Prøve GULL - Gratis

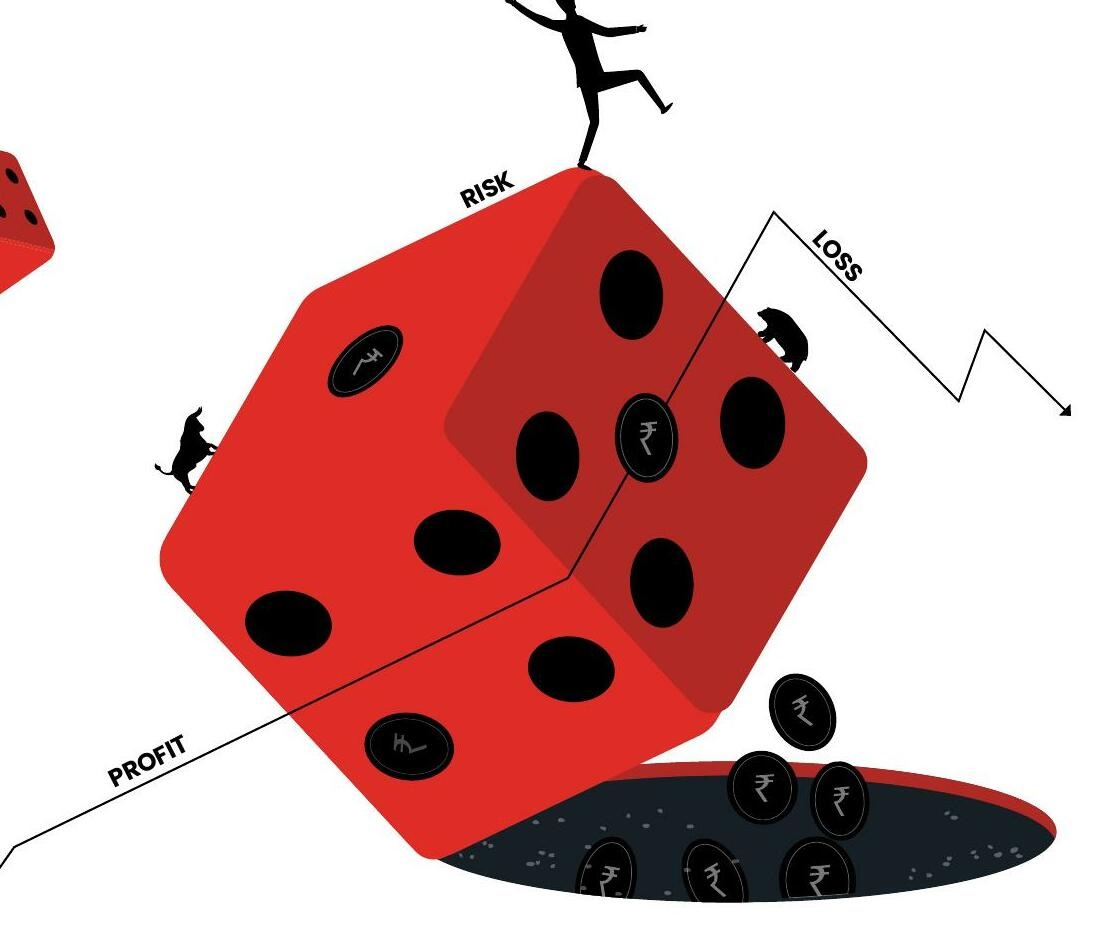

Big Losses In The F&O Game Of Quick Gains

Outlook Money

|May 2025

For many small traders, the lure of quick profits in Futures and Options (F&O) is hard to resist. But the reality is far more challenging and ridden with risks

When the Indian stock market saw a sudden boom post the Covid 19 pandemic, so did the number of investors. This was the period when more and more people became comfortable with using smartphones, and brokerage apps simplified the demat account opening process. Incidentally, the number of demat accounts has jumped from 39.3 million in 2019 to 192.4 million today—a four-fold growth in just five years.

