Prøve GULL - Gratis

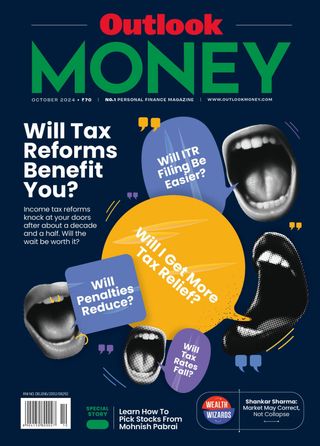

Tax Reforms: What's In Store?

Outlook Money

|October 2024

The government is working on reforming the existing Income-tax Act, 1961. The impending reforms have raised many questions in the minds of taxpayers. Will the old regime and deductions be done away with? Will it really simplify your life? What's the need for these reforms? We try to answer these and other questions regarding tax reforms

Among the most significant announcements in Union Minister of Finance Nirmala Sitharaman’s Budget Speech in July 2024 was the proposal to undertake a comprehensive review of the Income-tax Act, 1961.

In her Budget Speech, she said: “The purpose is to make the Act concise, lucid, easy to read and understand. This will reduce disputes and litigation, thereby providing tax certainty to the taxpayers. It will also bring down the demand embroiled in litigation. It is proposed to be completed in six months.”

Sitharaman further said that the changes proposed in the Budget were like a precursor to this overall review. Budget 2024 simplified the tax regime for charities, the tax deducted at source (TDS) rate structure, provisions for reassessment and search provisions, along with rules on taxation of capital gains.

The Union Ministry of Finance has also formed a panel headed by chief commissioner of income tax V.K. Gupta to review the provisions.

The review of the tax law has been long pending. It is not the first time that the government has initiated tax reforms in recent decades.

The Direct Tax Code (DTC), which was proposed in 2009, promised to undertake similar reforms. After roughly a decade-and-a-half, tax reforms may finally see the light of the day.

The questions now on taxpayers’ minds are: Will their lives be really simplified with the reformed law? Will the simplification mean easier income tax return (ITR) filing, more tax relief, lesser disputes? Will the law be completely overhauled or only bits of tinkering is to be expected?

Denne historien er fra October 2024-utgaven av Outlook Money.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Outlook Money

Outlook Money

How Budget Touches Your Life

There are two perspectives on how does the Union Budget impact us. One is that as a citizen, macro developments are relevant for us, as macro percolates in some way to make a micro impact.

4 mins

February 2026

Outlook Money

SIP Returns Beat Bank FDs' Over Long Term

I am 22 years old and have just started working. I want to invI am 22 years old and have just started working.

2 mins

February 2026

Outlook Money

Thematic Investing Without The Hype

How to turn trends into portfolios using discipline valuation checks and sensible sizing for investors

2 mins

February 2026

Outlook Money

Stop Raiding Your Long Term SIP

Short term goals need stability long term goals need equity. Time is what changes risk

2 mins

February 2026

Outlook Money

SIP VS SIP + Buying Market Dips: A Reality Check

It's common to assume that buying during market dips can enhance returns. We ran numbers to see what happens if you invest in a plain SIP and compared it with scenarios when you topped up during market dips. The results will shock you

7 mins

February 2026

Outlook Money

India's Evolving Equity Markets And The Design Of Flexi Cap Funds

India's market leadership rotates between large, mid and small caps, and flexi cap funds are built to rotate with it.

2 mins

February 2026

Outlook Money

Base Expense Ratio

The Securities and Exchange Board of India (Sebi) has changed how mutual fund expenses are disclosed by introducing the base expense ratio (BER). Sebi approved the change on December 17, 2025, under the new Sebi (Mutual Funds) Regulations, 2026. Previously, investors kept a track of their mutual fund expenses through the total expense ratio (TER), which combined fund management fees with taxes and statutory charges, such as goods and services tax (GST) and securities transactions tax (STT). This made it difficult for investors to see what fund houses actually charged. In contrast, BER includes only the core expenses of running a mutual fund scheme, and statutory charges are disclosed separately.

2 mins

February 2026

Outlook Money

Top-Up Solution To Piling Claims

Base policies are proving to be inadequate because of rising medical costs and premiums. To ensure a large coverage at affordable rates, they need to be combined with a super top-up insurance that takes care of rising family claims

7 mins

February 2026

Outlook Money

Retirement Is Not About Slowing Down

At 63, Murli Sundrani doesn't come across as the typical retired gentleman. He treks, goes on world tours, is pursuing multiple courses, and is financially savvy, too

5 mins

February 2026

Outlook Money

'Ideal Retirement' Lasts Only A Couple Of Years, Says Riley Moynes

Retirement is not just about cavorting on the beach with a glass of wine, but also about coming to terms with loss and trauma, and then re-picking yourself to find a purpose, believes Riley Moynes, a former public educator and financial advisor and now TED speaker, podcaster and author of many books, including The Four Phases Of Retirement. In an interview with Nidhi Sinha, Editor, Outlook Money, as part of the Wealth Wizards series, he talks about the challenges seniors face as they stare at around 30 years of retirement years

8 mins

February 2026

Listen

Translate

Change font size