يحاول ذهب - حر

Silver Lining

October 03, 2025

|Forbes India

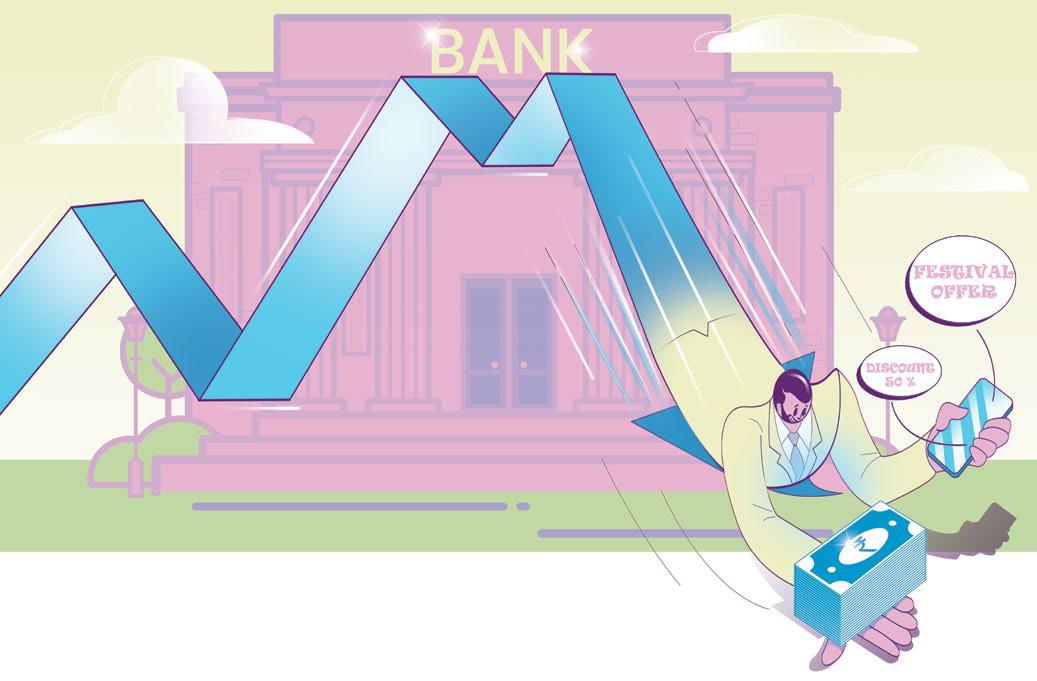

Bank credit growth is weak, but demand for loans and consumption is set to pick up in the festival season. This has led banks to reassess their underwriting models

AMID THE USUAL RHETORIC >that consumption demand in India will pick up in the festival season which started in September, there are dark clouds which loom and threaten to impact both demand and growth.

The pace of incremental bank credit growth in the current year lags at ₹390,000 crore for the five months of FY26, down 23 percent from ₹510,000 crore for the previous year.

However, Moody's-owned credit rating agency ICRA says the recent Good & Services Tax (GST) rate cuts—aimed at spurring domestic demand and to partly offset the tariff impact on exports—would support credit expansion for banks and NBFCs (non-banking financial companies) in the near term.

“Retail demand for loans is not an issue... it is more about lenders pulling back slightly due to concerns of asset quality. They are relooking at their underwriting models and taking a more informed opinion rather than depending only on the bureau score,” Anil Gupta, senior vice president and co-group head, financial sector ratings, ICRA, tells Forbes India.

“There could be concerns in the job market which could impact demand. But we feel it is more of a supply issue, where lenders are reevaluating the creditworthiness of borrowers," Gupta says.

MODEST CREDIT EXPANSION

هذه القصة من طبعة October 03, 2025 من Forbes India.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

Listen

Translate

Change font size