試す 金 - 無料

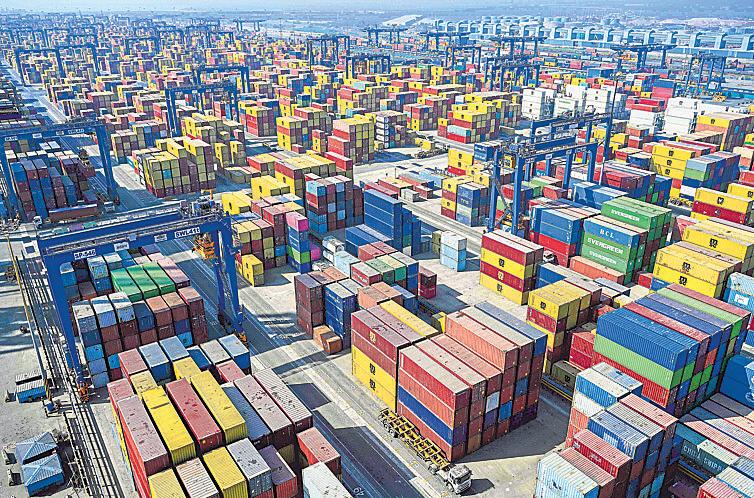

Push for local products as new US tariffs take effect

Mint Mumbai

|August 27, 2025

Extra tariff to punish India's Russian oil purchases takes total levies to a steep 50%

The Centre is doubling down on locally made products to counter a likely drop in overseas shipments, as hefty US tariffs kick in and President Donald Trump vows to punish countries targeting US technology firms.

India aims to wait out the deadlock with the local push, four people aware of the plan said, after US trade talks stalled and its president Donald Trump put India in crosshairs. Earlier in the day, the US notified an extra tariff of 25% on Indian goods, citing New Delhi's refusal to stop buying Russian oil, raising total levies to a steep 50%.

India's position on not granting wider market access for American agricultural and dairy products remains unchanged, and a solution may be several months or even years away, the first of the four people said.

In the meantime, the government plans to unleash a campaign to promote local goods, and may extend duty drawback incentives for several goods. Duty drawback rates are refunds for import duties for materials used to make goods which are exported later.

Prime Minister Narendra Modi, who made a strong push for India-made products on 15 August, on Tuesday urged citizens to buy local goods and requested retail outlets to display 'Swadeshi Only' signboards. The officials said the plan is to drive the narrative further, with US trade talks effectively at a standstill.

"Swadeshi is not new; it has been there for a long time. The government is now planning to encourage consumers to buy only India-made products, while traders would also be advised to procure domestically manufactured goods instead of relying on imported items," the second person said.

このストーリーは、Mint Mumbai の August 27, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Mint Mumbai からのその他のストーリー

Mint Mumbai

Indian IT slashes spending on US lobbying on H-1B visa blues

The Indian IT industry has been lowering its lobbying spends in the US in recent years, according to filings made to the US House of Representatives and accessed by Mint.

2 mins

November 29, 2025

Mint Mumbai

Ahead of its IPO, Meesho bets on tech for stability

From a WhatsApp-based reseller platform a decade ago, Meesho’s journey to become the country’s first multi-category online retailer to debut on the bourses underscores the untapped potential for growth beyond the top-tier cities.

2 mins

November 29, 2025

Mint Mumbai

Former DBS CEO is Temasek India's new non-exec chair

Piyush Gupta, the former chief executive of DBS Group, has joined Singaporean state-owned multinational investment firm Temasek as India chairman, albeit in a non-exec role, and will work with Ravi Lambah, head of India and strategic initiatives, the firm said. He will join on 1 December.

1 mins

November 29, 2025

Mint Mumbai

Q2 GDP surprises at 8.2% growth, rate cut unlikely

The number exceeds both the RBI's projection and the estimate from a Mint poll

3 mins

November 29, 2025

Mint Mumbai

Europe fears it can't catch up in great power competition

In the accelerating contest between great powers, Europe is struggling to keep up.

4 mins

November 29, 2025

Mint Mumbai

LIC’s response to voting on RIL, Adani resolutions

A Mint story on Friday reported how Life Insurance Corp. of India Ltd, or LIC, had approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected similar proposals at other large companies.

1 min

November 29, 2025

Mint Mumbai

'The Family Man' S3: Agent down

The new season of the popular spy thriller series starring Manoj Bajpayee feels like a hedged bet

4 mins

November 29, 2025

Mint Mumbai

Fiscal deficit widens on higher capex, lower tax

India’s fiscal deficit for the April-October period rose on higher capital expenditure and lower net tax revenue.

2 mins

November 29, 2025

Mint Mumbai

Reels, reacjis & conversations with friends

Emojis, GIFs, stickers, reacjis and Al-generated suggestions occupy the spaces where sentences framed by humans once thrived, leaving us to contend with how this changes the way we express, connect with, and understand each other and ourselves

4 mins

November 29, 2025

Mint Mumbai

The miseries of convention

Parades, rainbow-coloured flags and conferences, while critical to claiming space and reinforcing the importance of inclusion and equality, often camouflage the fact that for many in the LGBTQ+ community, there is no option of stepping into the light, even in cities, even with financial independence.

1 min

November 29, 2025

Listen

Translate

Change font size