Prøve GULL - Gratis

"There isn't another market like India"

Business Today India

|October 26, 2025

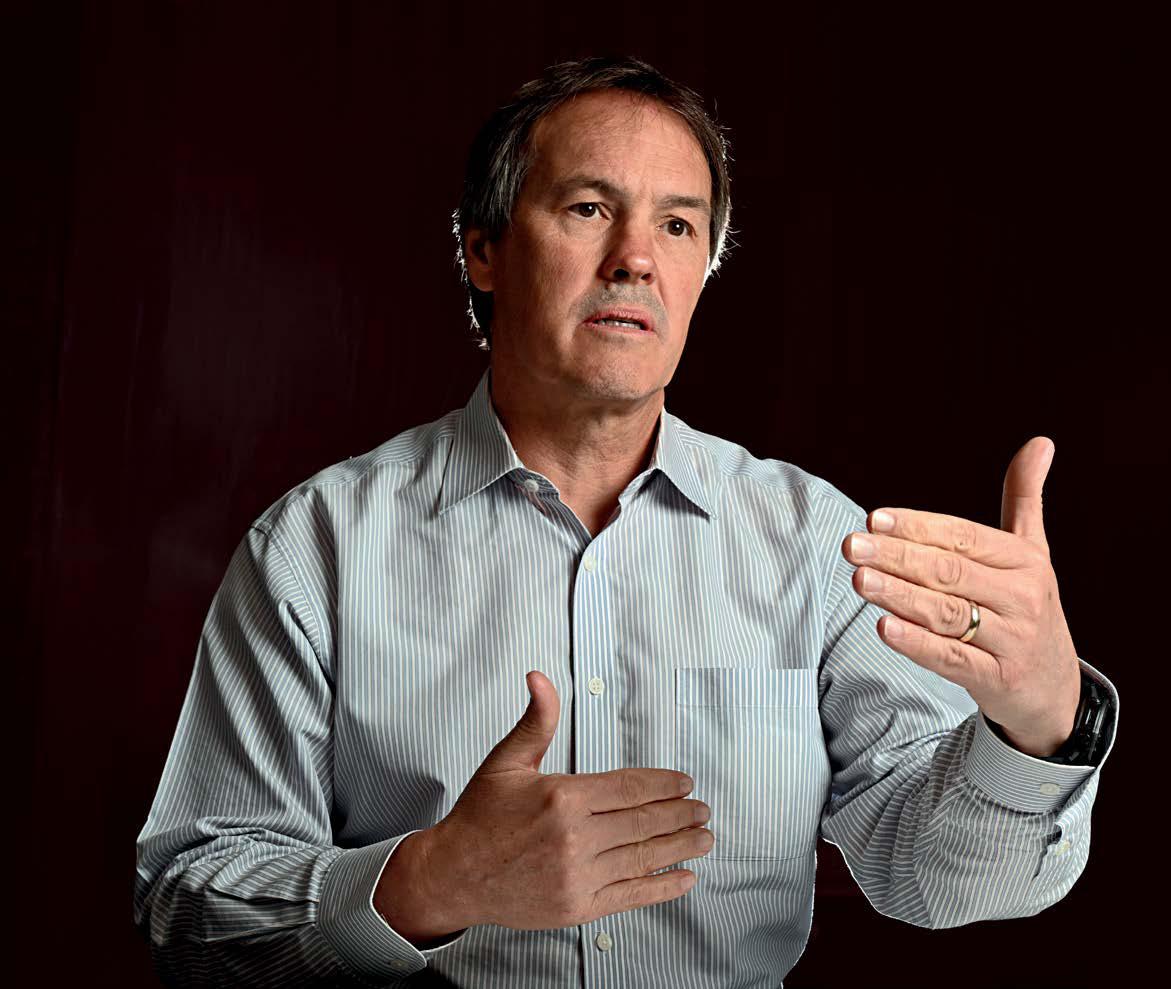

Steven Hawkins, President, Syngenta Crop Protection, on the opportunity for expanding agricultural exports and more

Over 75% business of the $17-billion Syngenta comes from crop protection. The company was formed in 2000 with the merger of Novartis and AstraZeneca's agrichemical businesses. Steven Hawkins, President, Syngenta Crop Protection, talks with Business Today's Krishna Gopalan about why he is optimistic about India, the effects of geopolitical turmoil, and the overall outlook for agriculture. Edited excerpts:

Q: Every multinational corporation, without exception, says India is a critical market. What makes the country unique for your business?

