Essayer OR - Gratuit

Bang bang, he shot us down

Mint Mumbai

|August 09, 2025

Today's villain is less a character than a stepping stone for the hero's glory. Gabbar, in contrast, is a charismatic force of nature

Who is the hero of Sholay? This is a valid question. Thakur, played by Sanjeev Kumar, gets the revenge. Veeru, played by Dharmendra, gets the girl. Jai, played by Amitabh Bachchan, gets the heroic sacrifice at the close of the film. Which of them is the hero? You may as well toss a coin to decide.

There is no question about the man on the other side. Gabbar Singh has no peer, no equal. He is a villain beyond comparison. As played by Amjad Khan—a breakthrough performer in an all-star sea—Gabbar is theatre and terror, a villain who feels less taken from cinematic archetypes than conjured from folklore and nightmare.

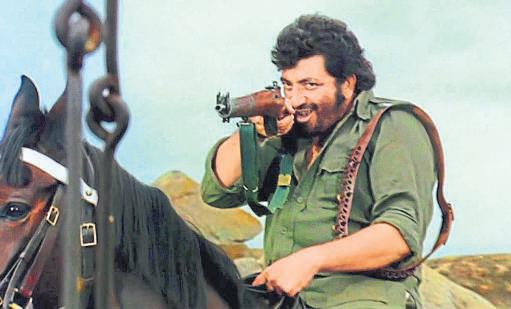

Gabbar Singh. He arrives on screen through dust and sweat. He's wrapped in sun-bleached olive green fatigues, hanging on him like the regalia of an absconding general. Part pirate, part Sergio Leone villain, grimy and ruthless and bearded, a man made for Ennio Morricone music. The way the bandolier falls across his swarthy chest, the way bullets hang from him like he is ready to take on an army by himself. A battered service revolver droops from his hip, casual as a house-key. His shirt is open wide at the neck, flaunting an amulet, a taabeez that may well stop a bullet. His boots, those heavy cavalry-style steely boots, announce him to us before the camera does, every crunch on Ramgarh's rocks working like the number on a countdown.

Khan's face looks ravaged by wars internal and external. His curls are sweaty, beard scraggly and unpredictable, eyes baggy with exhaustion... yet, also, a-twinkle with mischief. The mischief of the man who doesn't sleep and who doesn't let the world sleep. He grins a wonky grin and his teeth flash, irregularly. Unforgettably.

Cette histoire est tirée de l'édition August 09, 2025 de Mint Mumbai.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size