Essayer OR - Gratuit

FROM CREATIVE INTERPRETATION TO CORRECTIVE INTERVENTION: THE SUPREME COURT RECALIBRATES THE NEXUS BETWEEN TAX VIOLATIONS AND ENFORCEABLE DEBT

UNIQUE TIMES

|October - November 2025

A Comparative Analysis of P.C. Hari v. Shine Varghese and Sanjabij Tari v. Kishore S. Borcar & Ors.

Introduction- A Short-Lived Jurisprudential Controversy

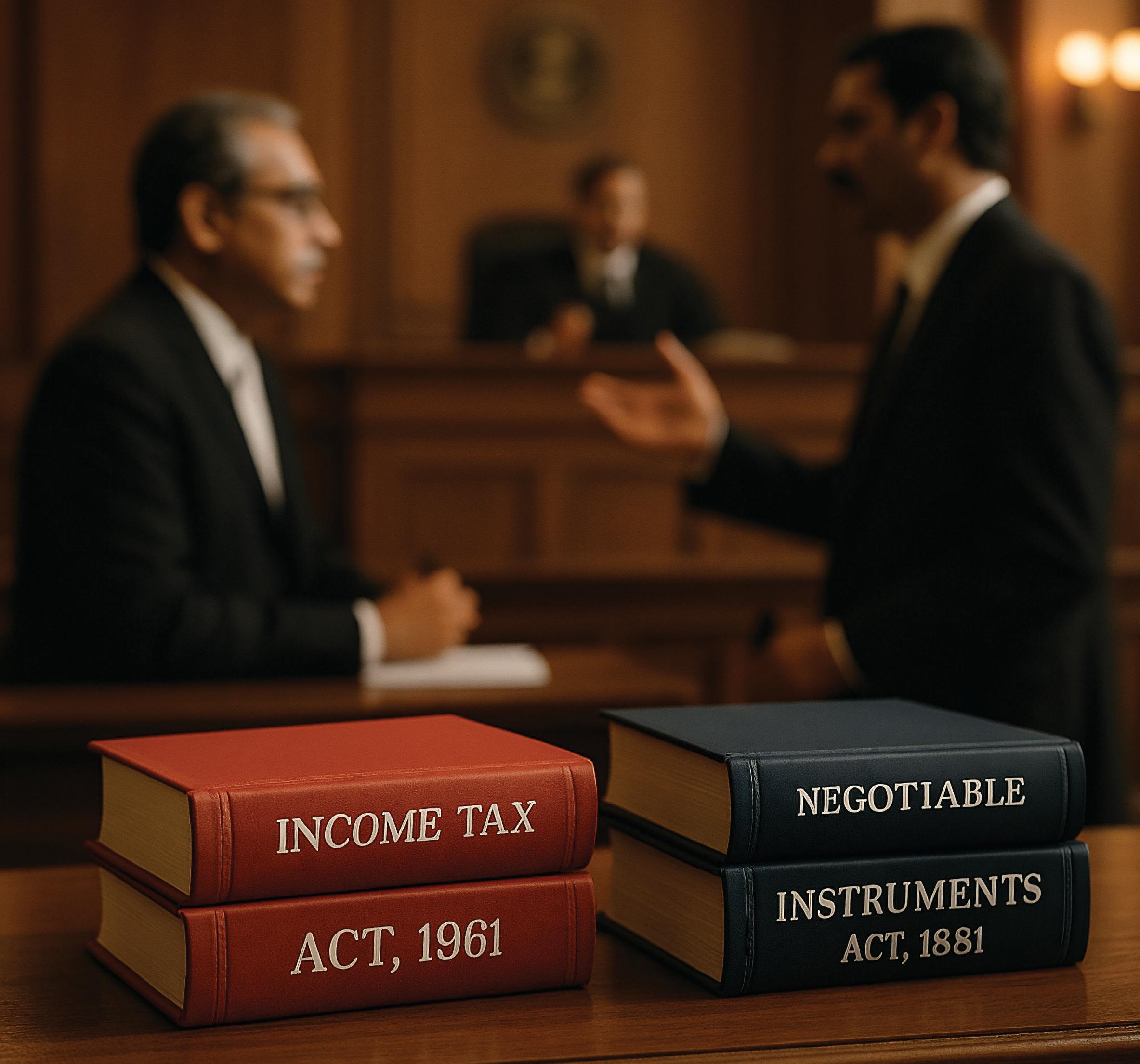

The interplay between the Negotiable Instruments Act, 1881 (“NI Act”) and the Income Tax Act, 1961 has long been a fertile ground for legal debate. The core question is simple yet profound: should a debt, otherwise valid in civil law, be rendered unenforceable under the NI Act because its creation violated a fiscal statute? In 2025, the Hon'ble Kerala High Court in P.C. Hari v. Shine Varghese delivered a bold, policy-driven answer in the affirmative, sending ripples through the commercial litigation landscape. Its ruling declared that a cash transaction violating Section 269SS of the Income Tax Act could not form the basis of a "legally enforceable debt" under Section 138 of the NI Act.

