Essayer OR - Gratuit

The Clash Of Handset Titans

Businessworld

|September 1st, 2018

The gloves are off. The time is ripe. The top-selling handset makers are battling it out to reach the No. 1 slot in India’s smartphone market.

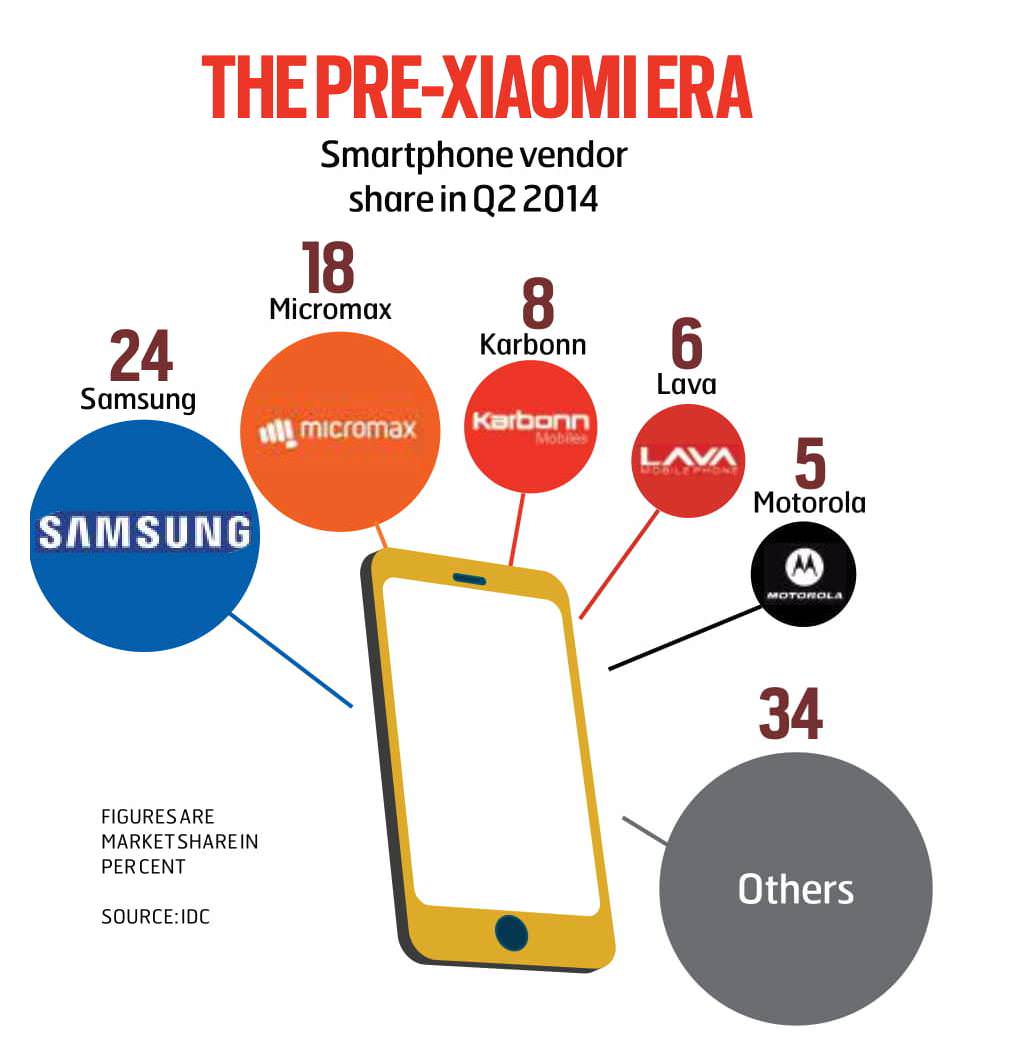

EARLY TWO DECADES AGO, Nokia invaded the fledgling Indian mobile market with a plethora of feature phones at attractive price points. Half a decade later, Nokia had a monopoly in the market as its products struck a chord with the masses and the classes. However, the Finnish telecom major’s dominance was short-lived as Samsung, which came out with its affordable feature phones and nextgen android smartphones, stormed the handset market. The game, it seems, is being played out again. Over the last few quarters, Samsung is finding it difficult to hold on to its lead, as Xiaomi, a five-year Chinese startup, has hit the sweet spot in the world’s fastest-growing smartphone market by offering best deals at cost-sensitive price bands.

