Essayer OR - Gratuit

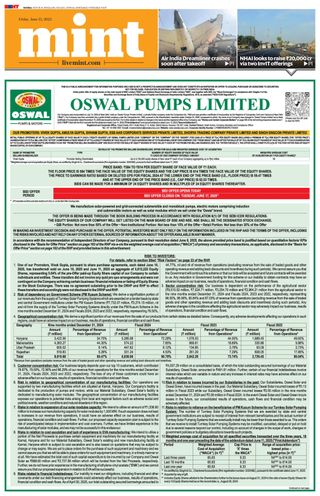

PFC's Withdrawals Could Hit New Zero-Coupon Debt Sales

Mint Mumbai

|June 13, 2025

These bonds, often issued by govt entities, are primarily used for infrastructure financing

Issuer interest in zero-coupon bonds (ZCBs) faces a potential setback after state-run Power Finance Corporation (PFC) pulled its planned offering for a second time in a row, reportedly due to a mismatch in yield expectations, experts said.

Following approval from the Central Board of Direct Taxes (CBDT) on 11 March 2025, PFC decided to launch its 10-year zero-coupon bonds, according to an official notification, with a base issue size of ₹1,500 crore and a green shoe option to raise additional ₹1,500 crore in the event of high demand from investors.

Business Standard reported on Monday, citing sources, that PFC has withdrawn its zero-coupon bond issuance for the second time in just over a month, as investors demanded higher yields than what the issuer was willing to offer. PFC had previously withdrawn the issuance on 30 April 2025.

"The subdued response on Monday (to the PFC bond issuance) from both arrangers and investors suggests that issuers may need to revisit their strategy, timing, and pricing assumptions. Although CBDT approvals provide flexibility over the issuance window, market conditions will ultimately dictate whether ZCBs can sustain their relevance," said Venkatakrishnan Srinivasan, founder and managing partner of financial advisory firm Rockfort Fincap LLP.

Cette histoire est tirée de l'édition June 13, 2025 de Mint Mumbai.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Mumbai

Mint Mumbai

Gen Alpha will make new rules for their workplace

Gen Alpha will expect hybrid workplaces, Al tools and 4-day weeks— offices unrecognizable to their parents’

3 mins

December 01, 2025

Mint Mumbai

EC extends electoral roll revision by a week to II Dec; final list on 14 Feb

The Election Commission on Sunday extended by one week the entire schedule of the ongoing special intensive revision (SIR) of electoral rolls in nine states and three Union territories amid allegations by opposition parties that the “tight timelines” were creating problems for people and ground-level poll officials.

2 mins

December 01, 2025

Mint Mumbai

THE PROBLEM IS NOT JUST ABOUT DYNASTIC POLITICS

These days Tejashvi Yadav is the target of intense trolling. Before him the Huda family in Haryana and Thackerays in Maharashtra got the same treatment. So, is the battle of victory and defeat in electoral politics a tussle between dynasts vs the rest? Absolutely not.

3 mins

December 01, 2025

Mint Mumbai

Green hydrogen: Fast fashion could help bump up demand

A boom in its use for clean synthetic inputs might make a difference

3 mins

December 01, 2025

Mint Mumbai

Let's be a bit more selective in using the word 'reforms'

Everybody should take a beat and think before uttering the word ‘reforms’ the next time. Glib usage, frequently in the wrong context, threatens to rob the word of its import.

3 mins

December 01, 2025

Mint Mumbai

As mid-cap alpha shrinks, should you consider passive strategies?

Advisers urge a balanced mix—add passives slowly and back strong, active managers, as mid-caps are still pricey

4 mins

December 01, 2025

Mint Mumbai

With $2.2 bn fund, ChrysCap has appetite for riskier bets

MD Saurabh Chatterjee details shift in global LP base, renewed focus on manufacturing

3 mins

December 01, 2025

Mint Mumbai

GDP growth of 8% plus: How to sustain this pace

Last quarter's economic expansion has cheered India but the challenge is to sustain a brisk rate for years to come. For private investment to chip in, revive infrastructure partnerships

2 mins

December 01, 2025

Mint Mumbai

INSIDE INDIA'S ATTEMPT TO TAME DEEPFAKES

Detection tools today are not universal or consistent across languages

5 mins

December 01, 2025

Mint Mumbai

APIs to innovation: Bulk drug makers ramp up CDMO bets

Once focused on low-margin active pharmaceutical ingredients (APIs), India’s bulk drug manufacturers are raising their ambitions, with several now investing heavily in research and development to win contract development and manufacturing work from global drugmakers.

2 mins

December 01, 2025

Listen

Translate

Change font size