कोशिश गोल्ड - मुक्त

SANITY OF SAFETY OR RUSH OF RISK

Outlook Money

|August 2020

You are utterly confused. Between April and June this year, many hurriedly scurried out of equities. And the stock indices bounced back with a vengeance in July. Now, there is frustration and desperation about the lost opportunities, as people wait for stock prices to correct so that they can re-enter. To seek safe havens, some of us got into cash, debt, and gold. Sadly, in these cases too, the events unexpectedly turned against us. The situation baffled us. Armed with cash, the hapless investors decided to ‘time the market’, and act on their own – largely as day traders. They realised, like many did in the past, that it is almost impossible to do so. Even the experts are unable to predict the random walks of the stock market. While debt seemed secure, there was uncertainty about future returns as interest rates fell, and inflation inched up. Gold seemed a no-brainer but was this a good time to buy at such high prices? Most investors are shocked and stunned. To be safe or take risks, that is the question today. What should one do over the next 3-6 months? Is it better to take the plunge into equities, and ride out the topsy-turvy waves and volatility in the market? Is it more pertinent to accept lower returns, but protect our investments, and shift to debt? Is bullion the new calling for most of us? As some experts contend, if there’s one advice they wish to give, it is to be in gold. In this cover story, Outlook Money takes a 360-degree look at short-term strategies to shield your wealth from tumultuous upheavals, and simultaneously safeguard your returns. We present the pros and cons related to each asset category to enable you to make informed and insightful decisions. Beware that there is no one shoe-size that will fit every feet. At the end of the day, we are on our own, and we will need to carefully re-construct our plans on an individual basis.

We consider ourselves to be rational human beings. But even the smartest of us tend to panic. Worse, we later defend our dim-witted decisions as logical and sensible. Given the information we had at that time, we theorise, what we did was the best we could. There were few choices, and we had to act in real time. Any delays from our side could only worsen the situation. Moreover, we couldn’t sit back, and watch our wealth being eroded, minute-by-minute, day-by-day.

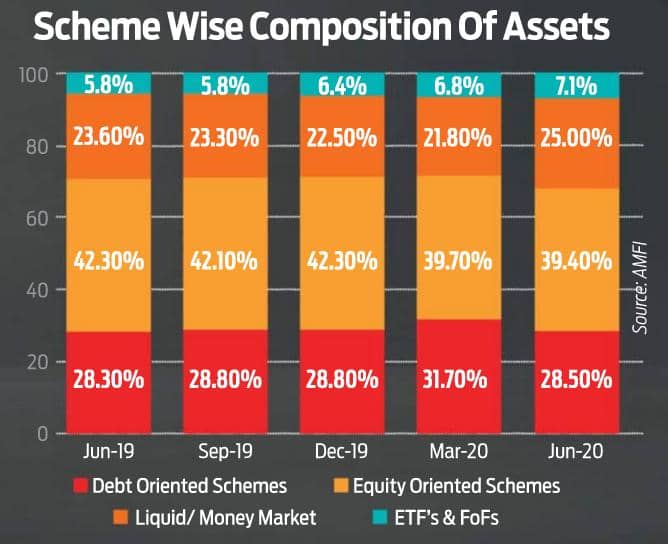

Nothing epitomised this panicked-rationality better than the mayhem in the mutual funds market. As the Indian stock indices tumbled by almost 40 per cent by March 23 this year, the crazed investors ran away in herds. In June, they pulled out a massive ₹13,500 crore from the equity-oriented schemes, an increase of more than 75 per cent compared to the previous month. The overall monthly inflows in such funds in June were the lowest in the past four years.

Massive outgoes were witnessed in the multicap equity funds, followed by the large-cap ones. A similar trend gripped the hybrid funds, which invest in a mix of equity and debt; arbitrage funds proved to be an exception. The mid-cap category survived the bedlam, but monthly inflows fell to ₹36.70 crore in June. Ironically, as the markets recovered, the assets-under-management of the equity funds grew by 8 per cent between May and June this year.

यह कहानी Outlook Money के August 2020 संस्करण से ली गई है।

हजारों चुनिंदा प्रीमियम कहानियों और 10,000 से अधिक पत्रिकाओं और समाचार पत्रों तक पहुंचने के लिए मैगज़्टर गोल्ड की सदस्यता लें।

क्या आप पहले से ही ग्राहक हैं? साइन इन करें

Outlook Money से और कहानियाँ

Outlook Money

10 FAQs ON RECENT CHANGES IN EPF WITHDRAWAL RULES

The Central Board of Trustees (CBT) of the Employees' Provident Fund Organisation (EPFO) has eased partial withdrawal rules for subscribers in October 2025.

3 mins

December 2025

Outlook Money

How To Use Thematic Investing Wisely In Your Portfolio

Good themes are built on data and discipline, not fashion; understand the forces before investing.

2 mins

December 2025

Outlook Money

How You Think Is How You Spend

Our actions and thoughts translate into how our money life shapes up. Look for blind spots before you make any money decisions

4 mins

December 2025

Outlook Money

Back To The Nest

Rising cost of urban living along with stagnant salaries are pushing a generation of young professionals to move back in with their parents. That situation may lead to friction but mature handling make the situation a win-win for both

8 mins

December 2025

Outlook Money

What's Enough For Retirement?

It's crucial to make your own estimate for a retirement corpus, based on your expenses and lifestyle habits. This exercise should be unique to each individual

4 mins

December 2025

Outlook Money

Buying A Home? Look For The Hidden Tag Too Price

Rera has made property buying more transparent, yet other costs can raise the actual price by 10-20 per cent. Buyers should not assume the price on the brochure is final. The true cost of homeownership is far higher

5 mins

December 2025

Outlook Money

One Flexicap Fund Many Market Opportunities

Blend large mid and small caps in one portfolio so gains offset volatility across cycles

2 mins

December 2025

Outlook Money

A Ride To Remember

A motorcycling road trip could be the ultimate adrenaline rush combining adventure along with relative comfort

7 mins

December 2025

Outlook Money

Eyeing Value Opportunity

Global markets are at an all-time high, with most major indices hovering near their peak, leaving limited room for further upside.

1 mins

December 2025

Outlook Money

Follow The Cycle Not The Noise To Keep Your Money Working Harder

Shift between growth and safety as the economy turns instead of reacting late to headlines

2 mins

December 2025

Translate

Change font size