Essayer OR - Gratuit

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint Ahmedabad

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

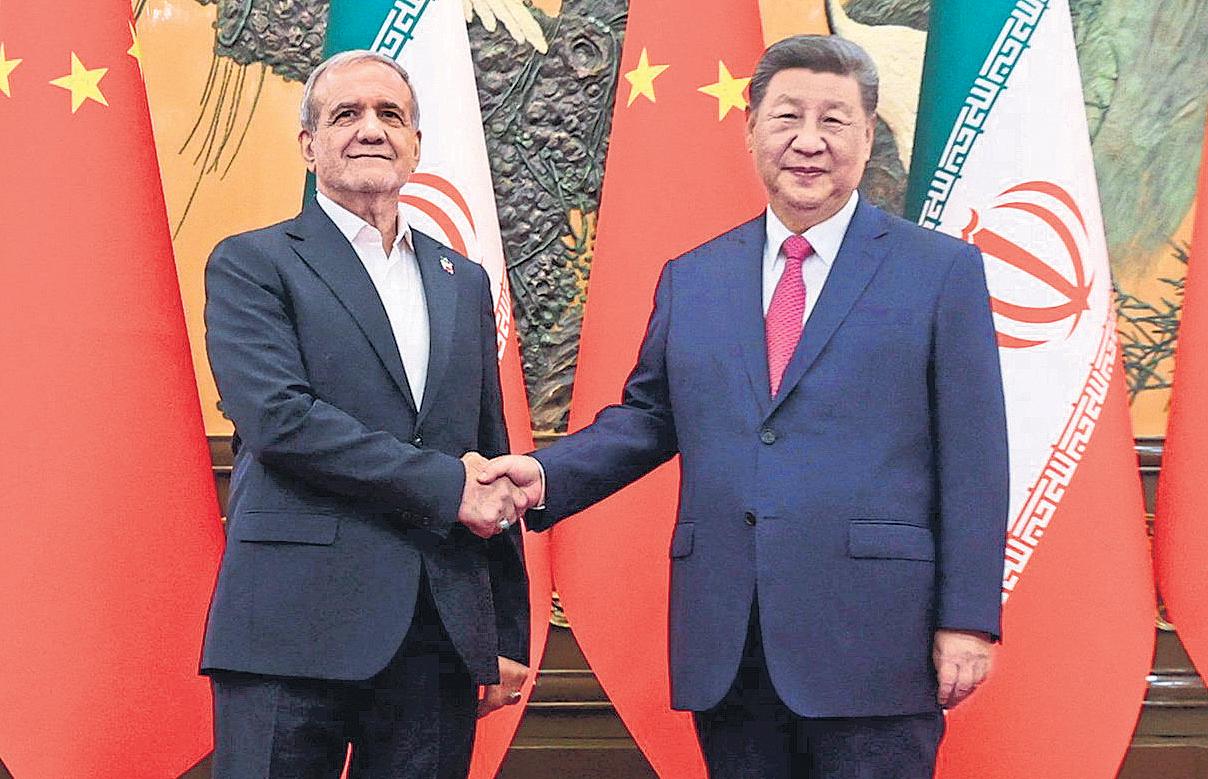

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit. REUTER

(REUTER)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

Cette histoire est tirée de l'édition October 07, 2025 de Mint Ahmedabad.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Ahmedabad

Mint Ahmedabad

The curious case of LIC's voting on RIL, Adani resolutions

Life Insurance Corp. of India Ltd, or LIC, consistently approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected several similar proposals at other large companies, some even part of other conglomerates, a Mint review of about 9,000 voting decisions by the government-run insurer showed.

1 min

November 28, 2025

Mint Ahmedabad

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

1 min

November 28, 2025

Mint Ahmedabad

Diversification holds the key to reducing our trade vulnerability

India's merchandise exports are less exposed to US policy vagaries than services. The latter need to find new export markets

4 mins

November 28, 2025

Mint Ahmedabad

It's a multi-horse race on stock markets as Smids muscle in

tion through retail flows, systemic investment plans (SIPs) and passive assets under management (AUM).

2 mins

November 28, 2025

Mint Ahmedabad

Investors expect AI use to soar. That’s not happening

On November 20th American statisticians released the results of a survey. Buried in the data is a trend with implications for trillions of dollars of spending.

2 mins

November 28, 2025

Mint Ahmedabad

Tech startups on M&A route to boost scale, market share

M&As were earlier used to enter new markets or geographies, but that strategy has evolved

2 mins

November 28, 2025

Mint Ahmedabad

VentureSoul closes first debt fund at ₹300 crore

VentureSoul Partners has announced the close of its maiden debt fund at ₹300 crore, with plans to raise an additional ₹300 crore through a green shoe option by February 2026.

1 min

November 28, 2025

Mint Ahmedabad

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Ahmedabad

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Ahmedabad

Can I claim TDS refund despite missing return filing deadline?

I am an NRI living in Dubai and have investments in Indian listed stocks. One of the companies I invested in, did a buyback in March, on which Tax Deducted at Source (TDS) was deducted. At that time, I was advised by a friend that I could claim a refund of TDS at the time of filing my tax return due to the benefits of the Double Taxation Avoidance Agreement (DTAA).

2 mins

November 28, 2025

Listen

Translate

Change font size