試す 金 - 無料

PROLONGED PURPLE PATCH

Businessworld India

|30 July 2022

Even the recent market correction is working in favour of VC firms like Blume Ventures as capital is pulling out of public markets and flowing into early-stage startups

INDIA WILL HAVE 122 unicorns in the next two to four years, according to the Hurun India Future Unicorns Index 2022 released by Hurum Research Institute. The projection is in line with the recent trends. In just one year, the number of unicorns has increased 65 per cent probably spurred by the pandemic.

As we celebrate India's emergence as the third largest ecosystem for startups after the US and China, we need to pause and review the emergence of unicorns and their impact on the capital market. The questions that naturally arise pertain to valuations and IPOs. However, leading investors feel that the valuation is between two-parties and has nothing to do with public money.

Valuation vs growth

Higher valuations are no longer a sign of healthy startup growth, especially so for a unicorn. However, since a number of unicorns are also some of the largest employers in the Indian market, a decline in valuation and business slowdown can be catastrophic, not just in terms of venture capital (VC) funds but by way of major job losses.

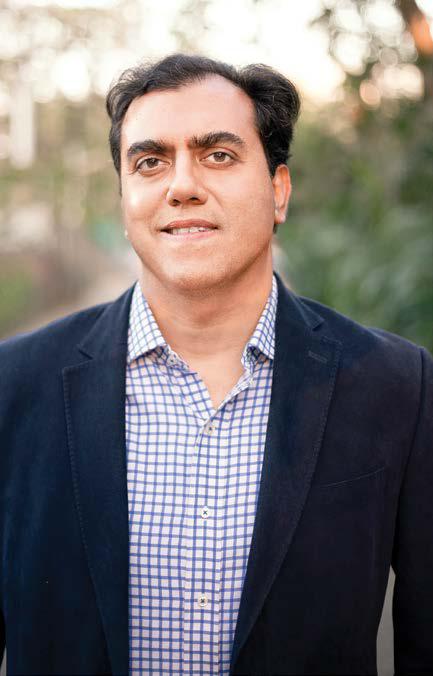

"We are in the middle of the year, Q3 or the second half of the year has just started. The Covid outbreak has been unfortunate but the last couple of years have been very healthy for venture capital. Just one word of caution is, of course, valuations. Indian ecosystem is creating digital tailwinds. What has happened in the ecosystem actually is not unhealthy, because one never wants over-valuations, but rather always wants companies to be rightly valued. I can see a silver lining in that companies get rightly valued and not richly valued," says Sanjay Nath, Founder, Blume Ventures, sharing his viewpoint on the current scenario.

このストーリーは、Businessworld India の 30 July 2022 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Businessworld India からのその他のストーリー

BW Businessworld

"WE EXPECT TO BE CLOSE TO A RS 100 CR VALUATION IN THE NEXT THREE TO FOUR YEARS"

Evolve, a wellness club for women launched this February at the Dhanmill Compound in New Delhi, has been designed to create a space that allows women to explore activities and services that promote physical and emotional well-being. At BW Businessworld, we spoke with Co-founder Shivam Bajaj to gain insight into their vision

1 mins

February 21, 2026

BW Businessworld

The Great Upgrade

The Budget aims to reduce import dependence, upgrade manufacturing ecosystems, support traditional crafts and position India strongly in global textiles value chain

4 mins

February 21, 2026

BW Businessworld

A Structural Reset

The Union Budget 2026-27 sets a long-term vision for India's workforce, but delivery will define its real impact

3 mins

February 21, 2026

BW Businessworld

GIVING IN THE DIGITAL AGE

Zaheer Adenwala has watched social giving in India shift from institutional drives to individual, digital participation. “Donating has become simple thanks to the growth of mobile payments, UPI, and crowdfunding platforms,” Adenwala notes, adding that thousands of small contributions can now come together to support healthcare or disaster relief.

1 min

February 21, 2026

BW Businessworld

VOICE FOR FORGOTTEN MEN

Zaheer Adenwala has watched social giving in India shift from institutional drives to individual, digital participation. “Donating has become simple thanks to the growth of mobile payments, UPI, and crowdfunding platforms,” Adenwala notes, adding that thousands of small contributions can now come together to support healthcare or disaster relief.

1 min

February 21, 2026

BW Businessworld

CAPITAL FOR SUSTAINABLE GROWTH

Impact capital in India has evolved into a core enabler of sustainable economic growth,” says Neelam Pandita, pointing to its expanding role across MSMEs, healthcare, climate transition and financial inclusion.

1 min

February 21, 2026

BW Businessworld

POLICY WITH A PATIENT VOICE

Urvashi Prasad approaches public health through both evidence and lived experience.

1 min

February 21, 2026

BW Businessworld

An Ardent Investor

From boundary-rider to brand builder, former England captain Kevin Pietersen is betting on India, whisky and the long game

4 mins

February 21, 2026

BW Businessworld

DIGNITY THROUGH LIVELIHOODS

For Meera Shenoy, workforce participation is the real test of inclusion. “We move the needle when inclusion moves from charity to smart business strategy,” she says, noting how inclusive hiring can influence entire ecosystems of vendors and partners.

1 min

February 21, 2026

BW Businessworld

The Buck Stops Where? Why we are Failing to Tackle Climate Change

Why climate action is failing despite ambition, and how capital allocation will determine the planet's future

3 mins

February 21, 2026

Translate

Change font size