Fascinating history of art heists...

Business Standard

|October 22, 2025

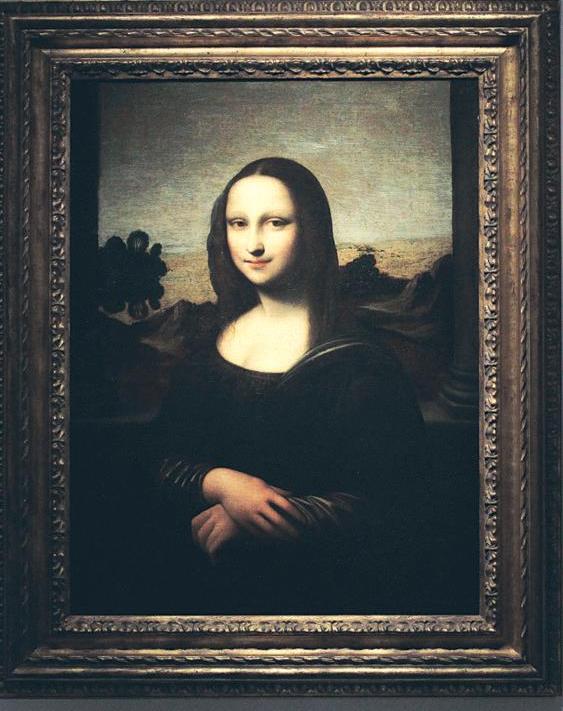

... from the Mona Lisa to a gold toilet, and now the Louvre's royal jewels

The world's largest art museum, the Louvre has about half a million objects in its collection, with about 30,000 on display, and sees on average 8 million visitors per year.

That's big on any scale, with a lot of people and objects to keep watch over. And Sundays are particularly busy.

In a cleverly conceived operation, four men wearing fluorescent vests pulled up at the Louvre in a flat-decked truck at 9.30 Sunday morning. Quickly setting to work, they raised an extendable ladder to the second storey. Climbing it, they cut through a window, entered the Galerie d'Apollon and, brandishing power tools, helped themselves to nine exquisite objects.

The objects taken were France's royal jewels, formerly belonging to the Empress Eugénie, Napoleon III's wife and arts patron.

This is where it gets tricky for the thieves: what can you do with these priceless objects? They can't wear them — too big and glitzy to go unnoticed-and they can't sell them legitimately, as images are all over the internet. The best-case scenario, from the thieves' perspective, is to break them down, melt the precious metals and sell the gems separately.

Empress Eugenie's crown, which the perpetrators took and subsequently dropped as they fled the scene on motor scooters, contains eight gold eagles, 1,354 brilliant-cut diamonds, 1,136 rose-cut diamonds and 56 emeralds. In short, this amounts to a sizeable stash of individual gems to try and sell.

Timing is everything

Diese Geschichte stammt aus der October 22, 2025-Ausgabe von Business Standard.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Business Standard

Business Standard

PE-VC investments at $33 bn in '25

Mega deals slide slightly; IT and BFSI lead sector investments

1 mins

January 01, 2026

Business Standard

RBI red-flags bank-NBFC interlink risks

Banks acquiring 80% assets through a limited number of NBFCs

2 mins

January 01, 2026

Business Standard

Precious metals outshine stocks in 2025 amid global volatility

Nearly 60% of the top 1,000 listed stocks delivered negative returns

1 mins

January 01, 2026

Business Standard

Weakness in ₹, broader equity market shrinks India's billionaire club in 2025

Top IPO promoters

3 mins

January 01, 2026

Business Standard

EV Policy 2.0: Delhi govt to meet five auto firms, Siam

Meeting scheduled on Jan 2 as capital remains in a smog of pollution

2 mins

January 01, 2026

Business Standard

Year of hope

India must aim to sustain the growth momentum

2 mins

January 01, 2026

Business Standard

Eight more cos to get incentives under auto PLI

Three vehicle makers, five auto part makers to get benefits from FY27

2 mins

January 01, 2026

Business Standard

Centre notifies revised draft rules for labour codes, seeks stakeholders' responses

The Ministry of Labour and Employment on Wednesday notified the revised draft rules for the four new Labour Codes, providing clarity on certain provisions such as gratuity payments and retrenchment of workers.

1 mins

January 01, 2026

Business Standard

Oyo parent files for ₹6,650 cr IPO via confidential route

Oyo’s parent firm Prism has filed confidential draft red herring prospectus (DRHP) papers with the markets regulator to raise up to %6,650 crore through an initial public offering (IPO), which would be the third attempt by the global travel technology company at public listing.

2 mins

January 01, 2026

Business Standard

External uncertainties may trigger outflows, Fx rate volatility: RBI

The Reserve Bank of India (RBI) has cautioned that the country's economy faces near-term risks largely from external uncertainties, including the possibility of a sharp correction in US equities that could trigger foreign portfolio outflows, heighten exchange rate volatility and tighten domestic financial conditions.

2 mins

January 01, 2026

Listen

Translate

Change font size