يحاول ذهب - حر

Yesterday Never Dies

August 30, 2025

|Mint Mumbai

James Bond is dead. Not only on screen—although the last of the Daniel Craig outings, No Time to Die, was indeed a weepie that killed him—but the character himself is now a perfectly lacquered fossil: aesthetically pleasing in a showcase, but dead as disco, and flagged with cautionary labels for young, impressionable visitors.

007, for all his glory, is incapable of actually evolving, and to drag James into 2025 appears not merely futile, but a little uncouth. Placing a trigger-warning on a man licensed to kill is like driving an Aston Martin to a vegan food-truck.

Thus I urge Amazon, the new owners of the franchise, not to cast a new Bond. The best one-liners have long since detonated, the martinis have been shaken. What remains is a genteel spectre, smelling of aftershave and anachronism. "He manages to combine uniquely, I think, violence and sexism with a sort of weird camp fussiness about everything he eats and drinks and does," Victoria Coren Mitchell brilliantly ranted on Room 101, "and yet women are supposed to find him irresistible because he has special pens."

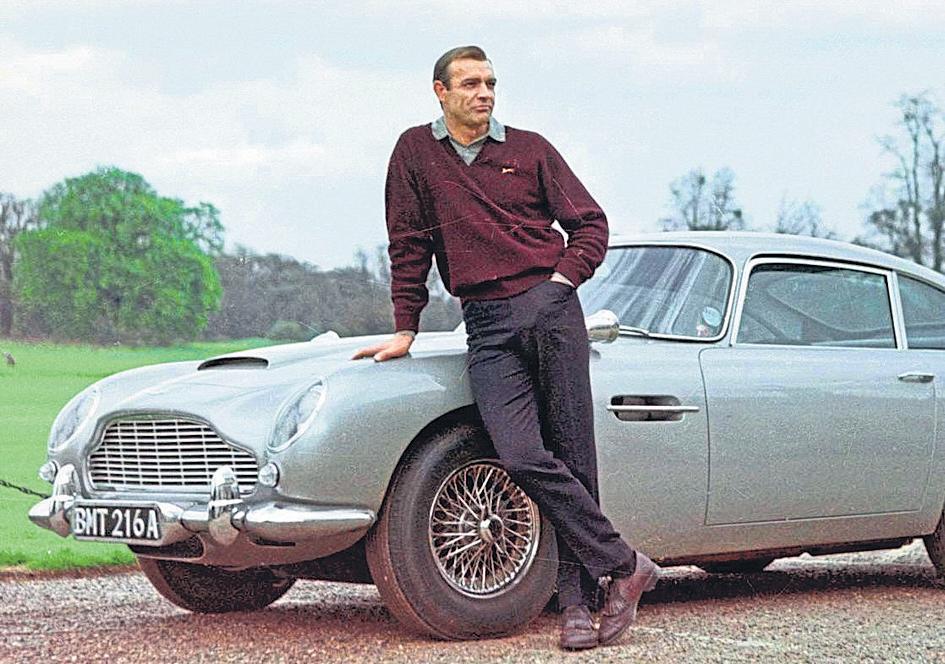

Brutally speaking, Bond is too toxic to live amongst us, and too iconic to kill off entirely. Who, then, should play him? Here is my bulletproof, gold-fingered argument: Nobody. (Insert Monty Norman's theme music in your head as you read ahead.) There is only one who always ran while the others walked. I say let Bond be played, henceforth and forever, by the one and only Sean Connery, resurrected by the necromancy of AI and the black magic of deepfakes.

If cultural baton-passing is inevitable, then surely the only safe hands belong to a digital ghost. Why not give the role to the original, and still the supreme, Commander Bond?

هذه القصة من طبعة August 30, 2025 من Mint Mumbai.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size