A: India, for sure, is a critical growth market. We must understand a few things here. The development and sophistication of agricultural production, or productivity as you call it, must catch up. That is still quite low in India compared to the global average. The good news is that it has improved. I have been coming to India for 25 years and the improvement from what it was in the past is evident. One key reason for this is that the industry has been able to bring in new technologies.

Of course, India is exporting agricultural products. That is a relatively new phenomenon and means the use of new technologies is really important. For the farmers, there is now access to better agronomic production.

Beyond all this, India is always special for many reasons. For one, it's a huge country and the fact that it has more than 100 million small holders in agriculture is very interesting. Then, there is the fact of how rural India is connected to agriculture, with almost half of India's population somehow involved in the sector. These dynamics make agriculture extremely critical to the country. I don't think there's another market like India.

Q: Are there markets that are similar?

Q: Are there markets that are similar?Denne historien er fra October 26, 2025-utgaven av Business Today India.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Business Today India

Business Today India

HOW WE ZEROED IN ON THE FUNDS

SOME FUNDS STAND OUT FOR THEIR CONSISTENT OUTPERFORMANCE COMPARED TO PEERS. HERE ARE THE 100 BEST-PERFORMING MUTUAL FUND SCHEMES IDENTIFIED BY BT & VALUE RESEARCH

4 mins

November 09, 2025

Business Today India

GLOBAL FUNDS, BIG RETURNS

INTERNATIONAL FUNDS HAVE DELIVERED 29% RETURN IN THE PAST YEAR. WILL VOLATILE MARKETS TEST INVESTOR RESILIENCE?

5 mins

November 09, 2025

Business Today India

THE HYBRID PATH TO RICHES

THE HYBRID FUND SPACE IS EVOLVING FAST, AND INVESTORS NEED TO STAY ON TOP TO ENSURE THEY ARE PICKING STABILITY OVER RISK

4 mins

November 09, 2025

Business Today India

SPREADING YOUR BETS

AS MARKET LEADERSHIP FRAGMENTS AND RETURNS TURN UNEVEN, ATTENTION IS SHIFTING BACK TO DIVERSIFIED EQUITY FUNDS, WHICH BALANCE GROWTH WITH STABILITY

4 mins

November 09, 2025

Business Today India

RIDING THE INDEX

AS INVESTORS GRAPPLE WITH A VOLATILE LANDSCAPE, PASSIVE FUNDS ARE PROVING INDISPENSABLE TO GET MARKET RETURNS FROM A DIVERSIFIED SET OF STOCKS AT A VERY LOW COST

6 mins

November 09, 2025

Business Today India

The Quiet Revolution

HOW INDIA'S INVESTORS DISCOVERED THAT BORING WORKS

5 mins

November 09, 2025

Business Today India

Management Advice

KAVIL RAMACHANDRAN PROFESSOR OF ENTREPRENEURSHIP (PRACTICE) AND SENIOR ADVISOR, INDIAN SCHOOL OF BUSINESS (ISB)

2 mins

November 09, 2025

Business Today India

CAUTIOUS MONEY

FOCUS ON GSECS AND QUALITY OF CORPORATE BOND PORTFOLIO MAKE DEBT FUNDS A STEADY ANCHOR FOR DIVERSIFIED INVESTMENT STRATEGIES.

5 mins

November 09, 2025

Business Today India

MAKING THE MOST OF SMALL- AND MID-CAPS

SMALL- AND MID-CAP FUNDS ARE NOT FOR THE FAINT-HEARTED. FOR LONG-TERM INVESTORS, DISCIPLINE, DIVERSIFICATION, AND ALIGNMENT WITH FINANCIAL GOALS REMAIN FAR MORE EFFECTIVE THAN TRYING TO TIME THE MARKET

6 mins

November 09, 2025

Business Today India

“Don't go overboard on small- and mid-cap stocks”

Parag Parikh Financial Advisory Services' Rajeev Thakkar on why investors should avoid the volatile stocks

5 mins

November 09, 2025

Listen

Translate

Change font size