Essayer OR - Gratuit

Sunjay Kapur's will forged, ex-wife's children tell court

Mint Bangalore

|October 10, 2025

Dispute revolves around ₹30,000-cr estate contested between Kapur's kids and widow Priya

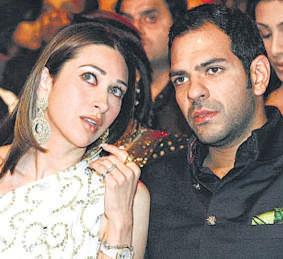

A file photo of Karisma Kapoor and Sunjay Kapur.

In a new twist in the dispute over the will of the late Sunjay Kapur, who was Sona Comstar chairman, his children with former wife Karisma Kapoor told the Delhi High Court (HC) on Thursday that the document governing Kapur's ₹30,000-crore estate was a "manifestly forged will", alleging it was created in a criminal conspiracy involving his widow Priya Sachdev Kapur and others.

Kapur died on 12 June in the UK after collapsing during a polo match from a sudden heart attack, reportedly triggered when he swallowed a bee.

Senior advocate Mahesh Jethmalani, representing Karisma Kapoor's children, presented the allegations before Justice Jyoti Singh, arguing that Sunjay had no role in drafting or modifying the will. The document, a typed Microsoft Word file, was allegedly altered on 17 March, while Sunjay was on a holiday.

Jethmalani said the file had no digital footprint of Sunjay, but shows activity from others allegedly involved, including Priya Kapur. He added that no lawyer was consulted, and the appointed executor was not informed.

Cette histoire est tirée de l'édition October 10, 2025 de Mint Bangalore.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Bangalore

Mint Bangalore

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

1 min

November 28, 2025

Mint Bangalore

Diversification holds the key to reducing our trade vulnerability

India's merchandise exports are less exposed to US policy vagaries than services. The latter need to find new export markets

4 mins

November 28, 2025

Mint Bangalore

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Bangalore

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Bangalore

Would you like to be interviewed by an AI bot instead?

don't think I want to be interviewed by a human again,\" said a 58-year-old chartered accountant who recently had an interview with a multinational company.

3 mins

November 28, 2025

Mint Bangalore

The curious case of LIC's voting on RIL, Adani resolutions

Life Insurance Corp. of India Ltd, or LIC, consistently approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected several similar proposals at other large companies, some even part of other conglomerates, a Mint review of about 9,000 voting decisions by the government-run insurer showed.

1 min

November 28, 2025

Mint Bangalore

Tune into weak signals in a world of data dominance

World War II saw the full fury of air power in battle, first exercised by Axis forces and then by the Allies, culminating in American B-29 bombers dropping atomic bombs on Hiroshima and Nagasaki.

4 mins

November 28, 2025

Mint Bangalore

When LLMs learn to take shortcuts, they become evil

Some helpful parenting tips: it is very easy to accidentally teach your children lessons you did not intend to pass on.

2 mins

November 28, 2025

Mint Bangalore

What if China weaponizes its dominance of pharma inputs?

Overdependence on China for drug-making should worry the US

3 mins

November 28, 2025

Mint Bangalore

VentureSoul closes first debt fund at ₹300 crore

VentureSoul Partners has announced the close of its maiden debt fund at ₹300 crore, with plans to raise an additional ₹300 crore through a green shoe option by February 2026.

1 min

November 28, 2025

Listen

Translate

Change font size