يحاول ذهب - حر

HDFC Bank walks loan tightrope

January 24, 2025

|Mint Mumbai

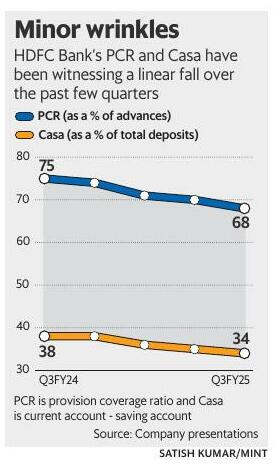

HDFC Bank Ltd performed well in Q3FY25 but reported a high loan-deposit ratio (LDR) of 98%, indicating less-than-ideal liquidity to cover urgent fund requirements.

The lender wants to grow its advances in line with industry levels in 2025-26 and higher than industry levels the following year. That will be difficult given HDFC Bank's focus on lowering its LDR to 90%.

Assuming a deposit growth rate of 15% in FY26, similar to that in Q3FY25, the bank's on-book advances can grow by 10%. HDFC Bank aims to expand its loan book faster than the industry in FY27, but to do that it would have to sell down its loan book to lower its LDR.

In Q3FY25, HDFC Bank's core net income—net interest income (NII) plus fee-based income—rose 10% year-on-year (y-o-y) to ₹38,853 crore. Thanks to a 19% hike in fee income to ₹8,200 crore, the bank overcame the adverse impact of high LDR on loan growth.

هذه القصة من طبعة January 24, 2025 من Mint Mumbai.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mint Mumbai

Mint Mumbai

Paint firms strengthen moats as competition heats up

A bruising market-share battle is escalating in India's ₹70,000-crore paints sector, forcing companies to look beyond aggressive discounting and instead strengthen their foothold in key geographical areas while sharpening their product portfolios.

2 mins

November 28, 2025

Mint Mumbai

Telcos slam Trai penalty plan for financial report flaws

Trai has proposed turnover-linked penalties for filing incorrect, incomplete financial reports

2 mins

November 28, 2025

Mint Mumbai

Consumers warm up to Bolt as it aces 10-min hunger games

A year after launch, Bolt is emerging as Swiggy's fastest-scaling bet.

2 mins

November 28, 2025

Mint Mumbai

Doing India’s needy a good turn: Everyone is welcome to pitch in

What may seem weakly linked with positive outcomes on the ground could work wonders over time

3 mins

November 28, 2025

Mint Mumbai

GOING SOLO: FACING THE GROWING REALITY OF SOLITARY RETIREMENT IN INDIA

What we plan for ourselves isn't always what life plans for us.

2 mins

November 28, 2025

Mint Mumbai

Catamaran to boost manufacturing bets

Catamaran is focused on a few areas in manufacturing, such as aerospace

2 mins

November 28, 2025

Mint Mumbai

How the latest labour codes will benefit most employees

Workers may see an increase in some statutory benefits such as gratuity and leave encashment

4 mins

November 28, 2025

Mint Mumbai

Tune into weak signals in a world of data dominance

World War II saw the full fury of air power in battle, first exercised by Axis forces and then by the Allies, culminating in American B-29 bombers dropping atomic bombs on Hiroshima and Nagasaki.

4 mins

November 28, 2025

Mint Mumbai

Investors expect AI use to soar. That's not happening

An uncertain outlook for interest rates. Businesses may be holding off on investment until the fog clears. In addition, history suggests that technology tends to spread in fits and starts. Consider use of the computer within American households, where the speed of adoption slowed in the late 1980s. This was a mere blip before the 1990s, when they invaded American homes.

2 mins

November 28, 2025

Mint Mumbai

Tech startups on M&A route to boost scale, market share

M&As were earlier used to enter new markets or geographies, but that strategy has evolved

2 mins

November 28, 2025

Listen

Translate

Change font size