Markets and businesses celebrated this peaking interest of retail investors in the markets.

However, there was a small problem. Among the new investors, a large chunk constituted of people who were big on aspirations, but small on cash. This set of investors was drawn to futures and options (F&O) trading, tempted by the idea of turning small sums into big profits.

Says Sahaj Agrawal, senior vice president and head of derivatives research, Kotak Securities: “While derivatives have long been a part of the financial landscape, the post-Covid period saw an unprecedented surge in retail interest, particularly in F&Os. Derivatives, by design, serve purposes, such as hedging, arbitrage, and active trading. However, the current retail participation is overwhelmingly skewed toward speculative activity.”

While the idea of making huge profits through F&Os seems promising, the reality is challenging, to say the least. That's because F&O trading involves speculation, which makes it highly risky. The lure of high returns often blinds novice investors to the risk they face. Besides, the process can be very complicated for retail investors, who end up with losses in most cases.

According to a study by the capital markets regulator, the Securities and Exchange Board of India (Sebi), released in 2024, 91.1 per cent of individual traders (around 7.30 million traders) lost money in the F&O segment in FY24. Only about 1 per cent of individual traders earned profits exceeding ₹1 lakh after adjusting for transaction costs.

Denne historien er fra May 2025-utgaven av Outlook Money.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Outlook Money

Outlook Money

Is Silver The New Gold?

Silver, an asset once considered gold's quieter cousin is now commanding investor's attention, given its extraordinary rally this year, with prices soaring to multi-year highs and shattering previous records. But does it make sense to add a touch of silver shine to your portfolio now?

7 mins

November 2025

Outlook Money

NPS MSF Schemes: More Choice Or More Confusion?

The launch of shorter-term schemes under the Multiple Scheme Framework (MSF) of the National Pension System (NPS) has given more choice to investors, but will that breed confusion and are these schemes fit for consistent long-term savings?

5 mins

November 2025

Outlook Money

Is Silver The New Gold?

Silver, an asset once considered gold's quieter cousin is now commanding investor's attention, given its extraordinary rally this year, with prices soaring to multi-year highs and shattering previous records. But does it make sense to add a touch of silver shine to your portfolio now?

7 mins

November 2025

Outlook Money

Invest with the Rhythm of the Market

Let professionals rotate sectors as cycles turn while you stay invested steadily.

2 mins

November 2025

Outlook Money

Stop Worshipping Sips And Start Using Them For Goals Now

Set an amount, automate increases, ignore noise, stick to horizons, review annually.

2 mins

November 2025

Outlook Money

Build Wealth That Survives Cycles With Ruthless Asset Allocation Discipline

Hold equity, debt and gold in balance and rebalance when valuations stretch.

3 mins

November 2025

Outlook Money

Gold As An Investment Not Ornament

Festive buying meets modern investing as the panel explains gold ETFs, costs, risks and mindset needed to make gold work.

1 mins

November 2025

Outlook Money

How To Handle A Cashless Health Claim

With many hospitals suspending cashless health insurance option, here's how to manage your temporary cash requirement and claim for a reimbursement from your insurer later

5 mins

November 2025

Outlook Money

Invest In Gold And Silver MFs And ETFs For Tax Efficiency

I recently retired with a Provident Fund of ₹70 lakh and equity and mutual fund investments of around ₹60 lakh. I plan to sell my house for ₹60 lakh and buy a smaller apartment for ₹30 lakh.

2 mins

November 2025

Outlook Money

'We Want That Even Before You Buy A Mutual Fund, You Should Be In NPS'

Pension Fund Regulatory and Development Authority (PFRDA) chairperson S. Ramann, in an interview with Outlook Money Editor Nidhi Sinha as part of the Wealth Wizards series, talks about how the National Pension System (NPS) is moving from catering to the government sector to the non-government sector, why the regulator is focusing on larger distribution through new Multiple Scheme Framework (MSF) products, why it's important to have more choice in pension products and how NPS is turning into an end-to-end product.

8 mins

November 2025

Listen

Translate

Change font size