Versuchen GOLD - Frei

What led Info Edge to file an FIR against Rahul Yadav

Mint Mumbai

|December 03, 2024

Apart from the 4B Networks founder, the FIR also names several key executives of the firm

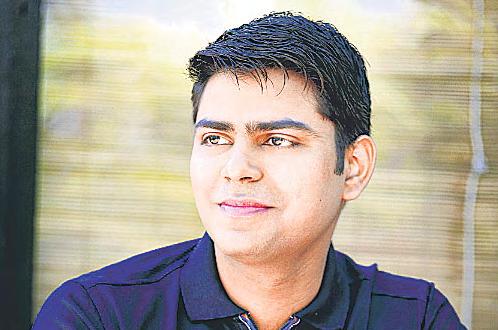

Investors rarely turn against the founders they back, but Info Edge (India) Ltd has taken an unusual step. Last week, the consumer internet group filed a first information report (FIR) against Rahul Yadav, founder of its portfolio company 4B Networks, and several key executives, alleging misuse of company funds.

Those named in the FIR include Devesh Singh, Pratik Choudhary, and Sanjay Saini. While Info Edge clarified in an exchange filing that the move would not materially affect its business operations, the FIR signals a rare showdown between an investor and a portfolio company founder. Mint breaks down the development.

What led to the FIR?

The dispute dates back to early 2023, when 4B Networks, a real estate-focused platform led by Yadav, failed to provide critical financial information requested by Info Edge, which owns a 65% stake in the company.

By June 2023, Info Edge had initiated a forensic audit following repeated failures to obtain financial details and disclosures about related-party transactions. Despite investing ₹280 crore in 4B Networks—including ₹275 crore in equity and ₹12 crore as debt—the company faced financial turmoil, defaulting on salaries and vendor payments amid glaring lapses in corporate governance.

These issues escalated as Broker Network, operated by 4B Networks, teetered on the brink of collapse. Info Edge eventually wrote off its entire ₹280 crore investment.

Diese Geschichte stammt aus der December 03, 2024-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

Europe bets on $25 bn space budget amid defence hike

Europe’s equivalent of NASA is seeking €22 billion ($25.

1 min

November 27, 2025

Mint Mumbai

China’s ‘McNuggetization’: It’s beneficial for the environment

A wide-scope dietary shift in China is doing the planet a good turn

3 mins

November 27, 2025

Mint Mumbai

Flexi-cap funds in focus as smids falter

A silent pivot

3 mins

November 27, 2025

Mint Mumbai

Labour codes: Focus on empathy and not just efficiency

The consolidation of 29 archaic labour laws into four comprehensive new codes—on wages, social security, industrial relations and occupational safety—is among the most significant structural reforms undertaken by India in the post-liberalization era.

3 mins

November 27, 2025

Mint Mumbai

These firms will sell shovels during semaglutide gold rush

Weight-loss drug semaglutide, also used to treat type-2 diabetes, will face its next big turning point in early 2026, when patents held by Novo Nordisk expire in India.

2 mins

November 27, 2025

Mint Mumbai

HC to hear Apple's plea on fine in Dec

Apple is challenging the new penalty math formula in India's competition law.

1 min

November 27, 2025

Mint Mumbai

Climate crisis: Innovation works, compression doesn't

After weeks of hot air, the UN’s CoP summit limped to an end in Brazil's Amazonian hub of Belém over the weekend, with a ‘deal’ that delivers nothing measurable for the climate, while wasting political capital and much effort on pledges.

3 mins

November 27, 2025

Mint Mumbai

MO Alternates launches its maiden private credit fund

The %3,000 crore fund has drawn capital from family offices, ultra-HNIs and institutions

3 mins

November 27, 2025

Mint Mumbai

Kharif grain production likely to rise to 173 mt

India's kharif foodgrain output is expected to rise to 173.

1 min

November 27, 2025

Mint Mumbai

IL&FS group repays ₹48,463 cr loan

Debt-ridden IL&FS group has repaid ₹48,463 crore to its creditors as of September 2025, out of the total ₹61,000 crore debt resolution target, as per the latest status report filed before insolvency appellate tribunal NCLAT.

1 min

November 27, 2025

Listen

Translate

Change font size