يحاول ذهب - حر

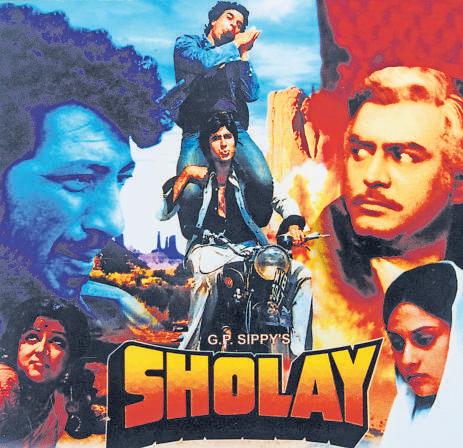

How Sholay Became India's OG Brand IP

August 04, 2025

|Mint Mumbai

As per Meta, nostalgia-based content sees 25% higher click-through rates, 30% longer watch times than generic messaging

In a world flooded with algorithms, franchise fatigue, and forgettable content, one Indian film continues to do what new-age brands desperately chase: command recall, spark emotion, and drive engagement across five generations. That film is Sholay. And it turns 50 this month.

For many, Sholay is the definitive Bollywood blockbuster. But for marketers, it's something more powerful: India's first mass-market cinematic IP, long before the term became jargon. It didn't just make box office history; it gave India a language of branding before we knew what that was.

"Sholay isn't a film that finds its identity solely as a commercial blockbuster—it's an iconic fixture in Indian cinematic memory. So relevant, it has transcended cinema, TV, OTT, and made its way into the meme-world," says Harikrishnan Pillai, chief executive officer and co-founder of digital marketing agency The Small Big Idea. "Advertising has milked its charm time and again: Gabbar selling cement, Veeru promoting mobile networks, Basanti endorsing scooters. Gabbar's voice has been recontextualized in Gen Z reels, now yelling at interns and customer care executives. The characters often show up in cameos and callbacks in newer films."

And marketers have plugged in. In 2023, Coca-Cola India launched a limited-edition 'Basanti's Orange' retro can, a quirky nod to Hema Malini's iconic character. It sold out within days. Bharti Airtel's #KitneAadmiThe reels challenge clocked over 12,000 user-generated videos in 72 hours. Hyundai created an artificial intelligence (AI) filter that let fans 'race' Jai and Veeru's bike through Ramgarh, leading to a 25% bump in test drive leads—no influencer needed.

هذه القصة من طبعة August 04, 2025 من Mint Mumbai.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mint Mumbai

Mint Mumbai

'FPIs, capex and earnings will drive markets up in Samvat 2082'

India is a market where exit is easy but entry is tough, says Nilesh Shah, MD of Kotak Mahindra AMC, the fifth-largest mutual fund based on quarterly assets under management (AUM) as of September-end.

4 mins

October 13, 2025

Mint Mumbai

Dissent aside, Tata Trusts keen to keep Tata Sons private

Tata Trusts remains committed to its decision to keep Tata Sons private, two Tata executives told Mint, hours after the Shapoorji Pallonji Group issued a public statement seeking a public share sale of the Tata Group holding company.

2 mins

October 13, 2025

Mint Mumbai

What the govt's capex growth does not reveal

The government's capital expenditure has surged sharply in the first five months (April-August) of FY26. It has already spent nearly 39% of the annual outlay of 11.2 trillion, a 43% year-on-year jump.

2 mins

October 13, 2025

Mint Mumbai

US seeks inventory model for e-comm

Negotiators cite 'level playing field', move may raise competition

2 mins

October 13, 2025

Mint Mumbai

EQT scraps Zelestra India sale, to pump in $600 mn

For scraps

2 mins

October 13, 2025

Mint Mumbai

INSIDE NADELLA'S AI RESET AT MICROSOFT

Earlier this month, Microsoft promoted Judson Althoff, its longtime sales boss, to chief executive of its commercial business, consolidating sales, marketing and operations across its products. The move was designed gence.

3 mins

October 13, 2025

Mint Mumbai

H-IB fee hike Trump's second blow to gems & jewellery firms

Losing sparkle

2 mins

October 13, 2025

Mint Mumbai

Slow drive for e-trucks as local sourcing rule bites

E-truck manufacturers wary of ambitious indigenization due to concerns over tepid demand

2 mins

October 13, 2025

Mint Mumbai

YOGA, AYURVEDA—INDIA CAN LEAD THE WISDOM ECONOMY

I was watching a video of a meditation studio in Manhattan when it struck me yet again. Twenty people, mostly American professionals, sitting cross-legged on expensive mats, were following breathing techniques that our grandparents and ancestors practised every morning.

2 mins

October 13, 2025

Mint Mumbai

Existing investors pour in $40 million into Dezerv

Wealth management platform Dezerv has raised ₹350 crore (about $40 million) in a new funding round from its existing investors, the company's top executive told Mint.

1 mins

October 13, 2025

Listen

Translate

Change font size