試す 金 - 無料

The Quiet Revolution

Business Today India

|November 09, 2025

HOW INDIA'S INVESTORS DISCOVERED THAT BORING WORKS

-

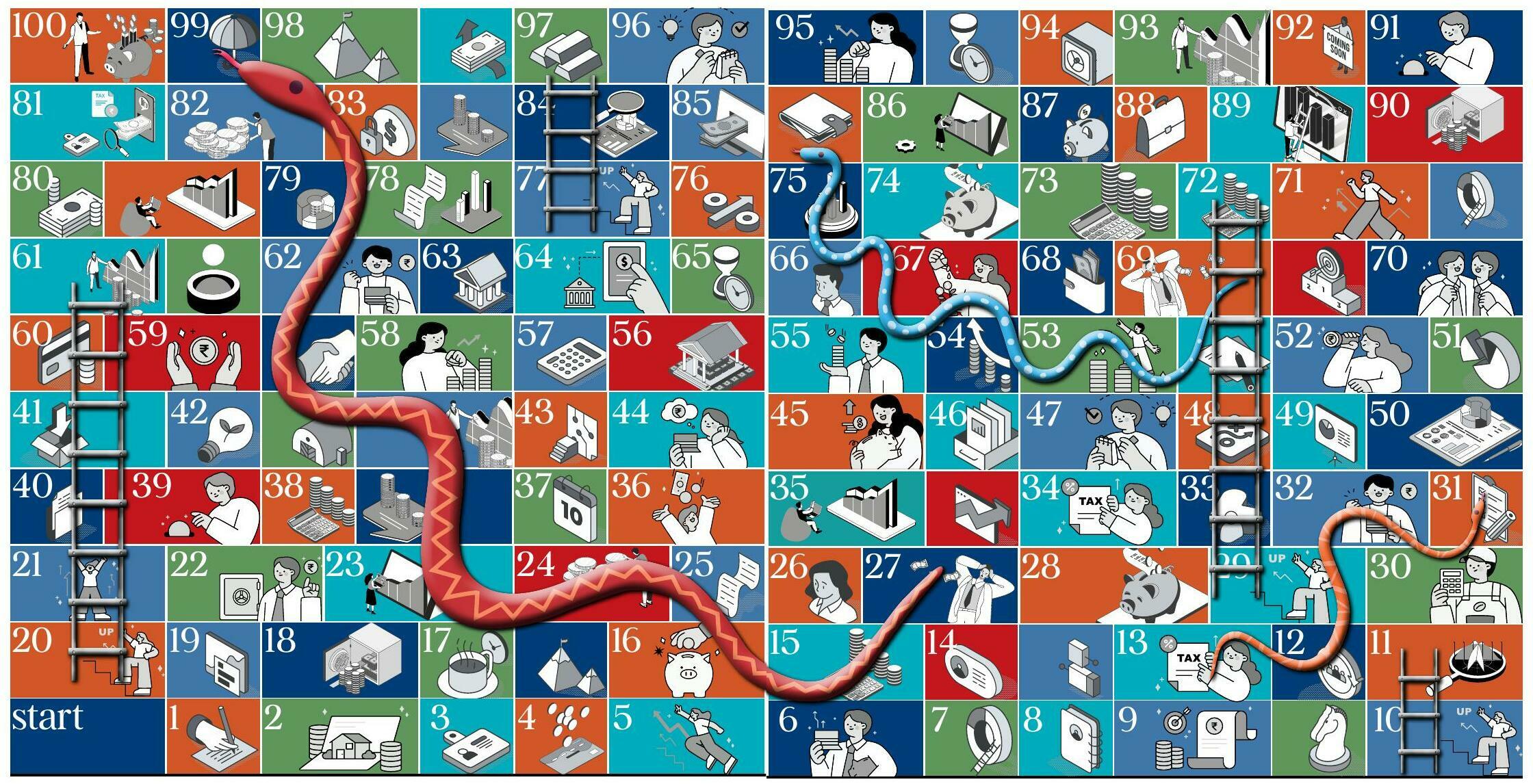

EVERY MONTH, MILLIONS of bank accounts send out small, automated payments. Nobody celebrates. Nobody posts about it. Nobody even notices. But ten years later, these unremarkable transactions have built something remarkable. This is the story of how India's savers became investors, not through dramatic market calls or guru predictions, but through the simple act of showing up. Month after month. Year after year. Through crashes and euphoria alike. Three decades ago, when someone mentioned mutual funds, the typical response involved confusion with cooperatives or perhaps even chit funds. The few who understood were treated with suspicion. Why would you give your money to strangers to invest when your brother-in-law was an 'agent'? Why pay fees when bank fixed deposits and PPF are always there? The answer, it turns out, wasn’t in the products themselves but in what they made possible: a process that worked even when you didn’t.

