Versuchen GOLD - Frei

A bank for welfare transfers can fix India's KYC crisis

Mint New Delhi

|March 04, 2025

KYC rules are locking out millions of DBT beneficiaries and depriving them of welfare provisions

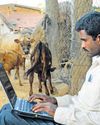

When millions of Indians cannot afford a ₹10 packet of Parle-G biscuits, how do we expect them to spend ₹100 a month on a 4G SIM card to access their own money? Financial inclusion should mean ease of access. But for many, it has become an uphill battle. Bank accounts being suddenly frozen due to KYC issues is a growing crisis across India, leaving millions locked out of their savings. While customers blame banks and banks blame regulations, the real issue runs much deeper.

Banks are bound by regulations, including the Prevention of Money Laundering Act (PMLA), which requires them to track suspicious transactions. They must file suspicious transaction reports when red flags arise. These indicators may be either probabilistic, such as high transaction volumes, or deterministic, involving a law-enforcement notice, for example. However, the rules do not let banks disclose this to their customers. Every KYC verification comes at a cost.

Banks do not just bear routine expenses. They also bear the financial and operational burden of compliance. When the cost of maintaining an account outweighs its value, banks face difficult choices. Rural branches are hit the hardest. They operate on thin margins and are usually understaffed. Yet, they handle a disproportionate number of direct benefit transfer (DBT) accounts. When the Reserve Bank of India (RBI) mandates mass re-KYC under the PMLA, these branches struggle with backlogs that take months to clear. Customers, frustrated by frozen accounts, direct their anger at banks, often unaware that the latter have no choice.

Diese Geschichte stammt aus der March 04, 2025-Ausgabe von Mint New Delhi.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint New Delhi

Mint New Delhi

In India's car labs, Chinese models new benchmark

Walk into the vehicle development centre of any major Indian carmaker and you'll find dozens of rival cars stripped to their bones, engineers poring over every exposed circuit, nut and wire. Such 'benchmark-ing' helps companies understand why some models work while others don't, track technology trends, and plan their own vehicle roadmaps.

2 mins

November 17, 2025

Mint New Delhi

Insurance merger plan gets new life

Centre weighs consolidating National, Oriental, United

3 mins

November 17, 2025

Mint New Delhi

IFC, two others may pick 49% in green H₂ maker Hygenco

The World Bank's International Finance Corp. (IFC), Munich-headquartered Siemens AG, and Singapore's Fullerton Fund Management may acquire at least 49% in Gurugram-based green hydrogen manufacturer Hygenco Green Energies Pvt. Ltd, two people aware of the development said.

4 mins

November 17, 2025

Mint New Delhi

India's telecom spectrum: Who actually owns it?

On 13 November, the Supreme Court reserved its order on how spectrum held by Aircel and Reliance Communications (RCom) will be treated under their insolvency proceedings. The decision will bring clarity on whether spectrum can be sold to recover dues. Mint. explores.

2 mins

November 17, 2025

Mint New Delhi

‘Rise in earnings can bring FIIs back, elevate India’s global standing’

It’s still early, but if earnings turn around, much of the global underperformance over the past year could well be reversed, believes Trideep Bhattacharya, president and C1O-Equities, Edelweiss MF.

4 mins

November 17, 2025

Mint New Delhi

The ultrarich are spending a fortune to live in extreme privacy

When developers Masoud and Stephanie Shojaee dined out recently, they headed to the members-only section of MILA restaurant in Miami Beach, Fla., where they were whisked to a table already bearing their favorite cocktails and chopsticks engraved with their names.

5 mins

November 17, 2025

Mint New Delhi

Satellite internet firms may see fee cut for remote areas

Discount would apply to 5% annual spectrum charge that DoT plans to levy on the firms

2 mins

November 17, 2025

Mint New Delhi

Ravindran moves NCLT on TLPL deal

Riju Ravindran has moved the National Company Law Tribunal (NCLT) against the compulsory convertible debenture agreement between Think & Learn Pvt. Ltd (TLPL) anda wholly owned subsidiary of Glas Trust Co., edtech firm Byju’s US-based financial creditor, alleging it to be violative of foreign direct investment (FDI) and Foreign Exchange Management Act (Fema) regulations.

1 min

November 17, 2025

Mint New Delhi

Resilience spells hope as uncertainty reigns high

As trade-policy turmoil prolongs global uncertainty on an IMF index, we have some bright spots too. India should consider shifting focus from supply-side policies to demand stirrers

2 mins

November 17, 2025

Mint New Delhi

Urban co-op lenders eye online banking

The National Urban Cooperative Financial and Development Corp. Ltd (NUCFDC)—the umbrella body for India’s urban cooperative banks (UCBs)—plans to request the banking regulator to allow smaller UCBs with net worth below ₹50 crore to offer digital services, including internet banking.

1 min

November 17, 2025

Listen

Translate

Change font size