However, this seismic shift in jurisprudence was short-lived. The Supreme Court of India, in Sanjabij Tari v. Kishore S. Borcar & Ors., comprehensively analyzed the issue and expressly overruled the Kerala High Court's judgment. This article provides a critical comparative analysis of these two landmark rulings, tracing the journey from a strict, policy-oriented interpretation to a doctrinally pure, purpose-focused one, and establishing the current, settled position of law.

The Kerala High Court's Bold Gambit in P.C. Hari

The judgment of the Hon'ble Kerala High Court was a radical attempt to use the NI Act as a tool for enforcing fiscal discipline. Its reasoning was built on several key pillars, which are summarized below:

The Clash of Presumptions: The Court held that the presumption under Section 139 of the NI Act that a cheque is for the discharge of a legally enforceable debt, could not be used to legitimize a transaction expressly prohibited by Section 269SS of the IT Act. It advocated for a harmonious construction, effectively making tax compliance a precondition for enforceability under the NI Act.

Cette histoire est tirée de l'édition October - November 2025 de UNIQUE TIMES.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE UNIQUE TIMES

UNIQUE TIMES

Legendary Italian Singer and 'Ocean's Twelve Voice Ornella Vanoni Dies at 91

Legendary Italian singer Ornella Vanoni, whose timeless hit “L'appuntamento” gained global recognition after featuring in Ocean's Twelve, has died at 91 at her home in Milan.

1 min

December - January 2026

UNIQUE TIMES

Apple Challenges India's Global Turnover Penalty Rule in Delhi High Court

Apple Inc. has filed a writ petition in the Delhi High Court contesting provisions of India’s Competition Act that permit penalties to be based on a company’s global turnover.

1 min

December - January 2026

UNIQUE TIMES

ABODE OF PEACE

A visit to Shanti Niketan in West Bengal is truly peaceful, highly artistic and enriching.

4 mins

December - January 2026

UNIQUE TIMES

Mahindra Launches XEV 9S Seven-Seater EV to Accelerate Expansion in India's Electric SUV Market

Mahindra has unveiled its new seven-seater electric SUV, the XEV 9S, starting at around ₹ 20 lakh ($22,409), strengthening its push into India’s rapidly expanding EV market led by Tata Motors.

1 min

December - January 2026

UNIQUE TIMES

HP Plans Major Al-Driven Restructuring, to Cut Up to 6,000 Jobs by 2028

HP Inc. will lay off up to 6,000 employees worldwide by 2028 as part of an aggressive AI-driven overhaul aimed at automating operations, speeding up product development, and enhancing customer support, with CEO Enrique Lores estimating $1 billion in savings over three years.

1 min

December - January 2026

UNIQUE TIMES

OpenAl Launches Global Group Chats, Turning ChatGPT into a Collaborative Multi-User Workspace

OpenAI has launched its new Group Chats feature globally for all ChatGPT users-Free, Go, Plus and Pro-shifting the platform from a one-to-one assistant to a shared collaborative space.

1 min

December - January 2026

UNIQUE TIMES

India's Food Services Market to Hit $125 Billion by 2030, Led by Rapid Organised Sector Growth

India's food services market is expected to grow from $78 billion to $125 billion by 2030, driven primarily by the fast-expanding organised segment, according to Swiggy's \"How India Eats\" report with Kearney. While unorganised players still hold over half the market, organised food services are set to contribute more than 60% of future growth, expanding at twice the pace.

1 min

December - January 2026

UNIQUE TIMES

DIGITAL WILLS: VALIDITY AND RISKS

Wills are one of the most important documents a person might sign in their life.

4 mins

December - January 2026

UNIQUE TIMES

Finland Remains World's Happiest Country Despite Economic Struggles

Finland has been named the world's happiest country For the eighth year med the world's happie ste World Happiness Report, even as it faces mounting economic challenges.

1 min

December - January 2026

UNIQUE TIMES

NEEM: THE ANCIENT GREEN WARRIOR REDEFINED BY MODERN SCIENCE

Why this Ayurvedic leaf remains a global powerhouse in skin and scalp health

2 mins

December - January 2026

Listen

Translate

Change font size