कोशिश गोल्ड - मुक्त

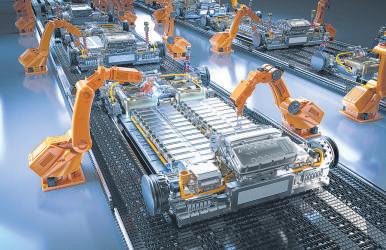

India's share of manufacturing in its economy could easily expand

Mint Mumbai

|September 09, 2025

Price effects hide a performance that can be strengthened by a strategic path that grants this sector global indispensability

For years, India has worried about the declining share of manufacturing in its economy. Two decades ago, the sector contributed nearly 18% of gross value added (GVA). Today, that number has slipped below 14%. At first glance, this decline is both puzzling and disheartening, especially when set against the country's ambition of lifting manufacturing's share in GDP to 25%. After all, the share of manufacturing in the country's gross value of output (GVO) has held steady at around 38%—almost the same as services. So, why is the manufacturing share of GVA low?

The answer lies not so much in output, but in prices. In GVA terms—which measure a sector's 'net contribution' after subtracting inputs—manufacturing looks far smaller than its share of 38% in GVO because intermediate consumption is very large in the manufacturing sector. Secondly, unlike agriculture, where prices have risen sharply due to the prevalence of government support, which sees an annual guaranteed price increase, or services, which enjoy more pricing power, manufacturing is usually characterized by global competition, cost-cutting technologies and narrower margins. For instance, by fiscal year 2024-25, the agricultural price deflator (current price GVA/constant price GVA) stood at 2.17 from the base year value of 1, compared to just 1.41 for manufacturing and 1.75 for services.

यह कहानी Mint Mumbai के September 09, 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Mint Mumbai से और कहानियाँ

Mint Mumbai

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint Mumbai

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint Mumbai

I-T dept to nudge taxpayers to declare foreign wealth

The department was able to collect 30,000 crore disclosed in the previous Nudge drive

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint Mumbai

Beyond the stock slump-Kaynes' $1 bn aim is just the start

Shares of Kaynes Technology India Ltd have fallen about 25% from their peak of 7,705 in October, amid a management reshuffle and the expiry of the lock-in period for pre-IPO shareholders.

1 mins

November 28, 2025

Mint Mumbai

How Omnicom’s IPG buy will change Indian advertising

Two of the advertising world’s Big Four holding companies—Interpublic Group and Omnicom—officially merged this week.

2 mins

November 28, 2025

Mint Mumbai

Why TCS is walking a tightrope

Tata Consultancy Services Ltd recently outlined an ambitious multi-year $6-7 billion investment plan to build artificial intelligence (AI)-focused data centres and is already making progress in that area.

2 mins

November 28, 2025

Mint Mumbai

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint Mumbai

Telecom firms flag hurdles in data privacy compliance

Operators need to comply with the data protection norms within 12-18 months

1 mins

November 28, 2025

Listen

Translate

Change font size