試す 金 - 無料

The Fed is increasingly torn over a December rate cut

Mint Hyderabad

|November 13, 2025

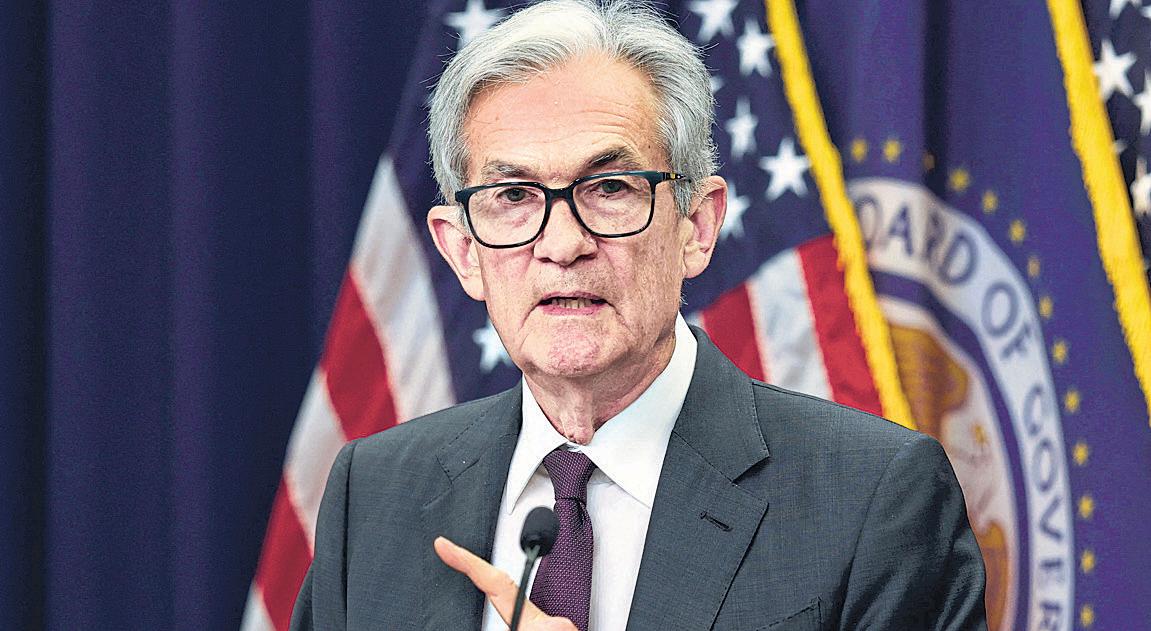

The path for interest-rate cuts has been clouded by an emerging split within the central bank with little precedent during Federal Reserve Chair Jerome Powell's nearly eight-year tenure.

Cutting rates at three consecutive meetings would echo the downward adjustments Federal Reserve Chair Jerome Powell made last year and in 2019.

(REUTERS)

Officials are fractured over which poses the greater threat—persistent inflation or a sluggish labor market—and even a resumption of official economic data may not bridge the differences.

The rupture has complicated what looked like a workable plan less than two months ago, though investors think a rate cut at the Fed’s next meeting is still more likely than not.

When policymakers agreed to cut rates by a quarter of a percentage point in September, 10 of 19 officials, a slim majority, penciled in cuts for October and December. Cutting rates at three consecutive meetings would echo the downward adjustments Powell made last year and in 2019.

But a contingent of hawks questioned the need for further reductions. Their resistance hardened after officials reduced rates again in late October to the current range between 3.75% and 4%. The debate over what to do in December was especially contentious, with hawks forcefully challenging the presumption of a third cut, according to public comments and recent interviews.

Indeed, a key reason Powell pushed back so bluntly against expectations of such a cut at the press conference that day was to manage a committee riven by seemingly unbridgeable differences.

The split was exacerbated by the government shutdown, which turned off the employment and inflation reports that can help reconcile such disagreements. The data void allowed officials to cite private surveys or anecdotes that reinforced earlier assessments.

The dynamic reflected two contingents growing louder and a center with less conviction. Doves worried about labor-market softness but lacked new evidence that would maintain a strong case for cutting.

このストーリーは、Mint Hyderabad の November 13, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Mint Hyderabad からのその他のストーリー

Mint Hyderabad

Eat, see, dance and repeat

A Mint guide to what's happening in and around your city

1 min

January 09, 2026

Mint Hyderabad

Venezuela’s oil shake-up could go either way for India

The unfolding crisis in Venezuela draws into sharp relief a less-recognized feature of the modern global economy: the movement of expectations often matters more than that of physical goods.

3 mins

January 09, 2026

Mint Hyderabad

Why do human lives remain so undervalued in India?

At first glance, this may seem like a question for economists and statisticians, a matter of compensation data, actuarial logic and policy benchmarks.

3 mins

January 09, 2026

Mint Hyderabad

Budget may propose fix for flaws in debt recovery framework

borrower consent, the people said on condition of anonymity.

3 mins

January 09, 2026

Mint Hyderabad

INDIA'S NEW CARRIERS' TROUBLED FLIGHT PATH

An investigation into 3 airline hopefuls reveals a trail of compliance issues, court convictions and capital shortfall

5 mins

January 09, 2026

Mint Hyderabad

Facebook leases space at Hitec City, Hyderabad

Facebook India Online Services, the local entity of social networking firm Meta, expanded its presence in Hyderabad, with a new five-year lease for 69,702 sq ft of office space in Hitec City, one of the prime information technology corridors in the city

1 min

January 09, 2026

Mint Hyderabad

New SIF compliance reporting format

AMCs managing SIFs will now have to report additional compliance details.

1 min

January 09, 2026

Mint Hyderabad

THE DEPRECIATING RUPEE AND WHAT IT MEANS FOR YOUR INVESTMENT PORTFOLIO

Rupee’s slide to the ‘nervous nineties’ rattled investors, even as RBI stepped in to pull it back

3 mins

January 09, 2026

Mint Hyderabad

NSE, IGX in talks for gas futures contracts

India's National Stock Exchange is in discussions with Indian Gas Exchange, or IGX, to develop and launch Indian natural gas futures, the country’s largest bourse said on Thursday.

1 min

January 09, 2026

Mint Hyderabad

LIC MF banks on agents for a comeback

Unlike private asset management companies’ offices, which often have a sleek, minimalist aesthetic, LIC Mutual Fund’s workspace looks exactly like you'd expect of a government-owned entity—drab furniture and yellow walls.

2 mins

January 09, 2026

Listen

Translate

Change font size