Prøve GULL - Gratis

Markets To Inch Higher – Time To Go Shopping!

Dalal Street Investment Journal

|November 09, 2020

When it comes to the equity markets there is never a dull moment – constant highs and lows keep investors in a state of perpetual movement. And that is the case even now when the current market condition has put many investors in a dilemma. The more than decent recovery in the markets has kept investors guessing about the future movement of their stocks. Geyatee Deshpande discusses how the markets have behaved in 2020 while Yogesh Supekar highlights the investing opportunities in the current markets even as the DSIJ research team shares its ‘top picks’ for the next one year

Its festive time, especially Diwali, and a good time to sit back, take a deep breath and indulge in a review of events affecting your portfolio. The current festival period is definitely sweeter than the previous one as the broader markets have performed much better than the previous year. The year 2020 can be termed as a ‘black swan’ year with the pandemic hitting us from the blue. Fortunately, the graph of the number of cases shows that recovery has been more than impressive in the past few days.

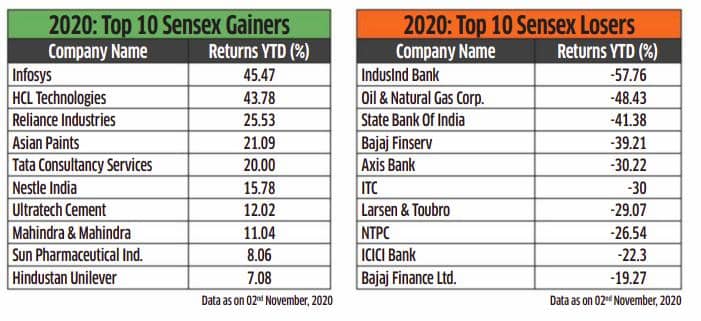

In response, the markets have turned positive, sending out a signal of hope to investors. However, the rally in 2020 has been restricted to high-growth stocks. And if we take into account the mother of all markets i.e. those of the US, it was the FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks that dominated the market moves. Amazon delivered more than 64 per cent returns while Netflix was up by more than 47 per cent on YTD basis with Facebook and Alphabet (Google) inching up by 28 per cent and 21 per cent, respectively, on YTD basis.

One may argue that there are several stocks which have inched up more than these FAANG stocks. A point to note here is that the FAANG stocks plus Microsoft comprise approximately 25 per cent of the market capitalisation of the S & P 500 and accounted for almost all the market gains on YTD basis for S & P 500. Without the contribution of these FAANG stocks the S & P 500 would be trading in the negative zone. It is because of this huge influence exerted by the FAANG stocks that they were the talk of the town in 2020.

Denne historien er fra November 09, 2020-utgaven av Dalal Street Investment Journal.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Dalal Street Investment Journal

Dalal Street Investment Journal

Capital Markets 2.0: From a Banyan Tree to Billion-Dollar Trades

From open street gatherings to today's tech-driven markets handling crores in daily turnover, India's capital markets have truly come a long way. But the transformation isn't over yet. In this story, Mandar Wagh explores the next wave of evolution reshaping India's financial landscape, highlighting SEBI's progressive reforms, the rise of a strong digital backbone, and the key companies positioned to benefit from this structural shift

6 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

India Inc's Q1 FY26: A Tale of Resilience and Reckoning

Q1FY26 has revealed a corporate India that's adapting smartly to shifting global currents while drawing strength from domestic policy support. With RBI's timely rate cuts cushioning demand, sectors like banking and insurance have surged ahead, even as IT and consumer segments navigate headwinds. Early results from 200+ companies suggest a story of selective strength and strategic resilience. The rest of the earnings season could either cement this momentum—or test it

5 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

RIDING WATER INFRA BOOM WITH VALUE-ADDED GROWTH

Jai Balaji Industries Ltd

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Active Momentum Funds Timing the Market or Tapping the Trend?

Abhishek Wani evaluates whether India's active momentum funds are skillfully timing markets or simply riding trends. By dissecting strategies of Samco and Quant, he scrutinizes the fine line between tactical rotation and disciplined trend-following in a volatile momentum investing landscape

10 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

FIEM INDUSTRIES LTD LEADING THE CHARGE IN AUTOMOTIVE LED LIGHTING

India has become the fastestgrowing major economy in the world in recent years, which has led to significant demand for automobiles, including auto components.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

The Case for Value-Oriented Mutual Funds

We Indians love a good bargain. Known for our haggling skills, we take pride in not overpaying - whether it's for a product or a service. After all, why pay more than what something is truly worth?

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

EMI vs SIP : Finding the Financial Sweet Spot

With rising home loan interest rates and evolving tax rules, many individuals face a critical choice- should surplus funds go toward prepaying their loan or building long-term wealth through SIPs? This piece compares both strategies across scenarios, helping you make an informed decision based on savings, returns, risk, and time horizon

9 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Make Your Portfolio Inflation-proof

Inflation is crucial to investing as it reduces the value of your money over time. Therefore, keeping up with the rate of inflation, to protect the value of investments, should be the top priority for every long-term investor. Remember, the ability to earn a positive real rate of return, i.e., gross returns minus taxes minus inflation, would depend upon the composition of the portfolio.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

AI Tailwind in IT Stocks: Time to Reboot Your Tech Portfolio?

After one year of sectoral underperformance, Indian IT is quietly undergoing its most radical overhaul since the cloud revolution, this time led by AI. The shift isn't cosmetic; it's existential. GenAI is reshaping services, rewarding agile midcaps and prompting investors to rethink legacy bets. The future of tech belongs to the AI-ready.

11 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Gen Z: High Conviction Story, but Priced to Perfection?

From skincare routines to fashion trends, Gen Z is transforming how India consumes. This digital-first generation doesn't just buy; they curate experiences, demand personalization, and look for authenticity in every swipe and scroll. As India's 440-million-strong Gen Z cohort begins to dominate discretionary spending, platforms built to speak their language stand to gain immensely. Nykaa, India's leading content-led, lifestyle retail platform, is at the forefront of this generational shift

8 mins

July 28 - August 10, 2025

Translate

Change font size