कोशिश गोल्ड - मुक्त

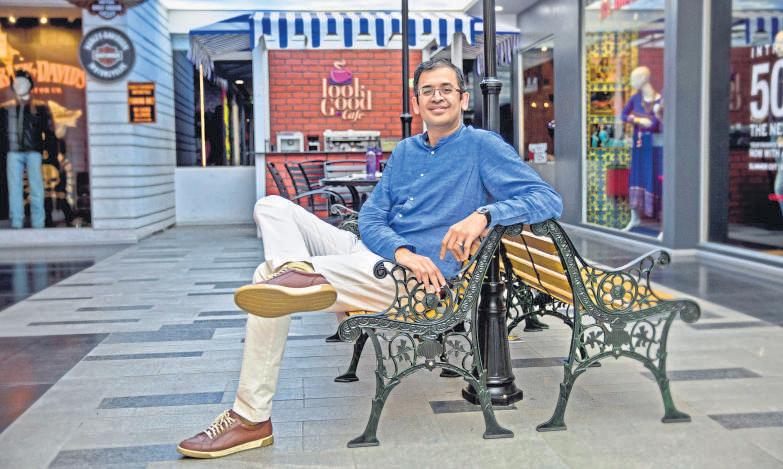

How Ananth Narayanan Plans To Reshape Brnd.Me

Mint Mumbai

|July 10, 2025

The brand aggregator's growth has cooled. A turnaround plan is in the works

India Lifestyle Network, a digital content company, started in 2009. Over the next 15 years, it changed hands thrice.

Founded by Angad Bhatia, the company was first sold to Times Internet in 2012. Ten years later, in 2022, Mensa Brand bought the company at a reported valuation of nearly $50 million. Mensa, recently rebranded as BRND.ME, operates as an aggregator of many consumer companies. India Lifestyle Network, the thinking was, could help its portfolio companies with digital brand-building.

However, in June this year, BRND.ME decided to sell the content company at a significant discount, for $9 million, to the RP Sanjiv Goenka (RPSG) Group.

As ownership changed hands for the third time, Bhatia left (he is now the CEO of Firstpost and Creator18), as did a few other employees.

Several people Mint spoke to said that BRND.ME didn't know how to make the content company work for its brands. However, Ananth Narayanan, the founder and CEO of the firm, clarified that his house of brands didn't need a media company any longer.

"We later realized that we could do the brand building anyway without having to own a media company. We found a better home for the company in the RPSG Group and even from a management standpoint, this helped us to better focus on our core areas of lifestyle, health, and wellness," Narayanan, who in his previous role was the CEO of fashion marketplace Myntra, clarified.

यह कहानी Mint Mumbai के July 10, 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Mint Mumbai से और कहानियाँ

Mint Mumbai

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

4 mins

November 28, 2025

Mint Mumbai

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

3 mins

November 28, 2025

Mint Mumbai

I-T dept to nudge taxpayers to declare foreign wealth

The department was able to collect 30,000 crore disclosed in the previous Nudge drive

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

India, UAE review trade agreement to ease market access

Officials of India and the United Arab Emirates (UAE) met on Thursday to review how the Comprehensive Economic Partnership Agreement (CEPA) is working, and remove frictions that may be impeding trade between the two nations.

1 mins

November 28, 2025

Mint Mumbai

Beyond the stock slump-Kaynes' $1 bn aim is just the start

Shares of Kaynes Technology India Ltd have fallen about 25% from their peak of 7,705 in October, amid a management reshuffle and the expiry of the lock-in period for pre-IPO shareholders.

1 mins

November 28, 2025

Mint Mumbai

How Omnicom’s IPG buy will change Indian advertising

Two of the advertising world’s Big Four holding companies—Interpublic Group and Omnicom—officially merged this week.

2 mins

November 28, 2025

Mint Mumbai

Why TCS is walking a tightrope

Tata Consultancy Services Ltd recently outlined an ambitious multi-year $6-7 billion investment plan to build artificial intelligence (AI)-focused data centres and is already making progress in that area.

2 mins

November 28, 2025

Mint Mumbai

It's a multi-horse Street race now as Smids muscle in

For years, India’s stock market ran on the shoulders of a few giants. Not anymore.

3 mins

November 28, 2025

Mint Mumbai

Telecom firms flag hurdles in data privacy compliance

Operators need to comply with the data protection norms within 12-18 months

1 mins

November 28, 2025

Listen

Translate

Change font size