Prøve GULL - Gratis

‘Index is Just a Data Point'

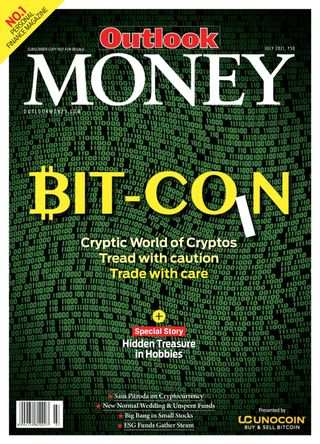

Outlook Money

|July 2021

One of the oldest financial groups with a legacy of over 150 years, Damodar Samaldas Purbhoodas (DSP), stands strong even today. DSP group’s mutual fund (MF) arm DSP Investment Managers is one of the top-rated fund houses in the country. Its business is presided over by young and energetic Kalpen Parekh, who manages funds worth more than ₹1.15 lakh crore. Parekh shared his views on various issues related to the mutual fund industry, economy and stock markets with Yagnesh Kansara in a freewheeling interview. Excerpts from the interview:

-

There is a visible disconnect between the market and the economy. Why do you think this has happened? Moreover, how the stock market is going up despite the disconnect?

Markets always look ahead, whether they are heading upwards or downwards. Generally, they look to the future over the next 2-3 years and how the economy would look like. India has always been seen as a growth market, notwithstanding the fact that in the last 10 years, the average profit growth was less than 10 per cent. However, during the last year, corporate profits have risen much faster than before. Reacting to lockdowns, a lot of companies have either redesigned their business models or taken advantage of their industry consolidation and picked up market share from fragmented smaller players.

The overall economy had significantly slowed down and has just started to revive. We could have temporary glitches because of new lockdowns, but the stronger companies have got stronger.

Second, for the stock prices to move either up or down, liquidity also plays a very important role. Today, the world over as well as in India there is a lot of liquidity in the hands of investors, that is getting invested in equity funds and stocks. So the demand for equity as an asset class has only increased over the last few years.

Denne historien er fra July 2021-utgaven av Outlook Money.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Outlook Money

Outlook Money

10 FAQs ON RECENT CHANGES IN EPF WITHDRAWAL RULES

The Central Board of Trustees (CBT) of the Employees' Provident Fund Organisation (EPFO) has eased partial withdrawal rules for subscribers in October 2025.

3 mins

December 2025

Outlook Money

How To Use Thematic Investing Wisely In Your Portfolio

Good themes are built on data and discipline, not fashion; understand the forces before investing.

2 mins

December 2025

Outlook Money

How You Think Is How You Spend

Our actions and thoughts translate into how our money life shapes up. Look for blind spots before you make any money decisions

4 mins

December 2025

Outlook Money

Back To The Nest

Rising cost of urban living along with stagnant salaries are pushing a generation of young professionals to move back in with their parents. That situation may lead to friction but mature handling make the situation a win-win for both

8 mins

December 2025

Outlook Money

What's Enough For Retirement?

It's crucial to make your own estimate for a retirement corpus, based on your expenses and lifestyle habits. This exercise should be unique to each individual

4 mins

December 2025

Outlook Money

Buying A Home? Look For The Hidden Tag Too Price

Rera has made property buying more transparent, yet other costs can raise the actual price by 10-20 per cent. Buyers should not assume the price on the brochure is final. The true cost of homeownership is far higher

5 mins

December 2025

Outlook Money

One Flexicap Fund Many Market Opportunities

Blend large mid and small caps in one portfolio so gains offset volatility across cycles

2 mins

December 2025

Outlook Money

A Ride To Remember

A motorcycling road trip could be the ultimate adrenaline rush combining adventure along with relative comfort

7 mins

December 2025

Outlook Money

Eyeing Value Opportunity

Global markets are at an all-time high, with most major indices hovering near their peak, leaving limited room for further upside.

1 mins

December 2025

Outlook Money

Follow The Cycle Not The Noise To Keep Your Money Working Harder

Shift between growth and safety as the economy turns instead of reacting late to headlines

2 mins

December 2025

Translate

Change font size