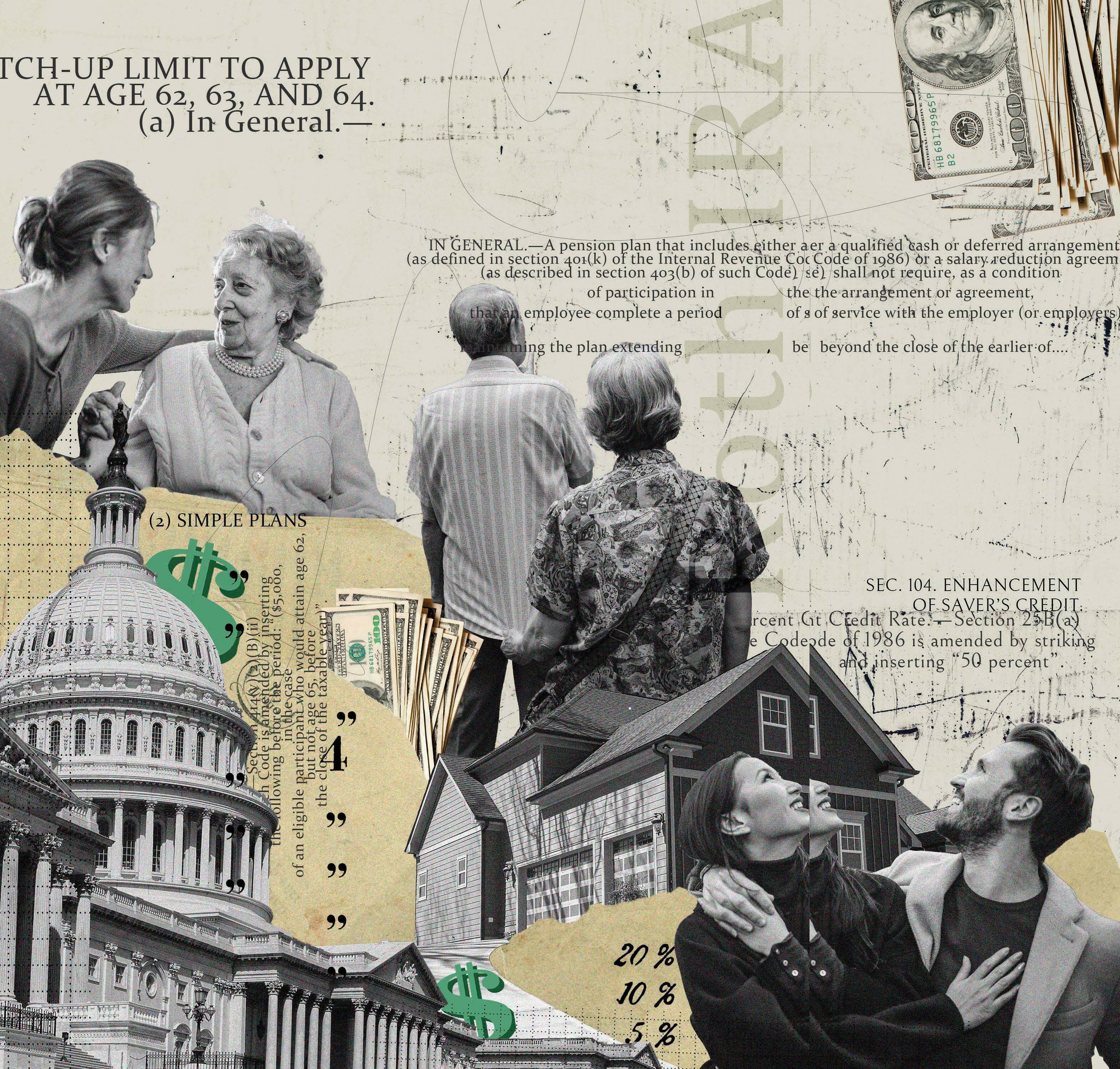

Congress has given retirement savers and retirees a huge gift: a slew of changes designed to help you achieve a more comfortable, financially secure retirement. SECURE Act 2.0, which was signed into law late last year, will affect every stage of retirement planning, from how much you can save in tax-advantaged accounts to how you'll manage your nest egg after you've stopped working. Some of the provisions in this legislative juggernaut won't take effect for a few years, and others will affect only a small percentage of savers. Still, "there's something for everybody" in the legislation, says Catherine Collinson, chief executive officer and president of the Transamerica Institute and Transamerica Center for Retirement Studies. Here's a look at how SECURE Act 2.0 could affect you.

MORE FLEXIBILITY FOR RETIREES AND NEAR-RETIREES

In 2023, the starting age for taking required minimum distributions from traditional IRAS, 401(k)s and other tax-deferred plans increases to 73, up from 72. In 2033, the starting age for RMDS will increase to 75.

The change means that individuals who turn 72 this year will get a one-year delay in RMDs. (Technically, you can wait until April 1, 2025, to take your first RMD, but that means you'll need to take two RMDs in 2025.) The change will be particularly useful to seniors who are still working in their early seventies because they'll be able to delay distributions until they retire and fall into a lower tax bracket. Almost 40% of workers expect to retire at age 70 or older or do not plan to retire, according to the Transamerica Center for Retirement Studies.

This story is from the April 2023 edition of Kiplinger's Personal Finance.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the April 2023 edition of Kiplinger's Personal Finance.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 8,500+ magazines and newspapers.

Already a subscriber? Sign In

A SOLID YEAR FOR THE KIPLINGER 25

All but one of our favorite actively managed, no-load mutual funds gained ground as markets recovered.

YOUR VACATION HOME COULD PROVIDE TAX-FREE INCOME

If you plan to rent out your vacation home, it's important to understand how your proceeds will be taxed.

IT'S NOT YOUR IMAGINATION: YOUR CEREAL BOX IS SHRINKING

To avoid raising prices, some manufacturers are reducing the size of common grocery items. Here’s how to fight back.

SHOULD YOU WORRY ABOUT BEING LAID OFF? IT DEPENDS ON YOUR INDUSTRY

Downsizing has hit certain sectors. But cutbacks may be slowing, and some companies are expanding.

How identity thieves are exploiting your trust

Con artists themselves are disguising as well-known brands to steal your money and personal information.

CUT THE COST OF YOUR WIRELESS BILL

AT&T, T-Mobile and Verizon dominate the market, but smaller outfits offer similar network coverage at lower prices.

MAKING HOME ENERGY MORE AFFORDABLE

Households in need can get energy-efficiency upgrades, help with utility bills and more from this nonprofit.

A HEAD START FOR SAVERS

The Saver's Credit is designed to help low- and middleincome taxpayers contribute to a retirement account.

Say I Love You With a Money Date

To nurture a lasting bond with your partner, meet regularly to talk about money.

Plan for Your Own Elder Care

AFTER I wrote a series of columns in 2022 about elder care planning for family members, I received a number of responses like this one: “What about married couples who have no children or whose family members don’t live nearby?” wrote one reader. “Or a single individual with no close relatives? How should these people plan for their own elder care?”