Prøve GULL - Gratis

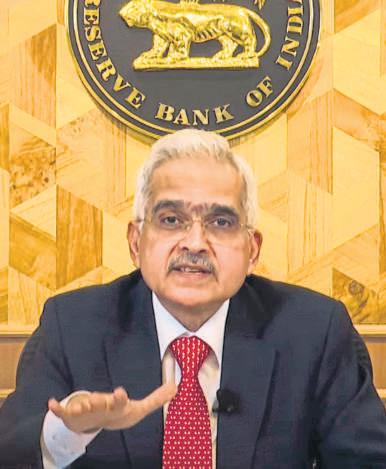

Prudence wins the day: RBI does not effect a knee-jerk rate cut

Mint Mumbai

|December 09, 2024

By not dropping its inflation focus, RBI showed it'll go by what the economy needs and not what the government may want

Here's something about the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) meetings that makes these the cynosure of all eyes. What stood out about the meeting that concluded on Friday, however, was not only the usual toss-up between growth and inflation. Or the fact that it was the first after the government waded into RBI's territory with first commerce and industry minister Piyush Goyal and then finance minister Nirmala Sitharaman making public statements on the need to cut policy rates. Rather, it was the fact that it was the last MPC meet scheduled to be held under the chairmanship of RBI Governor Shaktikanta Das whose (extended) term ends on 10 December.

The unstated question on everyone's mind was whether in the choice between supporting growth and fighting inflation, the MPC (or more correctly, the governor, since he has a casting vote) would veer towards the former, as desired by the government, or continue its ongoing fight against high inflation.

Would Das succumb to government and market pressure or stand by what has long become what seems like an act of faith with him? That the bank would "remain unambiguously focused on a durable alignment of inflation with the target, while supporting growth."

That question was answered unambiguously by Das. The present growth-inflation balance requires the central bank to retain its vigil on inflation even as it keeps an eye on economic growth. No wonder the MPC voted by a 4:2 majority to keep the policy rate unchanged at 6.5%, as also the stance at neutral.

Denne historien er fra December 09, 2024-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint Mumbai

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint Mumbai

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint Mumbai

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint Mumbai

Would you like to be interviewed by an AI bot instead?

I don't think I want to be interviewed by a human again,\" said a 58-year-old chartered accountant who recently had an interview with a multinational company.

3 mins

November 28, 2025

Mint Mumbai

Sebi now trains sights on commodity derivatives

Following clampdown on equity derivatives after studies revealed steep retail losses, the stock market regulator is turning its attention to the commodity derivatives segment (CDS).

2 mins

November 28, 2025

Mint Mumbai

The curious case of LIC's voting on RIL, Adani resolutions

Life Insurance Corp. of India Ltd, or LIC, consistently approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected several similar proposals at other large companies, some even part of other conglomerates, a Mint review of about 9,000 voting decisions by the government-run insurer showed.

8 mins

November 28, 2025

Mint Mumbai

Refiners, SCI tap Korean giants for local shipyard

Indian Oil, Bharat Petroleum and Hindustan Petroleum are part of the discussions

4 mins

November 28, 2025

Mint Mumbai

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Mumbai

Telcos slam Trai penalty plan for financial report flaws

Trai has proposed turnover-linked penalties for filing incorrect, incomplete financial reports

2 mins

November 28, 2025

Listen

Translate

Change font size