Prøve GULL - Gratis

New Gen Reliance

Business Today

|June 14, 2020

As Mukesh Ambani’s children play a greater role in Reliance Industries, the group is adding muscle to its digital, retail and petrochemicals businesses

If you thought Mukesh Ambani and Mark Zuckerberg sat across a table, assisted by a battery of experts, to frame the Facebook-Jio deal, you are mistaken. Ambani's twin children Isha and Akash led talks for sale of a stake in Jio Platforms (JPL), flying down multiple times to Facebook headquarters in Menlo Park, California, for negotiations. The senior Ambani was given the minutes of the negotiations by the children. The details were shared often at dinner time in Antilla.

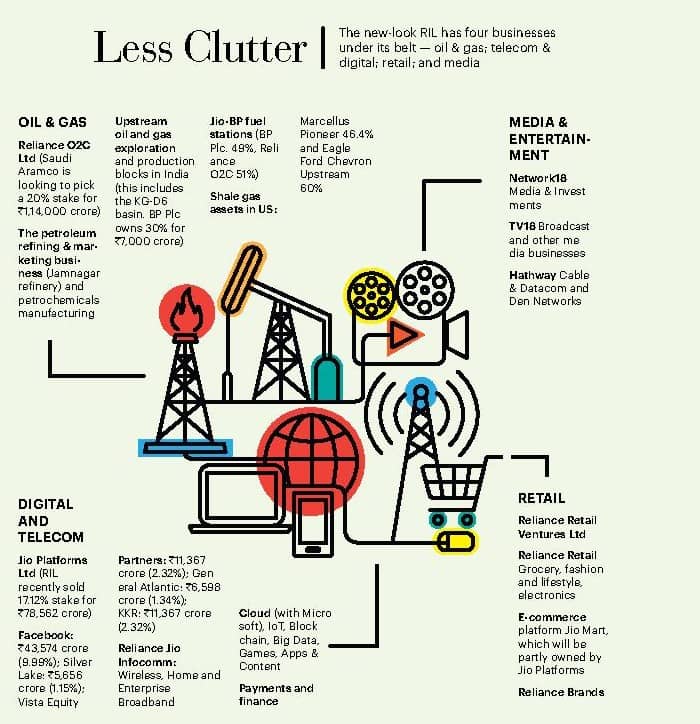

The stake sale is a step towards transforming the business empire founded by late Dhirubhai Ambani as a yarn trading company in Mumbai’s Masjid Bunder about 63 years ago. One aim is to rid Reliance Industries (RIL) of a bulk of the massive ₹3.36 lakh crore gross debt ac-cumulated to fund growth businesses — Reliance Jio, Reliance Retail and petrochemicals. The other is to prepare the group for a digital/consumer future. For years, petrochemicals and refining stood taller than others. That is changing. In fact, Ambani doesn’t even call RIL an oil and gas conglomerate any more. Instead, it’s being positioned as a technology company so that the larger objectives are clear: build three businesses — refining & petrochemicals, digital & telecom and retail — of global scale; cut off financial inter-dependence of these businesses; create debt-free balance sheets.

The JPL-FB Deal

Denne historien er fra June 14, 2020-utgaven av Business Today.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Business Today

Business Today India

MAGIC & Menace

OPENCLAW, AN OPEN-SOURCE AI ASSISTANT, ACTS, LEARNS AND SOMETIMES GOES OFF THE SCRIPT. EXPERTS CAUTION THAT WHILE AGENTIC AI FEELS MAGICAL, IT IS DANGEROUS

7 mins

March 01, 2026

Business Today India

PRICE SHOCK FOR SOLAR

RECORD SILVER AND COPPER PRICES ARE IMPACTING SOLAR PV MANUFACTURERS. THE INDUSTRY IS FOCUSING ON MATERIAL OPTIMISATION AND EFFICIENCY TO MANAGE COSTS

6 mins

March 01, 2026

Business Today India

BEYOND THE BLOCKBUSTERS

AFTER THE WEIGHT-LOSS DRUG BOOM, AND WITH GENERICS CLOSING IN, BIG PHARMA ARE GEARING UP FOR THE NEXT GAME-CHANGER

7 mins

March 01, 2026

Business Today India

“No compromise on agriculture, US deal is a win-win”

Piyush Goyal, Union Minister for Commerce and Industry, on the India-US trade deal, and what the new pacts signal about India

7 mins

March 01, 2026

Business Today India

INDIA'S TRADE RESET

TWO TRADE PACTS IN TWO WEEKS AND A GROWTH-ORIENTED BUDGET COULD REDEFINE THE COUNTRY'S ECONOMIC PROSPECTS

12 mins

March 01, 2026

Business Today India

INSIDE INDIA'S GIG ECONOMY

INDIA'S GIG WORKFORCE HAS INCREASED SIGNIFICANTLY OVER THE YEARS, POWERING THE RISE OF PLATFORM GIANTS IN SEGMENTS RANGING FROM QUICK COMMERCE TO LOGISTICS. BUT THE REAL CHALLENGE IS BALANCING WORKER PROTECTION WITH GROWTH AND PLATFORM ECONOMICS

6 mins

March 01, 2026

Business Today India

GOING BIG ON DARK STORES

DARK STORES ARE TAKING INDIAN CITIES BY STORM AS BLINKIT, SWIGGY INSTAMART, ZEPTO, BIGBASKET, AMAZON NOW, FLIPKART MINUTES AND JIOMART RACE TO DELIVER QUICK COMMERCE ORDERS

6 mins

March 01, 2026

Business Today India

Concentrated at the Summit

JUST 0.08% OF COMPANIES CORNERED TWO-THIRDS OF PRE-TAX CORPORATE PROFITS AND PAID THE LOWEST EFFECTIVE TAX RATES. CAN INDIA INC BROADEN THE PROFIT PIE?

5 mins

March 01, 2026

Business Today India

Management Advice

AJAY VIJ, SENIOR COUNTRY MANAGING DIRECTOR, ACCENTURE IN INDIA

2 mins

March 01, 2026

Business Today India

The Spirit of the Ocean

WITH INDIAN ROOTS, A LAYERED COLONIAL PAST, AND A VIBRANT CULTURE-MAURITIUS IS FAR MORE THAN A BEACH ESCAPE

3 mins

March 01, 2026

Translate

Change font size