Versuchen GOLD - Frei

RECIPE KEEPERS

Mint Mumbai

|August 30, 2025

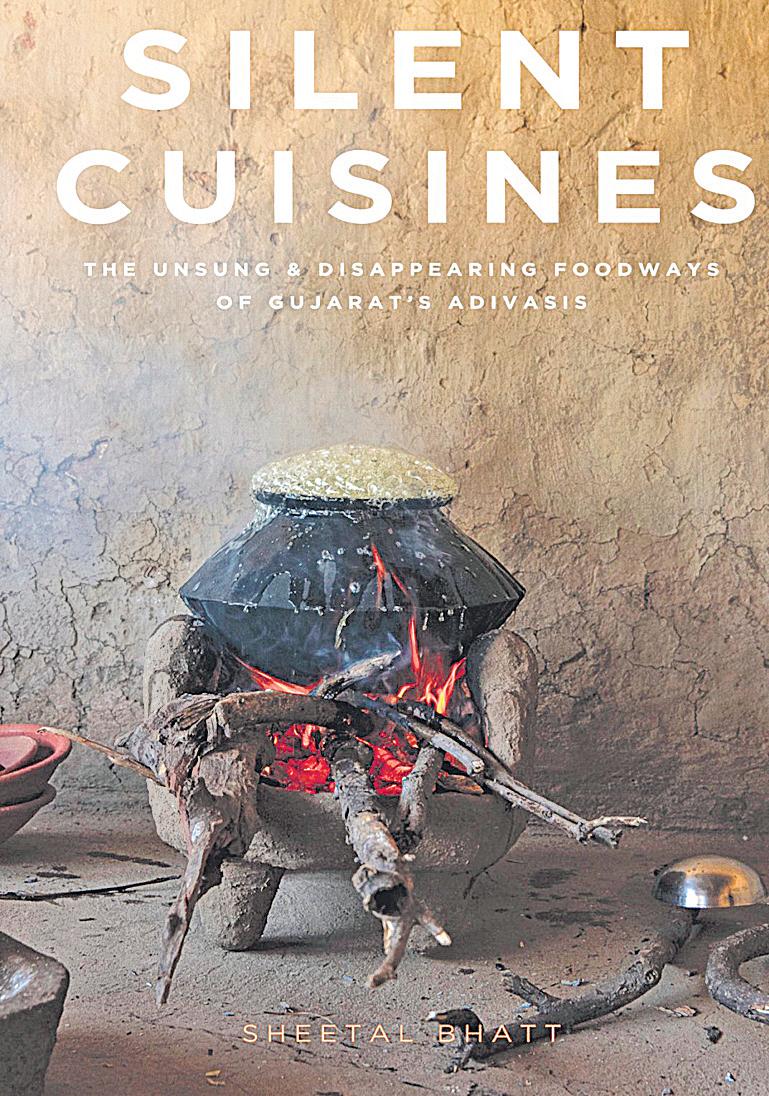

Cookbooks in India and elsewhere have always been something of an answer to the culinary anxieties produced by sweeping, destabilising social changes

Do you have family so fastidious about ensuring the exact taste of favourite foods that they buy ingredients only from preferred sources, and carry essentials on travels? If so, you're not alone. It is almost an Indian custom, a signature culinary method, to insist on such specificities—that local shop's regular supply of dhania-jeera-chilli for those precise measures of heat and flavour; tender tamarind leaves picked at the right seasonal moment, painstakingly transported, and flash-frozen in some far-off freezer to recreate Andhra specialities; rice, of course, and even water for the exact taste of a beloved khichdi. Indian families and communities have always taken great pride in their gastronomical traditions as marks of collective cultural distinction. "Specialities" and "delicacies" unique to different regions are everywhere sought after. Common elements are many, but Lonavala in Maharashtra and Kovilpatti in Tamil Nadu each have unique claims to the classic chikki.

For all this hyperlocal culinary devotion, however, Indian cookbooks appear to have awoken very late to the need to document all the regional insights we've known all along, and are now busy playing catchup. In the past quarter century, over 50 regional cuisine books on virtually all parts of India have been published, buoyed by a swelling social media interest which shows no signs of subsiding. Why did this need emerge so late? What sort of new national culinary culture is this new tranche of cookbooks trying to produce?

Diese Geschichte stammt aus der August 30, 2025-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size