Versuchen GOLD - Frei

Buy the world: Decoding Devina Mehra's winning global portfolio

Mint Mumbai

|March 21, 2025

Themes always change, nothing lasts. No country, asset class, sector, or investing style works forever Devina Mehra Founder, chairperson & MD, First Global Group

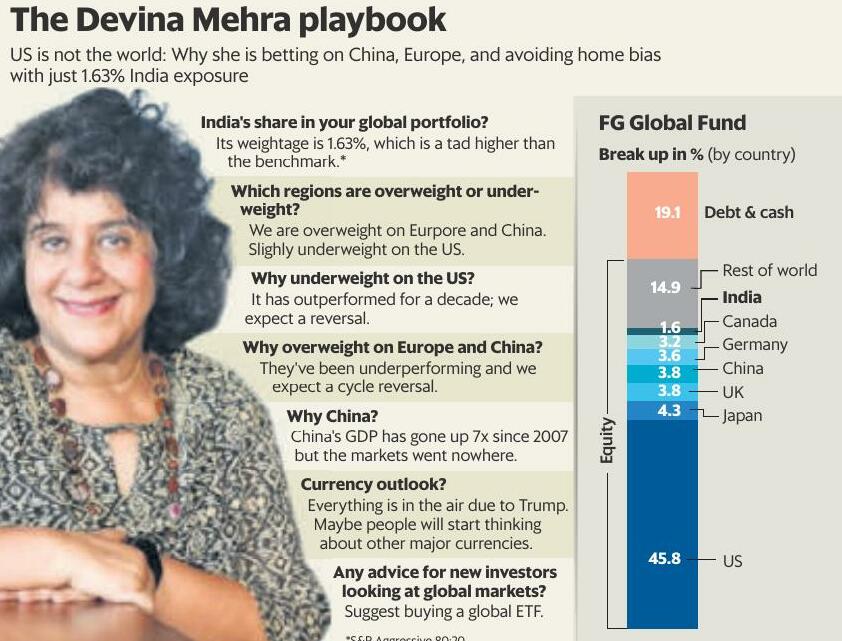

They say, 'Home is where the heart is'. But, when it comes to money, Devina Mehra, the founder and chairperson of securities firm First Global, feels strongly that part of it should be parked outside the home country. "Wherever possible, we like to buy individual stocks and securities globally. In certain markets, because of regulatory reasons, stocks cannot be purchased directly, in which case we may get exposure via country ETFs (exchange-traded funds)," said Mehra, who runs a global fund out of the Cayman Islands.

She invests 80% of her portfolio in her global fund and the rest in India PMS fund. "We bought South African REITs, Chinese shoemakers and Australian mining firm." In an interview with Mint she shares her investing strategy, global stocks, China, dollar index and more. Edited excerpts:

How should new investors select countries to invest in?

We prefer looking at individual stocks. Most of our portfolio is bottom-up stock picks. That said, we do make country bets by looking at how countries have performed over time.

This is not investment advice, but I'll give you one example. We track 42 countries' indices. This includes the major developed and emerging markets. What we've noticed is that the indices which are at the bottom, 39th to 42nd rank tend to become top performers in the coming years. For instance, Nasdaq was among the bottom-ranked in 2022, but became a top performer the next year.

Even geographies that have real issues, like Russia, Sri Lanka, Turkey, that have performed poorly, often see a complete reversal. If a country is going through issues, it does not necessarily mean it will stay like that forever—at least as far as the stock markets go. For all you know, if the crash is too sharp, the rebound is equally dramatic. That said, generally, in our portfolios, we took only small positions in such extremely beaten-down markets as we want to be a little conservative with our investors' money.

Diese Geschichte stammt aus der March 21, 2025-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

These firms will sell shovels during semaglutide gold rush

Weight-loss drug semaglutide, also used to treat type-2 diabetes, will face its next big turning point in early 2026, when patents held by Novo Nordisk expire in India.

1 mins

November 27, 2025

Mint Mumbai

'First-gen founders take bigger investment risks'

India’s markets are minting a new class of first-generation millionaires: entrepreneurs who’ve scaled ideas into Initial public offerings (IPOs) and unlocked unprecedented personal wealth.

2 mins

November 27, 2025

Mint Mumbai

EV, hydro boom to power 6x rise in battery storage by ‘47

India is preparing to meet a projected cumulative battery energy storage capacity of nearly 3 terawatt-hours (TWh) by 2047 across electric mobility, power, and electronic components, according to two people aware of the development, with electric vehicles (EVs) expected to contribute a third of the demand.

2 mins

November 27, 2025

Mint Mumbai

Candidates using AI? No, thanks, say IIT recruiters

As the annual placement season dawns at the Indian Institutes of Technology (IITs), colleges and recruiters are working to bar artificial intelligence (AI) tools and prevent cheating at test venues, a concern that first rose last year.

3 mins

November 27, 2025

Mint Mumbai

Taxpayer base soars, but return filings lag sharply: CBDT data

India’s income tax base is growing faster than the number of those conscientiously filing returns, driven by the expanding reach of the tax deducted at source (TDS) system, according to latest data from the central board of direct taxes (CBDT).

3 mins

November 27, 2025

Mint Mumbai

Market nears peak on dollar tailwind

Stocks jump 1.2%, but futures rollovers signal weak conviction

3 mins

November 27, 2025

Mint Mumbai

SP Eyes Tata exit to cut debt costs

Debt-laden Shapoorji Pallonji Group is banking on Tata Trusts softening the stance on its potential exit from Tata Sons to reduce its borrowing costs, two people aware of the matter said.

2 mins

November 27, 2025

Mint Mumbai

MO Alternates launches its maiden private credit fund

The %3,000 crore fund has drawn capital from family offices, ultra-HNIs and institutions

3 mins

November 27, 2025

Mint Mumbai

HP to cut jobs after profit outlook miss

HP Inc.gave a profit outlook for current year that fell short of estimates and the company said it will cut 4,000 to 6,000 employees through fiscal 2028 by using more AI tools

1 mins

November 27, 2025

Mint Mumbai

Apple set to regain top smartphone maker spot after 14 yrs

Apple Inc.will retake its crown as the world’s largest smartphone maker for the first time in more than a decade, lifted by the successful debut of a new iPhone series and a rush of consumers upgrading devices, according to Counterpoint Research.

1 min

November 27, 2025

Listen

Translate

Change font size