Prøve GULL - Gratis

RISK IN BANKING: AN INEVITABLE THING THAT NEEDS TO BE MITIGATED NOT AVOIDED

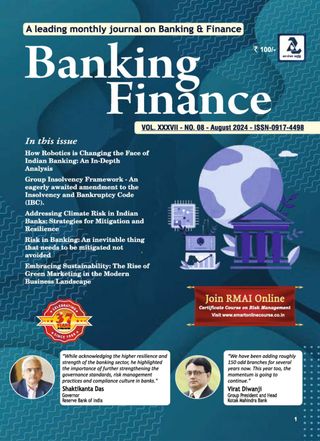

BANKING FINANCE

|August 2024

As we all know that the banking is a business of trust where we are dealing with public money with utmost care and earn the profit which makes the bank afloat. Risk is involved in every business decision of banking be it fund based decision, Non-fund-based decision, Financial decision or Non-financial decision.

Risk goes hand in hand which we can not separate from banking. The profit of a bank depends on the risk management of the bank as the better risk management gives better financial result and on the other hand the bad risk management puts the bank on risk and some time that may become the reason of having huge loss to the bank. The recent crisis of Yes Bank, PMC Bank etc. have shown the severity of risk management.

If we define Risk in a simple language we can say that the Risk is the probability of happening some thing bad which is not expected or desired. It means that the risk implies future uncertainty about deviation from expected outcome. Bank being a financial intermediary is exposed to various risks, primarily Credit risk, Market risk, Liquidity risk, Operational risk, Technology risk, compliance risk, Legal risk and Reputational risk. Every bank is committed to managing all the material risks and participating in opportunities as part of the strategic approach of risk calibrated growth in core operating profit with a less scope of provisions.

Major Risks which the Bank Faces:

Risks are part and parcel of the banking business which every bank faces and mitigates them with its laid down guidelines and policies in the broad framework of Reserve Bank of India. The major risks which the bank faces are:

Operational Risk: The risk which arises due to inadequate or failed internal processes, people and systems or from any external events. Major activities that comes under operational risk are Internal fraud, External fraud, Employment practices and workplace safety, Clients, Products and Processes, Damage to Physical assets of the bank, Execution and delivery of services etc.

Denne historien er fra August 2024-utgaven av BANKING FINANCE.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA BANKING FINANCE

BANKING FINANCE

Mutual Fund News

The Securities and Exchange Board of India (SEBI) has raised the minimum block deal size from Rs. 10 crore to Rs. 25 crore and widened the permissible price band for execution.

3 mins

November 2025

BANKING FINANCE

Industry News

1.4 crore Aadhaar numbers deactivated to prevent identity fraud

12 mins

November 2025

BANKING FINANCE

Applying the Cynefin Framework in Decision Making for Bankers

Misjudging the domain can lead to costly errors viz. applying redundant practices in a complex scenario or over analysing a situation that requires quick action. Cynefin offers a moment to reflect before reacting.

4 mins

November 2025

BANKING FINANCE

Insured bank deposits fall 9.5 percentage points in 5 years

While India's bank deposit base has expanded, the share of deposits protected by insurance has slipped. In the five years between September 2020 and March 2025, assessable deposits swelled by over Rs. 91 lakh crore, but the insurance coverage ratio dropped by 9.5 percentage points, leaving a wide gap between small savers who are fully covered and largevalue accounts that remain exposed.

2 mins

November 2025

BANKING FINANCE

Sustainable Finance in India: The Role of ESG in Banking and Investments

The concept of Environmental, Social, and Governance (ESG) has emerged as a transformative framework in the global financial sector, driving sustainable decision-making in banking and investments.

14 mins

November 2025

BANKING FINANCE

Banks and ECL norms

On October 7, the Reserve Bank of India (RBI) issued the draft Reserve Bank of India (Scheduled Commercial Banks-Asset Classification, Provisioning and Income Recognition) Directions, 2025 for public comments. These directions are proposed to be implemented by banks and financial institutions with effect from April 1, 2027 - a possible indicator that banks and financial institutions will transition to Indian Accounting Standards (Ind AS) from this date.

2 mins

November 2025

BANKING FINANCE

TRUMPeting Tariffs

These new trade taxes are a challenge for India, but they also create some opportunities. By finding new customers, making more things at home, and working with other countries, India can turn this problem into a chance to grow stronger.

3 mins

November 2025

BANKING FINANCE

RRR in Banking

This is very crucial area where bankers strive to pitch their products for the customers to achieve the set targets. Profiling is the major operation to understand the customer and identify their exact needs for providing suitable products.

6 mins

November 2025

BANKING FINANCE

World trusts India with semiconductor future

Prime Minister Narendra Modi pitched India as one of the most promising destinations for semiconductor manufacturing, saying \"the world trusts India, the world believes in India, and the world is ready to build semiconductor future with India\".

2 mins

November 2025

BANKING FINANCE

Legal News

Auction purchasers are liable to pay the property tax dues of erstwhile owners, the Calcutta HC held on Sept 25 in a case where a company sought a waiver of the outstanding property tax of Rs 1,23,84,142, for which KMC refused to grant mutation.

2 mins

November 2025

Listen

Translate

Change font size