Prøve GULL - Gratis

5 Questions That Will Lead You To The Right Financial Planner

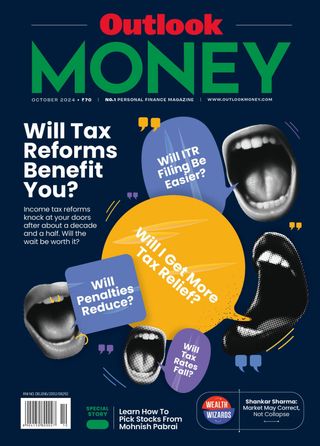

Outlook Money

|October 2024

Choosing a financial planner is not as easy as it may seem. Besides the right credentials, you should also consider things like the kind of services you will be needing-tax advisory, estate planning-as well as the fee structure. Here are five questions that will help you choose the right planner

You want to save and invest diligently, but are at a loss about where to invest, which instruments to choose, and how to apportion the investments for various goals. Or you may have an idea about all of that but are just too busy to put things in order and follow up your portfolio regularly.

You realise it's time to seek professional help, but how do you find the right advisor? It's not just about picking someone with impressive credentials or the right qualifications; it is about entrusting your financial future to someone who understands your goals, values, and the intricacies of the financial world.

There's no right time to start a financial plan, but the earlier you start, the better. Says Abhishek Kumar, a Securities and Exchange Board of Indiaregistered investment advisor (Sebi-RIA), and founder, SahajMoney, a wealth management firm: "Just like there is no right age to be physically fit, likewise there is no right stage to be financially fit. One should always start early so that they don't commit errors, such as mixing insurance with investment or taking loans to fulfil their wants. Correcting these mistakes won't be that easy later?"

So, here are five fundamental questions you should ask yourself; the answers to these will guide you in the right direction.

Do you need a financial advisor?

Each stage in life comes with a different set of financial goals. Events, such as buying a new vehicle or new home, wedding and marriage, childbirth and education, medical expenses, and retirement plans, often require a skilled and qualified professional to help you navigate your planning to meet the financial requirements unique to each event.

Denne historien er fra October 2024-utgaven av Outlook Money.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Outlook Money

Outlook Money

10 FAQs ON RECENT CHANGES IN EPF WITHDRAWAL RULES

The Central Board of Trustees (CBT) of the Employees' Provident Fund Organisation (EPFO) has eased partial withdrawal rules for subscribers in October 2025.

3 mins

December 2025

Outlook Money

How To Use Thematic Investing Wisely In Your Portfolio

Good themes are built on data and discipline, not fashion; understand the forces before investing.

2 mins

December 2025

Outlook Money

How You Think Is How You Spend

Our actions and thoughts translate into how our money life shapes up. Look for blind spots before you make any money decisions

4 mins

December 2025

Outlook Money

Back To The Nest

Rising cost of urban living along with stagnant salaries are pushing a generation of young professionals to move back in with their parents. That situation may lead to friction but mature handling make the situation a win-win for both

8 mins

December 2025

Outlook Money

What's Enough For Retirement?

It's crucial to make your own estimate for a retirement corpus, based on your expenses and lifestyle habits. This exercise should be unique to each individual

4 mins

December 2025

Outlook Money

Buying A Home? Look For The Hidden Tag Too Price

Rera has made property buying more transparent, yet other costs can raise the actual price by 10-20 per cent. Buyers should not assume the price on the brochure is final. The true cost of homeownership is far higher

5 mins

December 2025

Outlook Money

One Flexicap Fund Many Market Opportunities

Blend large mid and small caps in one portfolio so gains offset volatility across cycles

2 mins

December 2025

Outlook Money

A Ride To Remember

A motorcycling road trip could be the ultimate adrenaline rush combining adventure along with relative comfort

7 mins

December 2025

Outlook Money

Eyeing Value Opportunity

Global markets are at an all-time high, with most major indices hovering near their peak, leaving limited room for further upside.

1 mins

December 2025

Outlook Money

Follow The Cycle Not The Noise To Keep Your Money Working Harder

Shift between growth and safety as the economy turns instead of reacting late to headlines

2 mins

December 2025

Listen

Translate

Change font size