يحاول ذهب - حر

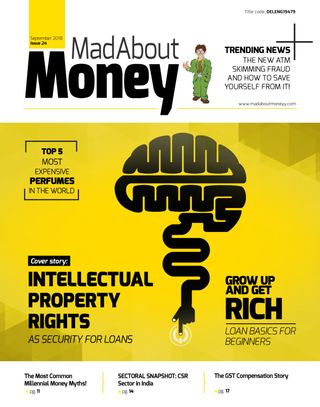

The Most Common Millennial Money Myths!

September 2018

|Mad About Money

Many a times, millennials get stigmatized as being terrible money managers, whether it‘s indulging in binge shopping instead of enjoying life‘s simple joys, taking on credit like a ruthless tornado engulfing a city or flaunting a sky-dive, while watching their emergency funds vanish into thin air.

-

The media especially has sketched a complex portrait of the modern millennial today - one whose inclination for binge-watching has pummelled broadcast TV ratings, one whose dependency on social platforms makes Instagram and Facebook the first and last destination to travel to every day, one whose expectations for online and offline experiences has redefined every industry, and one who is crushed by such an oppressive weight of monetary debt that it‘s shrivelled the housing market. The truth is millennials have grown up in some of the toughest financial conditions there has been in decades. As a result, they need to make a living on a much lower income. Not only are they holding down jobs, they are also the most likely to have a second job, or secondary hustle, to keep their income supplementing.

Having said that, it is time to analyse if these millennial stereotypes are still rightfully deserved! Let us look at the common millennial money myths, and decode the reality underlying them.

Myth1

Millennials are careless about financial investments

هذه القصة من طبعة September 2018 من Mad About Money.

اشترك في Magzter GOLD للوصول إلى آلاف القصص المتميزة المنسقة، وأكثر من 9000 مجلة وصحيفة.

هل أنت مشترك بالفعل؟ تسجيل الدخول

المزيد من القصص من Mad About Money

Mad About Money

The Turkey Story - What Has Gone Wrong For Turkish Finance?

With the fall of Turkish lira, has fueled doubts and fears of financial fallout which could affect the other emerging markets as well as banking systems in Europe.

2 mins

September 2018

Mad About Money

Top 6 Personal Finance Books For Millennials

Millennials Have a Distinct Problem With Finance. This Statement Is a Fact, Plain and Simple. A Large Majority of Them Are in Crushing Debt Because of Student Loans.

2 mins

January 2018

Mad About Money

The 8 Must-know Income Tax Changes From April 1st

Though Finance Minister Arun Jaitley in his Budget Speech this year did not really make any changes in the Tax percentages or income tax slabs, however some proposals announced by him will still have an impact on the amount of tax you pay.

2 mins

April 2018

Mad About Money

If You Can't Handle Pressure You Can't Be An Entrepreneur

Let’s face it, being a successful entrepreneur and making it big in life is actually all about handling pressure and nothing else. Surprised? Well, don’t be. You might think success as an entrepreneur might come from having great ideas, from hard work, from exceptional team handling skills, from being able to predict the market demand, etc…but if you really think about it, keep aside all the fluff and go deep down into the core, it is all about handling the pressure.

2 mins

April 2018

Mad About Money

Grow Up & Get Rich Sip Basic – All That You Need To Know!

Sip or systemic investment planning is one of the most common, popular and also the safest way to invest in mutual funds. Since many people are still confused about sips and how they work, here’s a quick guide to help you understand this investment option and to make the best out of it!

2 mins

April 2018

Mad About Money

It Is Not The Inherited Money But The Effort That Counts

It Is Not The Inherited Money But The Effort That Counts

2 mins

April 2018

Mad About Money

Importance Of Staying Rich Once You Are There

Most of Us Define Success as Having a Good Job or Making It Big in Business, Being Rich and Owning Fancy Cars and Luxury Apartments With a Couple of World Tours Thrown in Off and on. Everybody Is in the Rat Race to Make Money. Making Money and Being Rich Is Everyone’s End Goal or Destination in Life.

2 mins

May 2017

Mad About Money

If Getting Rich Is Difficult, Staying Rich Is That Much More Difficult

Ramesh Chandra Is A Famous Businessman Who Used To Be A Billionaire. He Built Himself From Ground Up. He Owned A Private Ltd. Company And Loved Betting In Real Estate Industry. With Profitable Ventures Of 1980s, He Laid The Foundation Stone For A Well-known Real Estate Company Unitech. He Was Worth Over 11 Billion Usd At His Peak In 2007.

4 mins

May 2017

Mad About Money

Dissecting Assets & Liabilities

Knowing the Difference Between Assets and Liabilities Is the First and Most Important Lesson Towards Gaining Financial Consciousn

2 mins

May 2017

Mad About Money

Teach Your Kids To Handle Money So Your Legacy Is A Blessing, Not A Curse

Each One of Us Has an Expiry Date on Earth and One Day It Will Be Our Children Who Will Inherit Everything We Have Built and Saved. The Inheritance We Pass to Them, Can Either Become a Blessing in Their Lives, or Can Ruin Them for an Entire Lifetime.ess.

3 mins

May 2017

Translate

Change font size