Versuchen GOLD - Frei

Stocks at new high; volatility jumps too

Mint Mumbai

|December 28, 2023

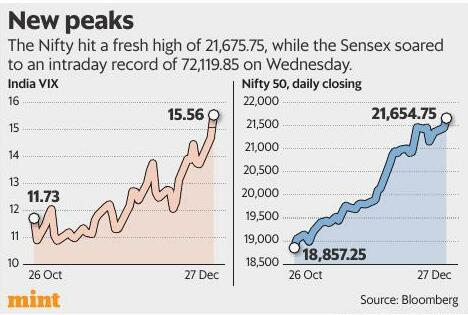

An outperformance in large-cap stocks drove the Nifty and the Sensex to fresh highs on Wednesday, as both foreign portfolio investors (FPIs) and direct retail investors stepped up buying. However, volatility index India Vix—which normally rises when markets fall and vice-versa—rose to a 10-month high, likely signalling trader discomfort at record high levels.

The Nifty hit a fresh high of 21,675.75, while the Sensex soared to an intraday record of 72,119.85 as FPIs purchased a provisional ₹2,926.05 crore even as domestic institutional investors (DIIs) sold ₹192 crore worth of shares. Though the indices closed a tad lower each, they posted closing records, with the Nifty gaining 1% to 21,654.75 and the Sensex 0.98% to 72,038.43. The indices have risen for four straight sessions. Direct retail volumes aren’t reported daily.

The Nifty and the Sensex have now clocked annual returns of 19.6% and 18.4%, respectively. Interestingly, the last two months accounted for the bulk of this, thanks to heavy FPI inflows during November and December. The Nifty has run up 14.83% and the Sensex by 14.07% from the closing of 18,857.25 and 63,148.14, respectively, on 26 October. That means 76% of the Nifty’s annual rally happened in the last two months.

Diese Geschichte stammt aus der December 28, 2023-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

Europe bets on $25 bn space budget amid defence hike

Europe’s equivalent of NASA is seeking €22 billion ($25.

1 min

November 27, 2025

Mint Mumbai

China’s ‘McNuggetization’: It’s beneficial for the environment

A wide-scope dietary shift in China is doing the planet a good turn

3 mins

November 27, 2025

Mint Mumbai

Flexi-cap funds in focus as smids falter

A silent pivot

3 mins

November 27, 2025

Mint Mumbai

Labour codes: Focus on empathy and not just efficiency

The consolidation of 29 archaic labour laws into four comprehensive new codes—on wages, social security, industrial relations and occupational safety—is among the most significant structural reforms undertaken by India in the post-liberalization era.

3 mins

November 27, 2025

Mint Mumbai

These firms will sell shovels during semaglutide gold rush

Weight-loss drug semaglutide, also used to treat type-2 diabetes, will face its next big turning point in early 2026, when patents held by Novo Nordisk expire in India.

2 mins

November 27, 2025

Mint Mumbai

HC to hear Apple's plea on fine in Dec

Apple is challenging the new penalty math formula in India's competition law.

1 min

November 27, 2025

Mint Mumbai

Climate crisis: Innovation works, compression doesn't

After weeks of hot air, the UN’s CoP summit limped to an end in Brazil's Amazonian hub of Belém over the weekend, with a ‘deal’ that delivers nothing measurable for the climate, while wasting political capital and much effort on pledges.

3 mins

November 27, 2025

Mint Mumbai

MO Alternates launches its maiden private credit fund

The %3,000 crore fund has drawn capital from family offices, ultra-HNIs and institutions

3 mins

November 27, 2025

Mint Mumbai

Kharif grain production likely to rise to 173 mt

India's kharif foodgrain output is expected to rise to 173.

1 min

November 27, 2025

Mint Mumbai

IL&FS group repays ₹48,463 cr loan

Debt-ridden IL&FS group has repaid ₹48,463 crore to its creditors as of September 2025, out of the total ₹61,000 crore debt resolution target, as per the latest status report filed before insolvency appellate tribunal NCLAT.

1 min

November 27, 2025

Translate

Change font size