कोशिश गोल्ड - मुक्त

The wall stands firm: 50 years of 'Deewaar'

Mint Mumbai

|January 25, 2025

Yash Chopra's 1975 film drew from mythology and societal upheaval to create a resonant work of popular art. Its reverberations are still being felt today

Tul Sabharwal has a distinct childhood memory from growing up in Agra. As a four- or five-year-old in the early 1980s, Sabharwal would wake up every morning to his father playing the dialogues of Deewaar, Yash Chopra's 1975 film, on his tape recorder while doing the accounts of his shop. "Day after day," recalls the writer-director, "on loop, he would listen to the album of Deewaar, and I would wake up every day to 'Mere paas maa hai'."

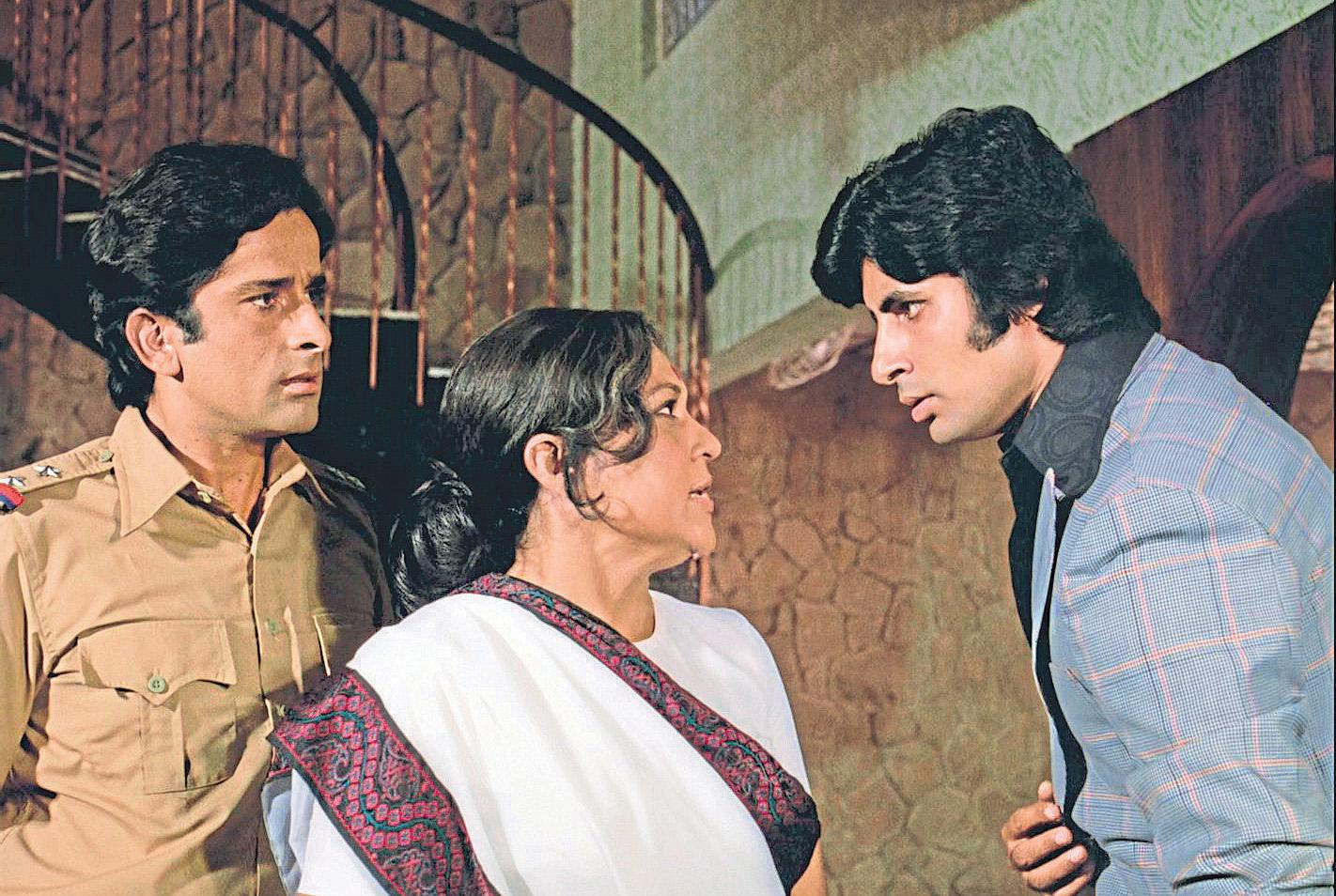

Deewaar was a film of its time. It released 50 years ago, on 24 January 1975, a few months before the Emergency. Salim-Javed's script touched on a host of evils plaguing society: greedy capitalism, worker exploitation, smuggling, blackmarketing, hoarding, unemployment and hunger. Framed around these overarching issues, the film's story-about two brothers, Vijay and Ravi, who find themselves on opposite sides of the law-captivated viewers.

The film's dialogue has been codified into modern Indian psyche. Lines such as the one Sabharwal woke up to, or the defiant Main aaj bhi phenkey huey paise nahin uthaata (Even today, I don't take money thrown at me), are a ready punchline irrespective of context. And Amitabh Bachchan, as dockworker-turned-gangster Vijay, changed Indian cinema. After a promising start in Saat Hindustani (1969), Bachchan had a spate of flops. Salim Javed recommended him as the vigilante cop-protagonist for their script that would become Zanjeer (1973). Bachchan never looked back, his explosive anger in Prakash Mehra's film earning him the moniker 'Angry Young Man'.

यह कहानी Mint Mumbai के January 25, 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Mint Mumbai से और कहानियाँ

Mint Mumbai

Europe bets on $25 bn space budget amid defence hike

Europe’s equivalent of NASA is seeking €22 billion ($25.

