कोशिश गोल्ड - मुक्त

Kirloskar Group to pump in ₹5,000 cr to double revenue

Mint Bangalore

|October 13, 2025

Kirloskar Oil Engines, new business forays expected to drive group's revenue growth

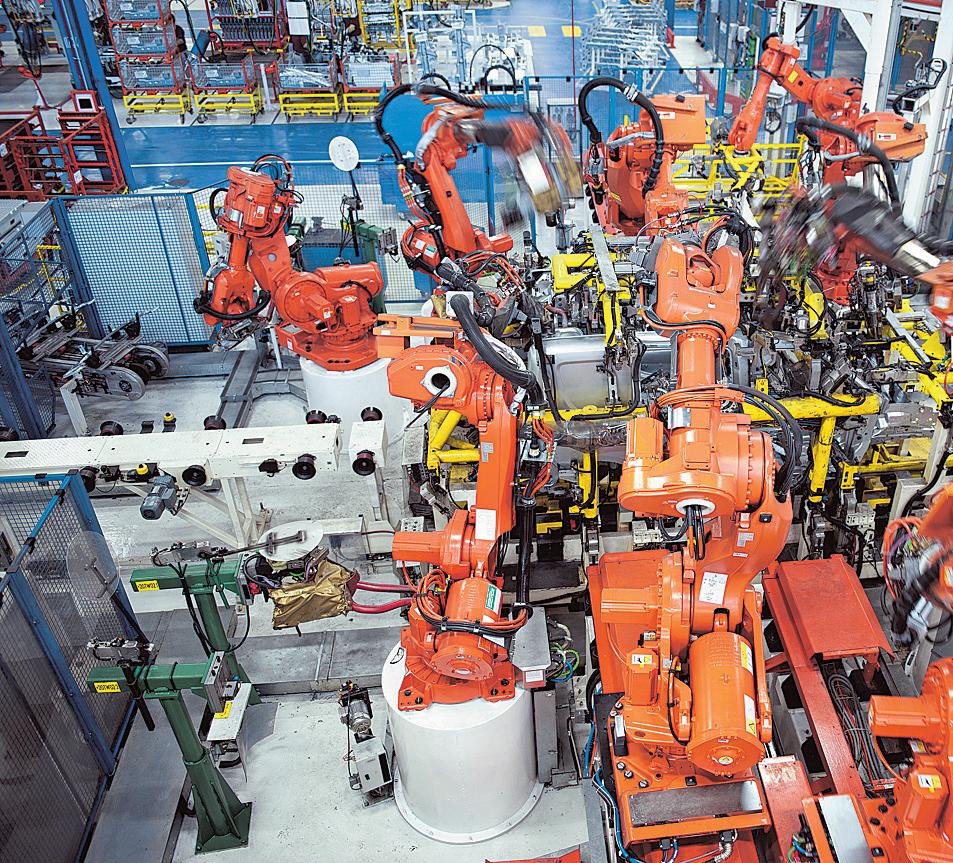

KOEL is entering into segments like high-horsepower engines.

(ISTOCKPHOTO)

The Kirloskar Group, led by siblings Atul and Rahul Kirloskar, has set itself a target of doubling the cumulative revenue across companies to $5 billion by 2030 as these firms enter newer businesses and segments.

Spanning four listed companies—Kirloskar Oil Engines Ltd (KOEL), Kirloskar Pneumatic Company Ltd, Kirloskar Ferrous Industries Ltd and Kirloskar Industries Ltd—the group plans to invest ₹5,000 crore over the coming three years in new manufacturing capacities, said Rahul Kirloskar, chairman of Kirloskar Pneumatic and Kirloskar Ferrous.

The group's revenue growth has been stagnant over the past decade, largely due to a lack of new products. However, a turnaround that began about three years ago has resulted in a sharp revenue uptick across companies. Shareholder interest in the stocks has picked up, too, with stock prices surging across the four companies in 2023 and 2024. The shares have since pared some of the gains, with all four stocks losing over a quarter since the beginning of 2025.

“We have switched gears and we see a bright future ahead of us,” Kirloskar said.

यह कहानी Mint Bangalore के October 13, 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Mint Bangalore से और कहानियाँ

Mint Bangalore

China used to be a cash cow for western companies. Now it’s a test lab.

For Western companies in China, a new reality has set in: The easy money is gone and competition is only getting fiercer.

1 mins

December 01, 2025

Mint Bangalore

Why MF distributors haven't grown as fast as MF assets

may not be substantial. More than banning upfront, what possibly was more damaging to the product was the lowering of TERs. Asa country, our financial footprint isstill at the foothills given our potential. ‘Thismove wasmuch ahead of itstime.”

2 mins

December 01, 2025

Mint Bangalore

India mulls food equipment QCO as China imports soar

China accounts for 41% of India's $843 million worth food-processing equipment imports

2 mins

December 01, 2025

Mint Bangalore

No, our election booth level officers aren't dying of stress

A dangerous thing the Indian news media does is attribute reasons for suicide.

4 mins

December 01, 2025

Mint Bangalore

Let's be a bit more selective in using the word 'reforms'

Everybody should take a beat and think before uttering the word ‘reforms’ the next time. Glib usage, frequently in the wrong context, threatens to rob the word of its import.

3 mins

December 01, 2025

Mint Bangalore

Smart GDP growth casts shadow over December rate cut

The Reserve Bank of India’s (RBI's) Monetary Policy Committee (MPC) is widely expected to keep the policy rate unchanged on 5 December, even as a sizable minority of economists argues that the space created by softening inflation and moderating nominal growth warrants another rate cut.

1 min

December 01, 2025

Mint Bangalore

BEHIND THE GLOSSY REPORT: THE MAKE BELIEVE ESG WORLD

Recently, the Sebi chairperson made a distinction that should make every company board squirm, Speaking at the “Gatekeepers of Governance’ summit, Tuhin Kanta Pandey separated “compliance” from “governance” in a way that was both elegant and damning.

2 mins

December 01, 2025

Mint Bangalore

Selling home to repay loan? Know the tax hit

I had availed an education loan against my residential property. If I now happen to sell the property and use the proceeds to clear the loan, what will be the tax implications I should be mindful about before going ahead with the transaction? The outstanding loan amount is ₹1.5 crore and the likely sale price of the property is also around ₹1.5 crore. I had purchased said the property in 2003 for ₹20 lakh.

2 mins

December 01, 2025

Mint Bangalore

EC extends electoral roll revision by a week to II Dec; final list on 14 Feb

The Election Commission on Sunday extended by one week the entire schedule of the ongoing special intensive revision (SIR) of electoral rolls in nine states and three Union territories amid allegations by opposition parties that the “tight timelines” were creating problems for people and ground-level poll officials.

2 mins

December 01, 2025

Mint Bangalore

GDP growth of 8% plus: How to sustain this pace

Last quarter's economic expansion has cheered India but the challenge is to sustain a brisk rate for years to come. For private investment to chip in, revive infrastructure partnerships

2 mins

December 01, 2025

Listen

Translate

Change font size