Versuchen GOLD - Frei

How China secretly pays Iran for oil and avoids U.S. sanctions

Mint Bangalore

|October 07, 2025

Hidden arrangement secured by prominent Chinese insurer connects Tehran with its biggest customer

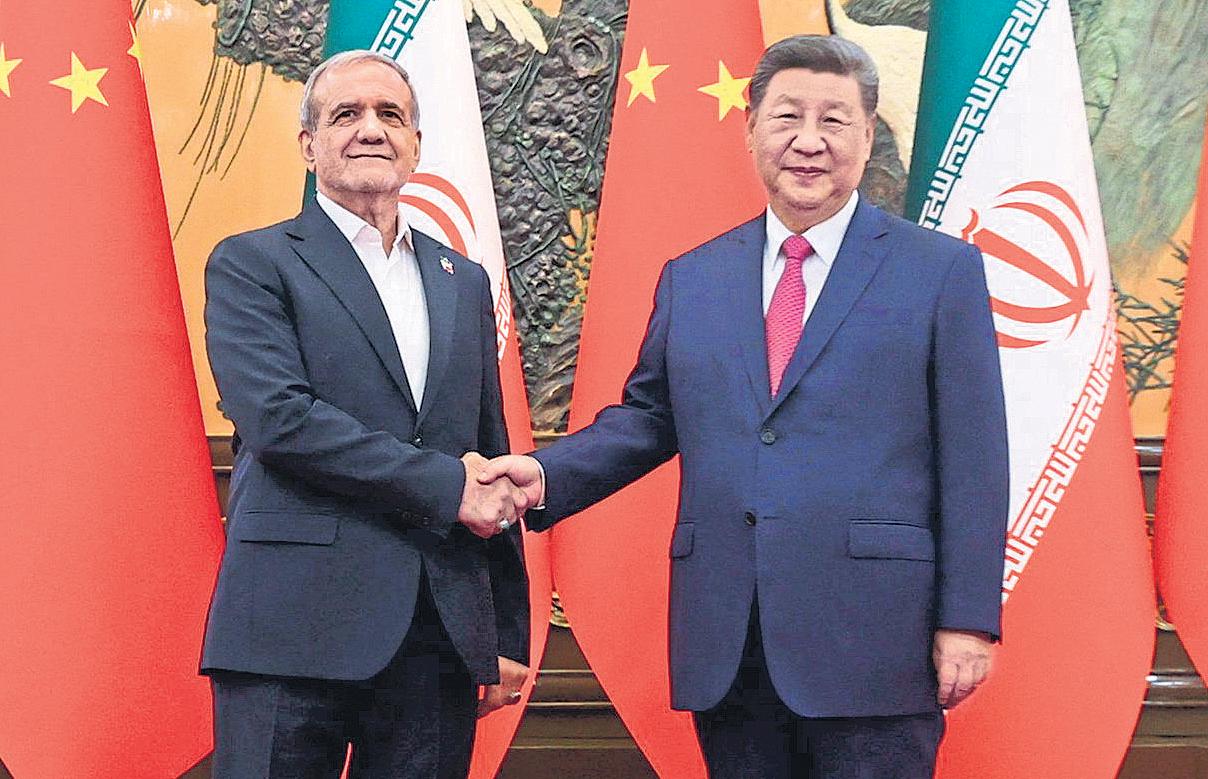

In September, Chinese leader Xi Jinping (right) hosted Iranian President Masoud Pezeshkian at a multinational summit. REUTERS

(REUTERS)

U.S. sanctions make it nearly impossible to pay Iran for its oil. China has figured out how to do it anyway, in an arrangement that has largely been secret.

The hidden funding conduit has deepened economic ties between the two U.S. rivals in defiance of Washington’s efforts to isolate Iran.

The barter-like system works like this, according to current and former officials from several Western countries, including the U.S.: Iranian oil is shipped to China—Tehran’s biggest customer—and, in return, state-backed Chinese companies build infrastructure in Iran.

Completing the loop, the officials say, are a Chinese state-owned insurer that calls itself the world's largest export-credit agency and a Chinese financial entity that is so secretive that its name couldn't be found on any public list of Chinese banks or financial firms.

The arrangement, by sidestepping the international banking system, has provided a lifeline to Iran’s sanctions-squeezed economy. Up to $8.4 billion in oil payments flowed through the funding conduit last year to finance Chinese work on large infrastructure projects in Iran, according to some of the officials.

Iran exported $43 billion of mainly crude oil last year, according to estimates by the U.S. Energy Information Administration. Western officials estimate that around 90% of those exports go to China.

China has been the predominant buyer of Iranian oil since 2018, when President Trump pulled the U.S. out of the 2015 nuclear accord and reimposed U.S. sanctions.

Two weeks after returning to office, Trump ordered the use of “maximum pressure” to force Tehran to curb its nuclear program and end support for allied militia groups. The directive sought to drive Iranian oil exports to zero.

Diese Geschichte stammt aus der October 07, 2025-Ausgabe von Mint Bangalore.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Bangalore

Mint Bangalore

360 One, Steadview, others to invest in Wakefit ahead of IPO

A clutch of firms, including 360 One, Steadview Capital, WhiteOak Capital and Info Edge, is expected to invest in home-furnishings brand Wakefit Innovations Ltd just ahead of its initial public offering (IPO) next month, three people familiar with the matter said.

1 min

November 28, 2025

Mint Bangalore

Diversification holds the key to reducing our trade vulnerability

India's merchandise exports are less exposed to US policy vagaries than services. The latter need to find new export markets

4 mins

November 28, 2025

Mint Bangalore

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Bangalore

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Bangalore

Would you like to be interviewed by an AI bot instead?

don't think I want to be interviewed by a human again,\" said a 58-year-old chartered accountant who recently had an interview with a multinational company.

3 mins

November 28, 2025

Mint Bangalore

The curious case of LIC's voting on RIL, Adani resolutions

Life Insurance Corp. of India Ltd, or LIC, consistently approved or never opposed resolutions proposed before shareholders of Reliance Industries Ltd (RIL) or any Adani Group company since 1 April 2022, even as it rejected several similar proposals at other large companies, some even part of other conglomerates, a Mint review of about 9,000 voting decisions by the government-run insurer showed.

1 min

November 28, 2025

Mint Bangalore

Tune into weak signals in a world of data dominance

World War II saw the full fury of air power in battle, first exercised by Axis forces and then by the Allies, culminating in American B-29 bombers dropping atomic bombs on Hiroshima and Nagasaki.

4 mins

November 28, 2025

Mint Bangalore

When LLMs learn to take shortcuts, they become evil

Some helpful parenting tips: it is very easy to accidentally teach your children lessons you did not intend to pass on.

2 mins

November 28, 2025

Mint Bangalore

What if China weaponizes its dominance of pharma inputs?

Overdependence on China for drug-making should worry the US

3 mins

November 28, 2025

Mint Bangalore

VentureSoul closes first debt fund at ₹300 crore

VentureSoul Partners has announced the close of its maiden debt fund at ₹300 crore, with plans to raise an additional ₹300 crore through a green shoe option by February 2026.

1 min

November 28, 2025

Listen

Translate

Change font size