कोशिश गोल्ड - मुक्त

Define Your Future

Outlook Money

|March 2025

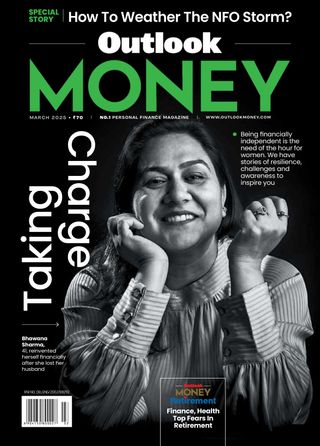

There are incremental changes that you need to make in your financial plan as you age, though the essence remains the same. We have stories of six women from different age groups that show how resilience and grit can secure your future, how awareness can define your path, and fill the financial gaps

The latest film, Mrs, a remake of the The Great Indian Kitchen (released in 2022) that is making waves on the issue of women empowerment, is an eye-opener on how patriarchy works in India and the kind of life women are forced to lead even in today’s day and age. The protagonist, Richa, is a modern-age girl, a choreographer in her 20s, who tries to fulfil all the demands of the institution of marriage, but revolts against it in the end when she realises that there’s no hope of changing or expecting anything positive from it. She goes on to make an independent career of her own and even chides her own parents—a symbol for Indian parenting—for pampering the son.

Some say that her case is extreme, but scores of Indian women, especially of the earlier generation, have spent similar lives and were unable to break from the grind. Even today, several others, like the second wife of Richa’s husband, are stuck in a similar situation.

But the good news is that more and more women living in the metros, especially in the age groups of 20s and 30s, are now becoming conscious about their surroundings and financial independence. In fact, a lot of them have started investing independently, according to a dip-stick survey carried out by this reporter. Experts agree that there is rising awareness among women in this age cohort.

Says Renu Maheshwari, CFP and a Securities and Exchange Board of India-registered investment advisor (Sebi-RIA): “I have witnessed that compared to any other age group, women in their 20s and early 30s are consciously choosing to invest and are selfstarters without any push. If I had to estimate (women’s participation in general), around 90 per cent of them (her clients) actively track their investments.”

Despite varied income brackets of different age groups, women are investing 37 per cent of their income, according to the survey.

यह कहानी Outlook Money के March 2025 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Outlook Money से और कहानियाँ

Outlook Money

Beyond Equity, Dynamic Asset Allocation is key to Emerging India

\"Long-term wealth preservation may be achieved not just by trying to earn the highest possible returns, but also by managing risk effectively.\"

2 mins

January 2026

Outlook Money

Don't Step Into The Equity SIP Illusion

SIPS are a powerful tool for wealth creation, but only if you do not give in to illusions such as SIPS always give double-digit returns

8 mins

January 2026

Outlook Money

Small Habits To Success

Good habits build you up, while bad habits pull you down. The one thing to ensure is that your habits are putting you on the path towards success. So, focus on your current trajectory

4 mins

January 2026

Outlook Money

Here's How To Add Or Change A Bank Nominee

From November 1, banks have allowed customers to name up to four nominees for accounts, deposits and lockers. Change or cancellation of a nominee must be acknowledged by the bank within three working days. Nominee details appear on passbooks, statements, and fixed deposit receipts.

1 min

January 2026

Outlook Money

An IPO To Fund Growth Without Distraction

Keertana is choosing public capital early to scale profitably and reduce dependence on repeated private rounds

2 mins

January 2026

Outlook Money

The "Choose Your Fighter" Fund for a Rotating Market

They shift between large mid and small caps as valuations, cycle signals and risk change.

2 mins

January 2026

Outlook Money

Riding On Expansion In South

India Shelter Finance Corporation is one of the fastest-growing affordable housing finance companies (HFCs) in India, catering to home buyers in tier II and III cities and towns. It operates across 15 states and Union Territories (UTs) with major presence in Rajasthan, Maharashtra and Madhya Pradesh.

2 mins

January 2026

Outlook Money

Rotate Sectors With The Cycle Not The Noise

Track signals to spot recovery or slump then shift sector exposure before consensus catches up.

2 mins

January 2026

Outlook Money

Banking On Loan Growth

ICICI Bank is among India's most structurally strong private banks, backed by consistent financial performance, superior risk management, and a well-diversified business franchise.

1 mins

January 2026

Outlook Money

Higher Margins Bode Well

Max Financial Services owns 80 per cent of Max Life, which is one of India’s largest private life insurers.

1 mins

January 2026

Listen

Translate

Change font size