especially with working-class voters?

Donald Trump's appeal, like that of right-wing ethno-nationalists elsewhere, owes much to rising levels of economic insecurity, which many regard as the result of deregulation, increased corporate power, globalization, deindustrialization and automation. As the traditional champions of the underdog, centre-left parties could have benefited from these developments. But they had come to speak more for educated professional elites, and they were slow to alter course. Faced with the growing perception that they'd abandoned their working-class roots, Biden's move toward economic populism seemed like the right strategy.

One interpretation of Trump's re-election is that economic populism was a mistake, implying that the Democratic Party should have moved more forcefully to the centre-ground instead. But Harris's apparently fruitless efforts to woo middle-of-the-road Republican voters was not much of a success either.

Denne historien er fra December 10, 2024-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

Automation hits tech jobs as GCCs too dial back on hiring

Quess ended last quarter with ₹3,832 crore in revenue, up 5% sequentially.

1 mins

November 21, 2025

Mint Mumbai

Donald Trump puts on ‘unbelievable show’ for Saudi crown prince

In feting the crown prince, Trump has again pivoted to foreign policy, one of his focus areas

4 mins

November 21, 2025

Mint Mumbai

India must build from within to protect itself in a fractured world

Can we function if the world unplugs us digitally? This is the litmus test of our sovereignty today

3 mins

November 21, 2025

Mint Mumbai

Mahindra targets 8-fold auto growth

Mahindra Group is aiming for an eight-fold growth in consolidated revenue of its auto sector by FY30 compared to that in FY20, betting big on SUVs and light commercial vehicles.

1 min

November 21, 2025

Mint Mumbai

Standardize expenditure heads by FY28: CAG tells states

CAG's move is aimed at overhauling India's public finance system.

1 min

November 21, 2025

Mint Mumbai

Decoding Narayana stock spurt

Narayana Hrudayalaya Ltd investors must be in the pink of health.

2 mins

November 21, 2025

Mint Mumbai

Valuation format plan may cut IBC disputes: IBBI

The Insolvency and Bankruptcy Board of India (IBBI) has proposed a new format for professionals valuing distressed assets to make reports uniform, credible, and reduce lawsuits.

1 mins

November 21, 2025

Mint Mumbai

Delhi may miss the biggest e-bus roll-out

The 2,800 electric buses allocated to Delhi under the PME-Drive scheme meant to electrify public transport hangs in the balance, as the city government has yet to meet a crucial condition under the incentive plan.

2 mins

November 21, 2025

Mint Mumbai

Institutional investor pushback eases

The percentage of company resolutions opposed by large institutional investors declined in the first half ended September, even as promoters continue to have their way on most decisions put to a vote.

2 mins

November 21, 2025

Mint Mumbai

KKR to raise $15 bn in new Asia PE fund

KKR has kicked off fundraising for its fifth Asia private equity fund, seeking to raise $15 billion in what would be one of the region's largest buyout fundraisings, three people with knowledge of the matter said.

1 min

November 21, 2025

Listen

Translate

Change font size