Versuchen GOLD - Frei

How China Curbed Its Oil Addiction—And Blunted a U.S. Pressure Point

Mint Mumbai

|July 23, 2025

As electric vehicle sales surged, China ramped up subsidies to build public charging ports, resulting in over 14 million charging points by May

China's thirst for oil drove global demand for decades. Now a government campaign to curb that addiction is nearing a milestone, with national consumption expected to peak by 2027, then begin to fall.

Chinese officials have long worried that the U.S. and its allies could hamstring the nation's economy by choking off its supply of foreign oil. So China has poured hundreds of billions of dollars into weaning itself off the imported stuff by reviving domestic production and swiftly building the world's leading electric-vehicle industry.

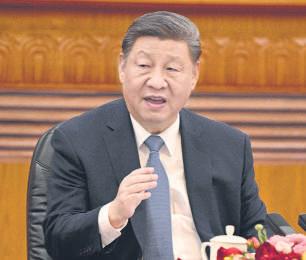

"The energy rice bowl must be held in our own hands," Chinese leader Xi Jinping has said.

Across China, fleets of gas-guzzling Volkswagen and Hyundai taxicabs are being replaced by electric models designed and produced locally. Last year, nearly half of passenger vehicles sold in the country were either all-electrics or plug-in hybrids, compared with 6% in 2020. THE WALL STREET JOURNAL.

In a remote corner of China called the "sea of death" for its harsh conditions, oil workers are trying to coax more crude out of the ground by drilling holes as deep as Mt. Everest is high. State-owned PetroChina reported $38 billion of capital expenditures last year, nearly as much as Exxon Mobil's and Chevron's combined.

China boosted oil output by 13% from 2018 to 2024, to around 4.3 million barrels a day. Crude imports fell nearly 2% last year, though they have rebounded slightly this year as some Chinese companies built stockpiles.

China's biggest state oil companies and the International Energy Agency all forecast that China's demand for oil will likely peak within two years, while gasoline and diesel demand has already topped out.

Diese Geschichte stammt aus der July 23, 2025-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

WHY GOLD, BITCOIN DAZZLE—BUT NOT FOR SAME REASONS

Gold and Bitcoin may both be glittering this season—but their shine comes from very different sources.

3 mins

October 14, 2025

Mint Mumbai

Gift, property sales and NRI taxes decoded

I have returned to India after years as an NRI and still hold a foreign bank account with my past earnings.

2 mins

October 14, 2025

Mint Mumbai

Prestige Estates’ stellar H1 renders pre-sales goal modest

Naturally, Prestige’s Q2FY26 pre-sales have dropped sequentially, given that Q1 bookings were impressive. But investors can hardly complain as H1FY26 pre-sales have already surpassed those of FY25

1 mins

October 14, 2025

Mint Mumbai

HCLTech has best Q2 growth in 5 yrs, reports AI revenue

Defying market uncertainties, HCL Technologies Ltd recorded its strongest second-quarter performance in July-September 2025 in five years. The Noida-headquartered company also became the first of India's Big Five IT firms to spell out revenue from artificial intelligence (AI).

2 mins

October 14, 2025

Mint Mumbai

Turn the pool into a gym with these cardio exercises

Water is denser than air, which is why an aqua exercise programme feels like a powerful, double-duty exercise

3 mins

October 14, 2025

Mint Mumbai

SRA BRIHANMUMBAI'S JOURNEY TO TRANSPARENT GOVERNANCE

EMPOWERING CITIZENS THROUGH DIGITAL TRANSFORMATION

4 mins

October 14, 2025

Mint Mumbai

Indian team in US this week to finalize contours of BTA

New Delhi may buy more natural gas from the US as part of the ongoing trade talks, says official

2 mins

October 14, 2025

Mint Mumbai

Emirates NBD eyes RBL Bank majority

If deal closes, the Dubai govt entity may hold 51% in the lender

4 mins

October 14, 2025

Mint Mumbai

Healing trauma within the golden window

As natural disasters rise, there's an urgent case to be made for offering psychological first-aid to affected people within the first 72 hours

4 mins

October 14, 2025

Mint Mumbai

Climate change has turned water into a business risk

Businesses in India have typically treated water as a steady input—not perfect, but reliable enough. Climate change is unravelling that assumption. Variable rainfall, falling groundwater tables, depleting aquifers and intensifying floods are reshaping how firms source this most basic of industrial inputs. Water has quietly become a new frontier of business risk.

3 mins

October 14, 2025

Listen

Translate

Change font size