WHEN BORING BECAME BEAUTIFUL

The transformation didn’t happen because mutual funds became exciting. It happened because they became boring in exactly the right way. The infrastructure arrived. UPI made payments effortless, e-mandates made SIPs automatic, and regulations made costs transparent. The rails removed friction, and friction was often the only thing standing between good intentions and actual wealth building.

But infrastructure alone doesn’t explain the shift. What changed was something more fundamental: Indians discovered that the market rewards process, not performance-chasing. The loud stuff—the themes that burn bright and fade, the tips that promise quick riches, the stocks that everyone is talking about—mostly make headlines, not wealth.

THE MARCH 2020 TEST

このストーリーは、Business Today India の November 09, 2025 版からのものです。

Magzter GOLD を購読すると、厳選された何千ものプレミアム記事や、10,000 以上の雑誌や新聞にアクセスできます。

すでに購読者ですか? サインイン

Business Today India からのその他のストーリー

Business Today India

HOW WE ZEROED IN ON THE FUNDS

SOME FUNDS STAND OUT FOR THEIR CONSISTENT OUTPERFORMANCE COMPARED TO PEERS. HERE ARE THE 100 BEST-PERFORMING MUTUAL FUND SCHEMES IDENTIFIED BY BT & VALUE RESEARCH

4 mins

November 09, 2025

Business Today India

GLOBAL FUNDS, BIG RETURNS

INTERNATIONAL FUNDS HAVE DELIVERED 29% RETURN IN THE PAST YEAR. WILL VOLATILE MARKETS TEST INVESTOR RESILIENCE?

5 mins

November 09, 2025

Business Today India

THE HYBRID PATH TO RICHES

THE HYBRID FUND SPACE IS EVOLVING FAST, AND INVESTORS NEED TO STAY ON TOP TO ENSURE THEY ARE PICKING STABILITY OVER RISK

4 mins

November 09, 2025

Business Today India

SPREADING YOUR BETS

AS MARKET LEADERSHIP FRAGMENTS AND RETURNS TURN UNEVEN, ATTENTION IS SHIFTING BACK TO DIVERSIFIED EQUITY FUNDS, WHICH BALANCE GROWTH WITH STABILITY

4 mins

November 09, 2025

Business Today India

RIDING THE INDEX

AS INVESTORS GRAPPLE WITH A VOLATILE LANDSCAPE, PASSIVE FUNDS ARE PROVING INDISPENSABLE TO GET MARKET RETURNS FROM A DIVERSIFIED SET OF STOCKS AT A VERY LOW COST

6 mins

November 09, 2025

Business Today India

The Quiet Revolution

HOW INDIA'S INVESTORS DISCOVERED THAT BORING WORKS

5 mins

November 09, 2025

Business Today India

Management Advice

KAVIL RAMACHANDRAN PROFESSOR OF ENTREPRENEURSHIP (PRACTICE) AND SENIOR ADVISOR, INDIAN SCHOOL OF BUSINESS (ISB)

2 mins

November 09, 2025

Business Today India

CAUTIOUS MONEY

FOCUS ON GSECS AND QUALITY OF CORPORATE BOND PORTFOLIO MAKE DEBT FUNDS A STEADY ANCHOR FOR DIVERSIFIED INVESTMENT STRATEGIES.

5 mins

November 09, 2025

Business Today India

MAKING THE MOST OF SMALL- AND MID-CAPS

SMALL- AND MID-CAP FUNDS ARE NOT FOR THE FAINT-HEARTED. FOR LONG-TERM INVESTORS, DISCIPLINE, DIVERSIFICATION, AND ALIGNMENT WITH FINANCIAL GOALS REMAIN FAR MORE EFFECTIVE THAN TRYING TO TIME THE MARKET

6 mins

November 09, 2025

Business Today India

“Don't go overboard on small- and mid-cap stocks”

Parag Parikh Financial Advisory Services' Rajeev Thakkar on why investors should avoid the volatile stocks

5 mins

November 09, 2025

Listen

Translate

Change font size