Prøve GULL - Gratis

HOW LOW INFLATION CAN RESHAPE INDIA

Mint Mumbai

|November 18, 2025

India's inflation may be undergoing a structural shift, supported by the RBI's flexible inflation-targeting policy. This lower, more stable inflation could have larger macroeconomic implications, but can it sustain?

Nearly a decade ago, India's central bank adopted a framework of "flexible inflation targeting", or FIT. It is widely accepted that inflation has been managed well under this mechanism.

Chief economic adviser V. Anantha Nageswaran recently pointed to the remarkable decline in inflation in recent months and suggested that India may even be witnessing a structural transformation in inflation.

Certainly, inflation data for this year support this idea. The retail inflation rate has dropped from 4.3% in January to 0.29% in October; wholesale inflation is down from 2.3% to (-)1.21%.

For an inflation-prone country like India, low inflation for a sustained period is an achievement in itself, and the Reserve Bank of India (RBI) has rightly been lauded for its deft management of the situation.

But if, indeed, the Indian economy is moving towards structurally lower inflation, there are some other macroeconomic variables that could face a significant impact as a result.

INFLATION-RUPEE LINK

INFLATION-RUPEE LINK The key impact, as Nageswaran noted in his speech, will be on the rupee's exchange rate. On a day-to-day basis, the rupeedollar exchange rate fluctuates in response to actual and expected dollar flows. But in the long run, exchange rate depreciation tends to be related to inflation differences between economies, as per the theory of purchasing power parity.

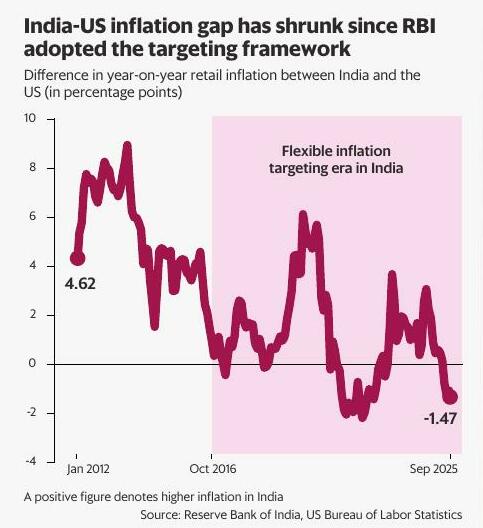

The inflation differential between the US and India has fallen significantly since the RBI adopted inflation targeting in June 2016. The average gap in the FIT era is about 1.6%, a big drop from the 6%-plus gaps in the years preceding it.

Denne historien er fra November 18, 2025-utgaven av Mint Mumbai.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Mint Mumbai

Mint Mumbai

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint Mumbai

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint Mumbai

I-T dept to nudge taxpayers to declare foreign wealth

The department was able to collect 30,000 crore disclosed in the previous Nudge drive

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint Mumbai

Beyond the stock slump-Kaynes' $1 bn aim is just the start

Shares of Kaynes Technology India Ltd have fallen about 25% from their peak of 7,705 in October, amid a management reshuffle and the expiry of the lock-in period for pre-IPO shareholders.

1 mins

November 28, 2025

Mint Mumbai

How Omnicom’s IPG buy will change Indian advertising

Two of the advertising world’s Big Four holding companies—Interpublic Group and Omnicom—officially merged this week.

2 mins

November 28, 2025

Mint Mumbai

Why TCS is walking a tightrope

Tata Consultancy Services Ltd recently outlined an ambitious multi-year $6-7 billion investment plan to build artificial intelligence (AI)-focused data centres and is already making progress in that area.

2 mins

November 28, 2025

Mint Mumbai

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint Mumbai

Telecom firms flag hurdles in data privacy compliance

Operators need to comply with the data protection norms within 12-18 months

1 mins

November 28, 2025

Listen

Translate

Change font size