Prøve GULL - Gratis

Life Insurance News

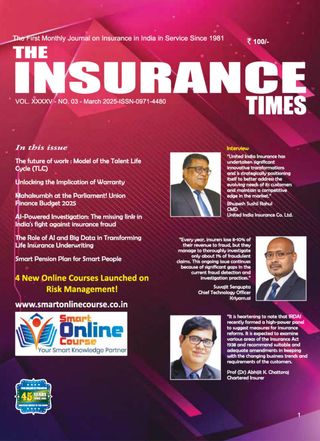

THE INSURANCE TIMES

|March 2025

SBI Life Insurance Company added 1.76% after the company reported 71.19% increase in net profit to Rs 550.82 crore despite a 52.21% fall in total income to Rs 18,542.16 crore in Q3 FY25 over Q3 FY24.

-

SBI Life net profit up 71%

The life insurer's net premium income grew by 11.25% YoY to Rs 24,827.54 crore in Q3 FY25. However, the company reported a loss of Rs 6,281.65 crore from investments during the December quarter FY25, compared to an income of Rs 16,468.64 crore in the same period of FY24.

The company's net worth grew by 15% YoY to Rs 16,590 crore in Q3 FY25 as compared to Rs 14,430 crore recorded in Q3 FY24.

SBI Life reported a robust solvency ratio of 2.04 as on 31 September 2024 as against the regulatory requirement of 1.50, indicating a strong financial position of the company.

Shriram Life Insurance Company eyes 3-fold rise in AUM by '30

Shriram Life Insurance Company plans a three-fold rise in assets under management (AUM) by 2030, growing from Rs 13,000 crore by focusing on rural India and using technology, said the top executive of the insurer.

The company's retail new business was seen at Rs 865 crore in April-December 2024, growing 49 per cent over the same period in the previous year. The company's Individual New Business APE, a focus area, grew 49 per cent - faster than private industry (19 per cent). Shriram Life's total premium for April-December 2024 stood at Rs 2,782 crore, growing 21 per cent from the year before. The company expects its AUM to cross Rs 15,000 crore in FY26.

"We expect to grow three-fold rise in our AUM by 2030, if we continue with the present growth of 20 per cent CAGR (compound annual growth rate) in the next five years," said Casparus J H Kromhout, managing director and chief executive officer, Shriram Life Insurance.

LIC gets Rs. 105 crore notice for short payment of GST

LIC said it has received a demand notice of about Rs 105.42 crore for short payment of Goods and Services Tax (GST) for seven financial years.

Denne historien er fra March 2025-utgaven av THE INSURANCE TIMES.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA THE INSURANCE TIMES

THE INSURANCE TIMES

Epigenetic Clocks as Predictors of Mortality: A New Tool for Life Insurance Risk Stratification

Numerous cohort studies have validated the utility of epigenetic clocks in predicting all-cause mortality. For instance, accelerated epigenetic aging, where biological age exceeds chronological age, has been consistently associated with increased mortality risk (Marioni et al., 2015).

5 mins

November 2025

THE INSURANCE TIMES

Life Insurance News

Life insurers cut distributor commissions to pass on GST relief to customers

7 mins

November 2025

THE INSURANCE TIMES

Insurance Regulator Update

Irdai's Deepak Sood calls for new distribution model to expand rural insurance reach

2 mins

November 2025

THE INSURANCE TIMES

Evaluating the Impact of the New Tax Regime on Motor Accident Compensation Awards

In India, compensation awarded under the Motor Vehicles Act majorly depends upon the income of the deceased (claimant- in case of injury), age and dependency. Since the compensation is calculated based on loss of income after the accident, it increases as the income rises.

4 mins

November 2025

THE INSURANCE TIMES

A Comprehensive Risk Management Framework for the Insurance Industry

In the insurance industry, risk is not merely a challenge to overcome; it is the very commodity we trade. Therefore, a robust and sophisticated risk management framework is not just a matter of good governance but a core strategic imperative. It is the bedrock upon which an insurer builds its solvency, ensures compliance with a complex regulatory landscape, and ultimately achieves sustainable, long-term growth.

13 mins

November 2025

THE INSURANCE TIMES

"The overall industry seems to have understood the need to change the attitude from selling what it has to what the customer needs. This realization has led to the development of add-ons and modular products which are quite flexible in nature."

About Mr. Lahiri - Mr. Samiran Lahiri is widely regarded as one of India's most accomplished insurance professionals and consultants, known for his strategic insight, deep technical acumen, and exemplary leadership across diverse domains of the insurance and financial services industry.

11 mins

November 2025

THE INSURANCE TIMES

Parametric Insurance - A Disruptive Model for Climate and Catastrophe Risk Management

Executive Summary - Traditional indemnity-based insurance models have long faced challenges in addressing the growing frequency and severity of natural disasters.

5 mins

November 2025

THE INSURANCE TIMES

Safety Perspectives - The Greatest Happiness of Greatest Number

The salvage dealer has many things to pay for, many expenses such as transportation, electricity, rent, employee salaries, machinery, and more. Hence, the salvage dealer would certainly offer a daily prayer: 'Dear God, please bless me with at least 50 salvage cases today and every day'. He wants 50 accident cases every day! There is no harm in his prayer. It is perfectly logical on his part to pray.

7 mins

November 2025

THE INSURANCE TIMES

Do's and Don'ts While Buying a Term Insurance Policy

Do’s (Things You Must Do)

4 mins

November 2025

THE INSURANCE TIMES

Newton's Law - Another interpretation of Proximate Cause

The fire policy we know doesn't cover any loss or damage occasioned by, through, or in consequence of, directly or indirectly, an earthquake, volcanic eruption, or other convulsions of nature. An earthquake is an excluded peril, but loss by theft is an uninsured peril( other than as provided in the RSMDT clause).

7 mins

November 2025

Listen

Translate

Change font size