試す 金 - 無料

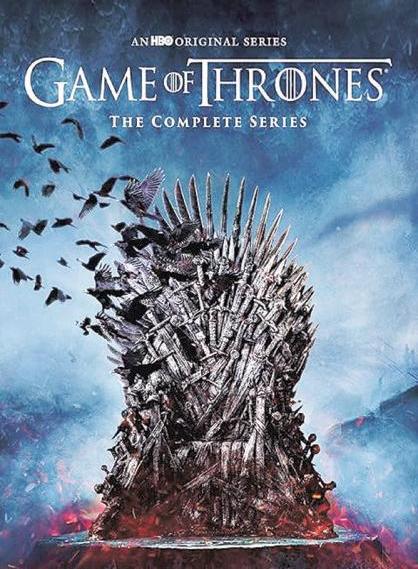

Netflix, Paramount in a game of thrones

Business Standard

|December 11, 2025

What does the sale of Warner Bros Discovery to Netflix or to Paramount mean for India? Time to recalibrate your viewing

The White Lotus, Sopranos, Mare of Easttown and Game of Thrones are among dozens of HBO Max shows that might leave Jio Hotstar over the next 12-18 months.

And The Big Bang Theory, The Vampire Diaries and Two and a Half Men among others could exit Amazon Prime Video.

That is if the $83 billion acquisition of Warner Bros Discovery, which owns these titles, by Netflix goes through. On December 5, Ted Sarandos, co-CEO, president and director of Netflix announced that it is buying “Warner Bros Discovery’s film and TV studios, HBO Max and HBO.” The deal does not include most of Warner's linear television networks like Discovery Global or TNT.

On December 8, Paramount, which had been thwarted in its attempts to buy Warner earlier in the year, launched a hostile bid at $108 billion.

If Netflix and Warner combine, it will create a player with an estimated $70 billion in revenue. If it’s Paramount and Warner, that figure is $79 billion, making it the largest in the entertainment space globally. It would be ahead of YouTube ($61 billion) and The Walt Disney Company, which, excluding parks and experiences, is at $58 billion, said a Media Partners Asia (MPA) research note.

“This deal is largely about the United States and Hollywood/English language franchises. I don’t think it’s going to significantly change Netflix’s life in India. Its Indian journey is about how to penetrate more households with local entertainment and content and, potentially, also with sports,” said Vivek Couto, CEO and executive director, MPA. Parry Ravindranath an, CEO and cofounder of Converj and former president and managing director, Bloomberg Media, international, agrees; “Whether the Warner Brothers deal happens with Netflix or Paramount, it makes no material difference to the Indian media landscape.”

The small-screen impact

このストーリーは、Business Standard の December 11, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Business Standard からのその他のストーリー

Business Standard

AI-driven growth of TCS makes its M&A strategy more aggressive

Even as Tata Consultancy Services (TCS) on Wednesday announced one of its largest ever acquisitions, the market reaction remained subdued.

2 mins

December 12, 2025

Business Standard

State to table 2nd edition of Jan Vishwas Bill

‘The Chhattisgarh government will bring out the second edition of the Jan Vishwas Act, which decriminalises minor offences by replacing prison terms with fines to facilitate investment and a business-friendly atmosphere.

1 min

December 12, 2025

Business Standard

Risk factor

Railways too must carefully assess duty hours

2 mins

December 12, 2025

Business Standard

Policy divisions

US policy differences will require monitoring

2 mins

December 12, 2025

Business Standard

Reorient PLI scheme on labour-intensive sectors to create more jobs: NCAER

Reorienting the production-linked incentive (PLI) schemes by focusing on labour-intensive industries instead of the current focus on capital-intensive ones could help increase job creation, according to a report released by the National Council of Applied Economic Research (NCAER).

1 mins

December 12, 2025

Business Standard

Flipkart Minutes plans to double dark stores by Apr

Flipkart Minutes, the quick-commerce (q-com) arm of e-commerce major Flipkart, plans to double its dark-store numbers to 1,000 by March-April next year, up from a little over 500 currently.

2 mins

December 12, 2025

Business Standard

RBI issues revised norms for cash credit, overdraft facility

THESE AIM TO STRENGTHEN CREDIT DISCIPLINE AND FACILITATE BETTER MONITORING OF TRANSACTIONS AND UTILISATION OF FUNDS

1 min

December 12, 2025

Business Standard

Prudential sells 4.5% in ICICI Pru AMC ahead of IPO

British insurer Prudential said on Thursday it has sold a 4.5 percent stake in ICICI Prudential Asset Management for ₹49 billion (about $545 million) ahead of the Indian fund manager's $1.2 billion initial public offering (IPO) that opens on Friday.

1 mins

December 12, 2025

Business Standard

Use global funds and gold to hedge against currency risk

RUPEE’S DEPRECIATION AGAINST DOLLAR

3 mins

December 12, 2025

Business Standard

IndiGo shares, earnings estimates for FY26 slide

Airline may have to hire expat pilots at high salary: Analysts

3 mins

December 12, 2025

Listen

Translate

Change font size