1 min

November 27, 2025

Mint Mumbai

China’s ‘McNuggetization’: It’s beneficial for the environment

A wide-scope dietary shift in China is doing the planet a good turn

3 mins

November 27, 2025

Mint Mumbai

Flexi-cap funds in focus as smids falter

A silent pivot

3 mins

November 27, 2025

Mint Mumbai

Labour codes: Focus on empathy and not just efficiency

The consolidation of 29 archaic labour laws into four comprehensive new codes—on wages, social security, industrial relations and occupational safety—is among the most significant structural reforms undertaken by India in the post-liberalization era.

3 mins

November 27, 2025

Mint Mumbai

These firms will sell shovels during semaglutide gold rush

Weight-loss drug semaglutide, also used to treat type-2 diabetes, will face its next big turning point in early 2026, when patents held by Novo Nordisk expire in India.

2 mins

November 27, 2025

Mint Mumbai

HC to hear Apple's plea on fine in Dec

Apple is challenging the new penalty math formula in India's competition law.

1 min

November 27, 2025

Mint Mumbai

Climate crisis: Innovation works, compression doesn't

After weeks of hot air, the UN’s CoP summit limped to an end in Brazil's Amazonian hub of Belém over the weekend, with a ‘deal’ that delivers nothing measurable for the climate, while wasting political capital and much effort on pledges.

3 mins

November 27, 2025

Mint Mumbai

MO Alternates launches its maiden private credit fund

The %3,000 crore fund has drawn capital from family offices, ultra-HNIs and institutions

3 mins

November 27, 2025

Mint Mumbai

Kharif grain production likely to rise to 173 mt

India's kharif foodgrain output is expected to rise to 173.

1 min

November 27, 2025

Mint Mumbai

IL&FS group repays ₹48,463 cr loan

Debt-ridden IL&FS group has repaid ₹48,463 crore to its creditors as of September 2025, out of the total ₹61,000 crore debt resolution target, as per the latest status report filed before insolvency appellate tribunal NCLAT.

1 min

November 27, 2025

Listen

Translate

Change font size