India being a cost-sensitive market, Xiaomi, through its online-only sales, has lured consumers with its spec-heavy handsets. Moreover, the company’s strategy of online flash sales with limited stocks on offer and a strong presence on social media has certainly helped them grow significantly in India. But online flash sales also hampers their potential customers as black marketers hoard handsets and customers have to wait for the next sale.

This goes to show that Xiaomi, too, suffers from vulnerabilities and there are other brands upping their ante to beat competition. For instance, brands like Realme and Honor that offer similar phones at reasonable prices have also climbed the popularity charts and posing a threat to the business model of Xiaomi.

So will it be a smooth sail for Xiaomi? Industry analysts do not seem to think so. Globally, there are around 1,000 companies that make smartphones. However, just one company, that is Apple, makes 92 per cent of the industry’s profits even though it sells less than 20 per cent of the overall handsets.

Cette histoire est tirée de l'édition September 1st, 2018 de Businessworld.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Businessworld

BW Businessworld

A NOVEL THAT GLIDES THROUGH MANY REALMS

Journalist Nikhil Kumar strides into the arena of fiction with aplomb. His novel navigates continents and decades, capturing both the rarified world of architecture and the intimate spaces where relationships fracture

2 mins

December 13, 2025

BW Businessworld

"Huge Capacities Are Required"

DV Kapur on India's energy future, the need to balance coal and renewables, his eponymous foundation, and much more

2 mins

December 13, 2025

BW Businessworld

METAL, MUSIC & MOTORCYCLING

From the new Bullet 650 to the Flying Flea C6 and S6 electric scrambler concept, Motoverse 2025 brought together heritage motorcycles, next-gen EVs, riding culture and a vibrant global community

5 mins

December 13, 2025

BW Businessworld

Redefining Unalloyed Nationalism

In My Idea of Nation First, author UDAY MAHURKAR argues that India's future governance is inseparable from its understanding of the past,\" writes Srinath Sridharan

3 mins

December 13, 2025

BW Businessworld

"We have consistently delivered an annual ROI of approximately 40 per cent"

Dushyant Singh, a food & beverage entrepreneur, has over 15 years of experience in building F&B brands, including On The House, Rustic, and The Lama. BW Businessworld recently caught up with Singh to chat about his latest venture, Coffee Sutra, a favourite among coffee aficionados in Jaipur. Excerpts

4 mins

December 13, 2025

BW Businessworld

"The AI Race Won't Be Decided By Models & Tokens, But By Economics"

PHILIPP HERZIG, Chief Technology Officer at SAP, discusses the changing mandates of tech leadership, the next phase of AI adoption, SAP's rapid progress with Joule and RPT1, and why India is core to SAP's future, in an interaction with BW Businessworld's Rohit Chintapali. Excerpts

4 mins

December 13, 2025

BW Businessworld

“The genie is not going back in the bottle”

Al will reshape commerce faster than any previous industrial shift, and businesses must now design for scale, trust and permanence rather than novelty, says DIARMUID GILL, Chief Technology Officer, Criteo, in this conversation with Noor Fathima Warsia

2 mins

December 13, 2025

BW Businessworld

PREMIUM PUSH

With Aston Martin watches and 200 new exclusive stores, Timex India sharpens its premium ambitions and long-term growth play

4 mins

December 13, 2025

BW Businessworld

Carrot & Stick Game

Unlisted shares are typically valued based on demand–supply dynamics, rather than on core fundamentals, as detailed financial information is usually limited

3 mins

December 13, 2025

BW Businessworld

STEADY ASCENT

In a fiercely competitive market, can home appliances and durable company Kenstar's calibrated expansion across categories and towns unlock its Rs 3,000-crore revenue ambition?

6 mins

December 13, 2025

Translate

Change font size