يحاول ذهب - حر

Let's hear it for the new music bars

August 09, 2025

|Mint Mumbai

Listening rooms inspired by Japanese 'kissas' are showing up in India, with a focus on intimate bar experiences

Khila Srinivas recalls that the two things she associated with Bengaluru during her college days were beer and music. In the 1980s and 1990s, long before pub culture became mainstream in India, Bengaluru was a rock and jazz hot-spot with bars like Pecos, Styx and Purple Haze serving up a heady mix of music and Kingfisher beer.

So when a spot opened up at the Courtyard, a community space she runs within a repurposed home that hosts a number of restaurants, cafés and bars in seemingly impossible nooks and crannies, she and her team zeroed in on recreating this, but doing something "a bit unexpected".

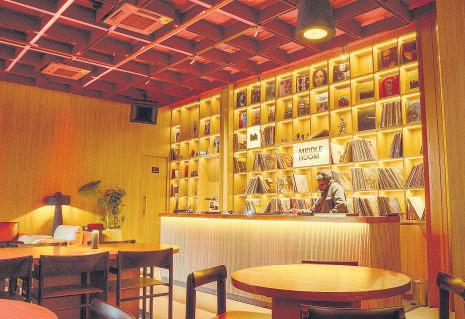

The result is the Middle Room, a music-forward bar inspired by Japanese kissas or listening rooms: intimate, dimly lit spaces where the focus is on listening to carefully curated music on vinyl records through high-end music systems. Along with Baroke and The Dimsum Room in Mumbai and Analogue in Goa, it is among a handful of new bar spaces in India that make playing music the old-fashioned way—on turntables and cassette players—the focus of your experience.

Articles on Japanese listening rooms, which have surged in popularity over the past decade, suggest that they evolved from Japan's music cafés (known as 'ongaku kissas') from the 1920s, with Tokyo listening rooms such as Ginza Music Bar and the Music Bar Cave Shibuya regularly featuring on the itineraries of audiophiles from all over the world.

New listening rooms have emerged in cities like New York, London and Bangkok, blending serious audio-mania with craft cocktails and small bites.

هذه القصة من طبعة August 09, 2025 من Mint Mumbai.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size