Versuchen GOLD - Frei

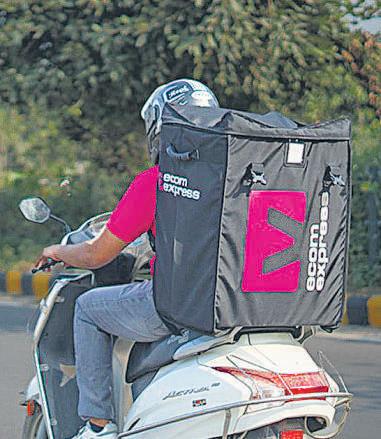

Will Ecom Express Deliver for Delhivery?

Mint Ahmedabad

|April 11, 2025

Analysts remain divided on the merits of the purchase, the economies of scale it can generate

It took less than a year for everything to unravel.

In August 2024, India's second largest business-to-consumer (B2C) logistics firm, Ecom Express, filed for an initial public offering. Valuation: nearly ₹7,500 crore.

This month, the company was sold to its biggest competitor, Delhivery, for less than half that amount.

In between, both the companies had an awkward spat via stock exchange filings. Ecom Express had claimed in its draft prospectus that it performed better than the much bigger Delhivery on some key metrics, including cost per parcel. Delhivery countered it by saying Ecom Express may be lying about its numbers.

None of it matters now. Earlier in the year, Ecom Express put its public offering plans on pause and began downsizing aggressively. And by April, it was sold. The biggest reason for its decline is well known: more than half of Ecom Express' revenue came from a single client that most in the industry say is Meesho, the tier-II and -III focused e-commerce platform. In February 2024, Meesho launched its own in-house logistics arm called Valmo and reportedly stopped using Ecom Express' services for most of its shipments.

Bereft of its biggest client, Ecom Express quickly spiralled downwards and could not stick the landing on the best way out: a public listing. Acquisition was the next best outcome for its investors—the list includes PE firm Warburg Pincus and impact fund British International Investment.

It is clear why Ecom Express needed a deal with Delhivery, even at a paltry valuation. With a deal size of ₹1,407 crore, Ecom Express is selling for roughly 0.6x enterprise value-to-sales (EV/sales), based on its financial reporting for FY24.

It is clear why Ecom Express needed a deal with Delhivery, even at a paltry valuation. With a deal size of ₹1,407 crore, Ecom Express is selling for roughly 0.6x enterprise value-to-sales (EV/sales), based on its financial reporting for FY24.Diese Geschichte stammt aus der April 11, 2025-Ausgabe von Mint Ahmedabad.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Ahmedabad

Mint Ahmedabad

Trump's bets on China and Argentina are souring fast

When it comes to US foreign economic polic policy, President Donald Trump’s administration has two problems on its hands.

3 mins

November 18, 2025

Mint Ahmedabad

Centre mulls cut in PLI auto sops to ₹2,000 cr for FY26

Scheme has faced challenges including localization requirements and delays in disbursal

2 mins

November 18, 2025

Mint Ahmedabad

SGX to list Bitcoin, Ether perpetual futures on 24 Nov

Traders in SGX's perpetual futures won't automatically get liquidated if a sudden market shift upsets their positions.

2 mins

November 18, 2025

Mint Ahmedabad

Do pre-IPO gains get long-term tax status?

I live in Australia and I own shares in a Indian company which got recently listed. I invested about 1.5 years back when it was not listed. When I sell the shares now, will it be considered as shortor long-term gains? —Name withheld on request

1 mins

November 18, 2025

Mint Ahmedabad

OTTs chase regional content with higher spends but viewership trails

Platforms need carefully considers content strategies to ensure they are meeting the needs but viewership trails

1 mins

November 18, 2025

Mint Ahmedabad

India's music stardom has moved from film sets to feeds

A few verses, a guitar, and an Instagram Reel were enough to catapult Anumita Nadesan into the national spotlight.

2 mins

November 18, 2025

Mint Ahmedabad

A. Vellayan, known for visionary bets, passes away at 72

His friends and peers called Arunachalam Vellayan (72), former chairman of Murugappa group who passed away in Chennaion Monday, a man with a high level of business acumen and an ability to see the future.

1 mins

November 18, 2025

Mint Ahmedabad

Sebi has started review of listing, disclosure norms

The Securities and Exchange Board of India (Sebi) has begun work on a review of the Listing Obligations and Disclosure Requirements (LODR), its chairperson Tuhin Kanta Pandey said, setting the stage for what could be one of the regulator's most significant cleanups of corporate disclosure rules in recent years.

1 mins

November 18, 2025

Mint Ahmedabad

INSIDE AP'S NEW MANTRA: 'SPEED OF DOING BUSINESS'

Nara Lokesh is facing off against rival states and historical financial strain. Can he repeat his father's legacy?

9 mins

November 18, 2025

Mint Ahmedabad

Marico’s margin on slippery slope despite healthy demand

The Marico Ltd stock hit a new 52-week high of ₹764.65 on the NSE on Monday after its consolidated revenue surged 31% year-on-year to ₹3,482 crore in the September quarter (Q2FY26), led by broad-based growth across product categories.

1 mins

November 18, 2025

Listen

Translate

Change font size