يحاول ذهب - حر

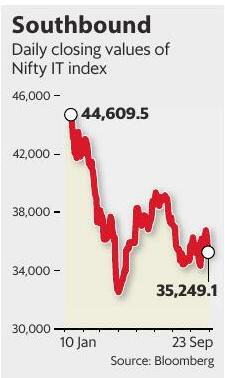

Bear mark over IT signals more pain for investors

September 24, 2025

|Mint New Delhi

MUMBAI Investors in Indian IT companies saw their combined wealth plunge by over ₹trillion over the last two days. The pain may not be over yet.

The hit followed President Donald Trump's weekend proclamation of a $100,000 one-time fee on new H-1B visas, sparking heavy selling and a surge in bearish bets in the derivatives market. Analysts warned the overhang could linger, with rallies likely to be short lived until companies outline strategies to cushion the blow from the visa fee hike.

On Tuesday, a day after bears raised short positions, the Nifty IT fell a further 0.71% to 35249.10. The worst-performing IT stocks included mid-cap stocks Mphasis and Coforge, which tanked up to 3% each, while the biggest large-cap loser was Tech Mahindra, which fell by 2.2%. Midcaps have borne the brunt, as the visa fee hike is expected to squeeze their cash flows more.

On Tuesday, a day after bears raised short positions, the Nifty IT fell a further 0.71% to 35249.10. The worst-performing IT stocks included mid-cap stocks Mphasis and Coforge, which tanked up to 3% each, while the biggest large-cap loser was Tech Mahindra, which fell by 2.2%. Midcaps have borne the brunt, as the visa fee hike is expected to squeeze their cash flows more.In all, seven out of 10 of the Nifty IT index slumped 0.3-3%.

هذه القصة من طبعة September 24, 2025 من Mint New Delhi.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mint New Delhi

Mint New Delhi

All eyes on RBI as fresh fall brings rupee closer to 90

The Indian rupee came within kissing distance of 90 to a dollar on Tuesday before likely central bank intervention rescued it from the brink, but not before it touched a new all-time low.

3 mins

December 03, 2025

Mint New Delhi

No silver bullet

Is silver set to emerge from the shadow of gold as a precious metal? Although its price fell about 2% on Tuesday, it has been enjoying a bull run that makes this dip seem more like a pause for breath than the start of a correction.

1 min

December 03, 2025

Mint New Delhi

Profits, credit lift fundraising by corporates

Corporate fundraising activity saw a significant revival in the September 2025 quarter.

2 mins

December 03, 2025

Mint New Delhi

Chinese rare-earth dealers are dodging Beijing’s export curbs

Chinese rare-earth magnet companies are finding workarounds to their government's onerous export restrictions, as they seek to keep sales flowing to Western buyers without falling afoul of Chinese authorities.

4 mins

December 03, 2025

Mint New Delhi

MAKING SENSE OF IMF RATING AND GDP DATA

India's Q2 growth surpassed expectations, but the IMF rated GDP data quality a 'C'. While India is addressing many of the issues, it's a reminder that the country cannot afford long gaps in statistical improvements.

4 mins

December 03, 2025

Mint New Delhi

State-owned banks flag deposit rate woes on policy eve

State-owned lenders have alerted the banking regulator that their inability to cut deposit rates as fast as loan rates is taking a toll on interest margins, three people familiar with the development said.

3 mins

December 03, 2025

Mint New Delhi

Sebi set to overhaul MF, disclosure, broker rules

Board to discuss new rules, update outdated ones at 17 December meeting

2 mins

December 03, 2025

Mint New Delhi

Can clawbacks, bonuses help cos retain IIT talent?

Deferred bonuses, joining incentives, and clawbacks are embedded in the high compensation offered at the Indian Institutes of Technology (IITs), reflecting a competitive job market and concerns over attrition. Can these measures help companies hold on to talent? Mint examines:

2 mins

December 03, 2025

Mint New Delhi

India’s battery dreams trip on visa hurdles for Chinese pros

Problems in renewal of visas for Chinese technicians have slowed the pace of buildout of India’s lithium-ion battery manufacturing factories for electric vehicles and energy storage, according to two people aware of the matter.

2 mins

December 03, 2025

Mint New Delhi

Ola rolls out non-AC rides pan-India

The new category creates significant opportunities for drivers, the firm said.

1 min

December 03, 2025

Listen

Translate

Change font size