Prøve GULL - Gratis

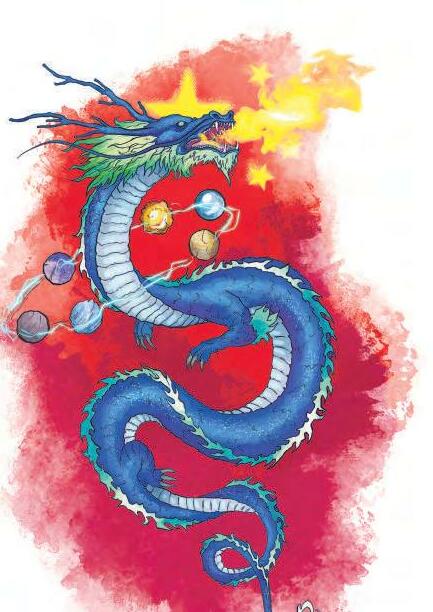

How Resources Turned Frontline Weaponry

Mint Mumbai

|June 02, 2025

The US-China battle for supremacy has turned commercial assets into strategic geopolitical instruments

Recently, J.D. Vance, the US vice president, confirmed what the world feared. He termed the competition between the US and China in developing artificial intelligence (AI) as an 'arms race'. Policy makers in both the countries believe that whoever wins this race will dominate the world, going forward. At the core of this battle is computing power and this has given a fresh impetus to the chip war that began between the US and China five years ago.

In May 2020, during his first term as the president of the US, Donald Trump fired the first salvo. The US commerce department added Chinese tech giant Huawei Technologies to the 'Entity List', a measure which prevented the company that sells smartphones, telecom equipment and cloud computing services from accessing advanced computer chips produced or developed using US technology or software. The reason? The US feared that Huawei's attractively priced products, backed by Chinese government subsidy, would soon dominate the next generation telecom networks, ending American clout in the field. The move had a debilitating impact on Huawei. Its global expansion took a hit and revenue crashed. "A corporate giant faced technological asphyxiation," Chris Miller, in his book Chip War, wrote.

According to him, this development reminded China of its weakness. "In nearly every step of the process of producing semiconductors, China is staggeringly dependent on foreign technology, almost all of which is controlled by its geopolitical rivals—Taiwan, Japan, South Korea or the US," he wrote. China began investing billions of dollars to develop its own semiconductor technology in a bid to free itself from America's chip choke, he added.

Denne historien er fra June 02, 2025-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

UPI loans soon, credit card-style

India's retail payments body, the National Payments Corporation of India, is in talks with lenders to roll out credit lines as low as ₹5,000 on the Unified Payments Interface (UPI), banking on credit card-like interest-free periods and regulatory clarity to boost uptake, according to two people close to the development.

3 mins

January 20, 2026

Mint Mumbai

TRUMP 2.0: ONE YEAR OF TWISTS AND TURNS

Since returning to office in January 2025, Donald Trump has used many tools-from tariffs to tighter borders and military interventions-many of which have hit India significantly.

3 mins

January 20, 2026

Mint Mumbai

IMF cautions on AI, raises India outlook

The International Monetary Fund (IMF) has sounded a warning note on the exuberance in artificial intelligence, cautioning that a failure to achieve productivity gains could curb investments, slam markets and radiate across the world through tightening financial conditions.

4 mins

January 20, 2026

Mint Mumbai

BRANNAN'S BLUEPRINT ON DALAL STREET

In India's capital markets gold rush, can 'shovel companies' be the shining bets?

9 mins

January 20, 2026

Mint Mumbai

China's lithium moves may hit Indian EV cos

Costlier batteries due to Beijing's export sop cut may push up EV prices

3 mins

January 20, 2026

Mint Mumbai

Our Gaza calculus

Should India join the Board of Peace for Gaza being set up by the US? This decision would hinge on what it implies for India's strategic autonomy.

1 min

January 20, 2026

Mint Mumbai

Discoms swing to profit. Why there is more to worry

India's power distribution companies or discoms, reeling under high debt and operational losses for years, swung to profits in fiscal 202425. Mint explains the current financial health of the discoms and the factors behind their revival:

2 mins

January 20, 2026

Mint Mumbai

China population falls as birth rate drops to lowest since 1949

A decade after ending China's longtime one-child policy, the country’s authorities are pushing a range of ideas and policies to try to encourage more births—tactics that range from cash subsidies to taxing condoms to eliminating a tax on matchmakers and day care centres.

1 min

January 20, 2026

Mint Mumbai

BUDGET SHOULD AID GROWTH WITH FISC CONSOLIDATION

India’s real and nominal GDP growth rates for 2025-26 are estimated at 7.4% and 8.0%, respectively, according to the National Statistics Office’s first advance estimates.

3 mins

January 20, 2026

Mint Mumbai

India-EU summit likely to seal FTA, defence pacts

European Council and European Commission heads will be chief guests on Republic Day

1 mins

January 20, 2026

Listen

Translate

Change font size