Prøve GULL - Gratis

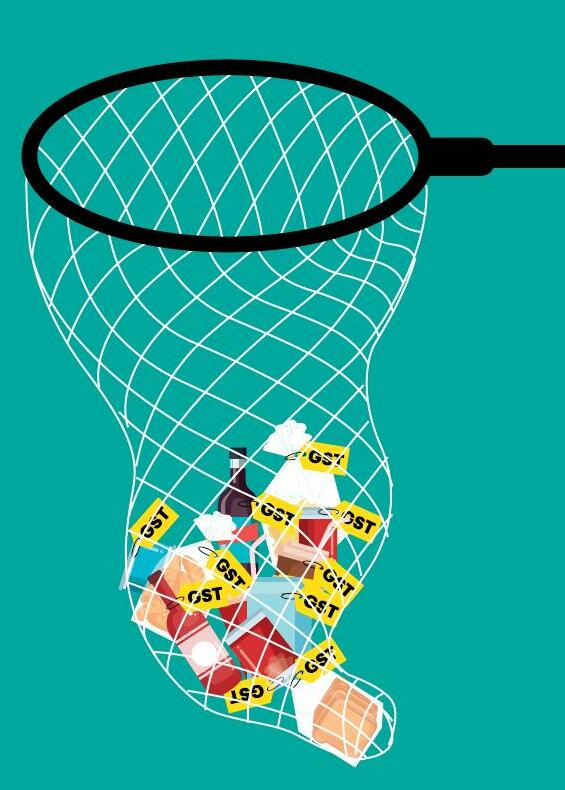

GST Needs Wider Net, Lower Rates

Business Today India

|March 16, 2025

Its grand success requires that the tax burden be moderate, coverage comprehensive, administration use cutting-edge technology, and dispute resolution swift and fair

HE FIRST comprehensive tax reform committee was set up in 1991 under the chairmanship of Raja Chelliah. That committee's goals were to simplify the tax code, lower the rates and improve tax administration. It also addressed the unfair skew in India's tax system, wherein the indirect to direct tax ratio was 85:15, which had to go much below 50:50.

A fair tax system requires that a richer person pays more than a poorer person, and that two persons earning the same income, irrespective of the source, roughly pay the same income tax. The journey toward a fair tax system in India is far from complete. Only 2% of India's population pays non-zero income tax. But almost everyone is subject to indirect taxes. The indirect to direct tax collection ratio is still too skewed. Indirect taxes do not depend on the income of the payer and hence tend to hurt the poor more than the rich. That is why they are called regressive, and unfair.

The Chelliah committee's road map for reform of indirect taxes was first to move toward a rational value added tax (VAT) which eventually paved the way to the Goods and Services Tax (GST). An important milestone in this journey was the Kelkar Tax Force on tax reforms set up in 2001, which, among other things, had recommended a median rate of 12% for GST, with a simple slab structure.

Denne historien er fra March 16, 2025-utgaven av Business Today India.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Business Today India

Business Today India

MAGIC & Menace

OPENCLAW, AN OPEN-SOURCE AI ASSISTANT, ACTS, LEARNS AND SOMETIMES GOES OFF THE SCRIPT. EXPERTS CAUTION THAT WHILE AGENTIC AI FEELS MAGICAL, IT IS DANGEROUS

7 mins

March 01, 2026

Business Today India

PRICE SHOCK FOR SOLAR

RECORD SILVER AND COPPER PRICES ARE IMPACTING SOLAR PV MANUFACTURERS. THE INDUSTRY IS FOCUSING ON MATERIAL OPTIMISATION AND EFFICIENCY TO MANAGE COSTS

6 mins

March 01, 2026

Business Today India

BEYOND THE BLOCKBUSTERS

AFTER THE WEIGHT-LOSS DRUG BOOM, AND WITH GENERICS CLOSING IN, BIG PHARMA ARE GEARING UP FOR THE NEXT GAME-CHANGER

7 mins

March 01, 2026

Business Today India

“No compromise on agriculture, US deal is a win-win”

Piyush Goyal, Union Minister for Commerce and Industry, on the India-US trade deal, and what the new pacts signal about India

7 mins

March 01, 2026

Business Today India

INDIA'S TRADE RESET

TWO TRADE PACTS IN TWO WEEKS AND A GROWTH-ORIENTED BUDGET COULD REDEFINE THE COUNTRY'S ECONOMIC PROSPECTS

12 mins

March 01, 2026

Business Today India

INSIDE INDIA'S GIG ECONOMY

INDIA'S GIG WORKFORCE HAS INCREASED SIGNIFICANTLY OVER THE YEARS, POWERING THE RISE OF PLATFORM GIANTS IN SEGMENTS RANGING FROM QUICK COMMERCE TO LOGISTICS. BUT THE REAL CHALLENGE IS BALANCING WORKER PROTECTION WITH GROWTH AND PLATFORM ECONOMICS

6 mins

March 01, 2026

Business Today India

GOING BIG ON DARK STORES

DARK STORES ARE TAKING INDIAN CITIES BY STORM AS BLINKIT, SWIGGY INSTAMART, ZEPTO, BIGBASKET, AMAZON NOW, FLIPKART MINUTES AND JIOMART RACE TO DELIVER QUICK COMMERCE ORDERS

6 mins

March 01, 2026

Business Today India

Concentrated at the Summit

JUST 0.08% OF COMPANIES CORNERED TWO-THIRDS OF PRE-TAX CORPORATE PROFITS AND PAID THE LOWEST EFFECTIVE TAX RATES. CAN INDIA INC BROADEN THE PROFIT PIE?

5 mins

March 01, 2026

Business Today India

Management Advice

AJAY VIJ, SENIOR COUNTRY MANAGING DIRECTOR, ACCENTURE IN INDIA

2 mins

March 01, 2026

Business Today India

The Spirit of the Ocean

WITH INDIAN ROOTS, A LAYERED COLONIAL PAST, AND A VIBRANT CULTURE-MAURITIUS IS FAR MORE THAN A BEACH ESCAPE

3 mins

March 01, 2026

Listen

Translate

Change font size