Prøve GULL - Gratis

Banking pads up to cover a new ground

Business Standard

|October 20, 2025

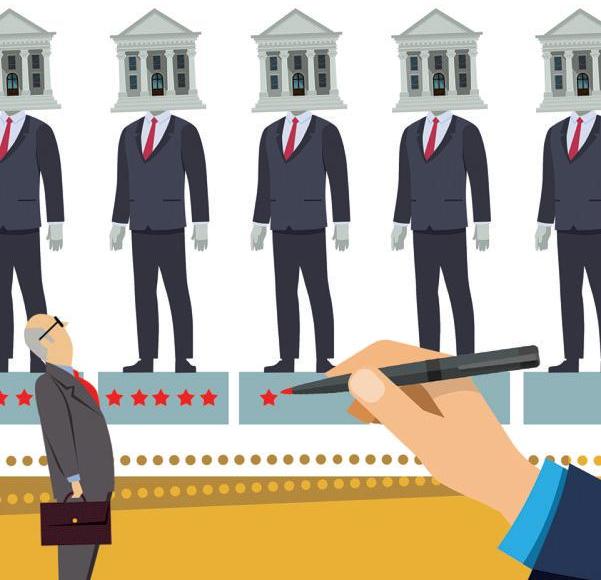

Shifting to a system of risk-based deposit insurance may over time force banks to become even more prudent and mindful of their finances, reports Raghu Mohan

-

Of the 22 additional measures announced by Mint Road after its Monetary Policy Committee's deliberations, the shift to risk-based deposit insurance framework is one of the most significant in the post-reform period. Think of it as tightening the screws on banks’ liability side. What's less known is that this architecture — radical as it may appear — is not a new concept. It was flagged by the Jagdish Capoor working group on Reforms in Deposit Insurance, 1999; the Committee on Credit Risk Model, 2006 set up by the Deposit Insurance and Credit Guarantee Corporation (DICGC); and the Jasbir Singh Committee on Differential Premium System for Banks, 2015. Incidentally, the Singh committee was set up after the issue of risk-based premium was discussed at a Reserve Bank of India (RBI) board meeting on October 16, 2014. It was felt that DICGC could “explore the possibility of putting in place a differential premium within the cooperative sector, linking it to governance and risk profile of cooperative banks.”

So, what is one to make of this approach to deposit insurance after all these years? Says Anand Sinha, former deputy governor of RBI (and senior advisor, Cyril Amarchand Mangaldas): “This is more equitable as it will require riskier banks to pay more (deposit insurance premium) than those which are sound. Importantly, it will provide an incentive to lower-rated banks to improve their health reflected in their ratings. These ratings, like supervisory ratings, will not be public. While risk-based deposit insurance has been discussed for a long time, the timing of its introduction is opportune as the banking system is in much better shape.” A point has to be made clear: It is not that weaker-rated banks will pay more than the current uniform premium of 12 paise for every ₹100 of deposits. But this will be the cap, and the better-rated banks will pay lower.

Glide path

Denne historien er fra October 20, 2025-utgaven av Business Standard.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Business Standard

Business Standard

‘Investor awareness becomes more important than ever’

Ananth Narayan G describes his three-year tenure as whole-time member of the Securities and Exchange Board of India (Sebi) as a privilege that allowed him to make an impact on a larger canvas.

3 mins

November 01, 2025

Business Standard

New currency of hard power

If China is an exporting superpower, America is an importing one. Mr Trump has turned what would usually be a liability into an asset

5 mins

November 01, 2025

Business Standard

Apple's India revenue hits new high in Sep qtr

Apple set an all-time revenue record in India for the September quarter, driven by strong iPhone sales, as the American technology giant’s overall sales revenue reached $102.5 billion globally.

1 mins

November 01, 2025

Business Standard

USFDA's new biosimilar norms to woo more players, fast-track mkt entry

The US Food and Drug Administration’s (USEDA)'s new draft guidelines aimed at speeding up and reducing the cost of developing biosimilars — lower-priced, near-replicas of complex biologic medicines — could significantly benefit Indian biotech companies.

2 mins

November 01, 2025

Business Standard

Apple revenue tops $100 bn for first time

iPhone price hike drives record quarter

1 mins

November 01, 2025

Business Standard

Broking industry sees high growth on digital push

The Indian broking industry is passing through a lean patch after two years of rapid growth and expansion.

3 mins

November 01, 2025

Business Standard

Al-related stocks have more room to grow'

Artificial intelligence (AI)-related stocks have more room to grow, said Mark Matthews, managing director (MD) and head of research for Asia at Julius Baer during lunch on the sidelines of the Business Standard BFSI Insight Summit 2025 on Friday.

1 mins

November 01, 2025

Business Standard

'Al unlikely to replace humans in fin services'

Artificial intelligence, or AI, has had an influence in the way we invest in stocks. While it helps you narrow the list of opportunities, it has not reached a point where it can replace wealth managers, points out Shankar Sharma, founder, GQuants, in a fireside chat with A K Bhattacharya. Edited excerpts:

4 mins

November 01, 2025

Business Standard

Vedanta net profit plunges 59% on exceptional losses

Mining major Vedanta’s consolidated net profit plunged 58.69 per cent year-on-year (Y-0-Y) to %1,798 crore inthe second quarter of 2025-26 (Q2FY26), dragged down by exceptional losses booked during the period under review. The company had reported anet exceptional gain of $1,160 crore in Q2FY25.

2 mins

November 01, 2025

Business Standard

Sebi chief stresses responsible tech use, stronger market resilience

The Securities and Exchange Board of India (Sebi) is promoting the responsible use of emerging technologies, such as artificial intelligence in financial markets, strengthening cybersecurity, and preparing entities for change, said Chairman Tuhin Kanta Pandey on Friday.

1 mins

November 01, 2025

Listen

Translate

Change font size