Over the years, we have put out a number of articles introducing the various trading courses and systems that we publish at Institute of Cosmological Economics, but we have never followed up with reviews and examples of system performance in challenging market settings. A number of our clients have asked us how these different systems have handled the latest market top and ensuing drop that is currently slamming our economy, so I asked each author to provide me with a chart(s) and explanation of how their tools and rules have handled this year's downward move.

Sean Erikson's Trading with Selene's Chariot

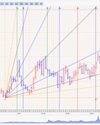

Sean was the first person to provide me with a chart and analysis, not just of this last swing, but of all the major moves since the 2020 top and how the Selene's system would have handled it. Following is the chart he provided:

And here is Erikson's own explanation of these points and channels on the above chart:

A-B: was the 2020 crash. The red channel was known as soon as point A was in. When we moved out of this channel, we moved into the HUGE light blue channel. Note that we had a price target for this, which I've drawn. We're either long the whole time, or we zoom into smaller channels and get long/flat all the way up (but never short!)

C: This is the big top earlier this year in January. The market is forming a head-and-shoulders pattern here, right on top of our target zone. We've set up the pink channel at the point when the top was defined.

D: We drop into the low part of our blue channel for the first time since point B. If we can't break here, we're long up into the pink channel, which is exactly how it worked.

E: This is the right shoulder of the head-and-shoulders. It's in our target zone, and the pink channel is coming down on top of it. Easy selling point here.

F: Revisiting the channel line again. Sell more on the break of the blue upwards channel line.

This story is from the July/August/September 2022 edition of TradersWorld.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the July/August/September 2022 edition of TradersWorld.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

Review of Trading Market Dynamics Using Technical Analysis by Constance M. Brown, CFTE, MFTA

The author, Constance Brown is a well-known experienced trader and technical analyst. She has written several articles for Traders World. She has written a top notch book which you can learn and understand technical analysis from.

WealthCharts Continues to Evolve With New Features and the Champion Trend Pack Indicators

In the April/May/June 2021 edition of TradersWorld magazine, I took my first look at one of the newer trading platforms to come on the market, WealthCharts, and I was impressed by the number of cutting-edge features it contained for active traders and investors.

THE YEAR OF 144, W.D.GANNS BIRTHDAY

Very few people are really doing anything like what Gann was studying, they aren't going back far enough, daily trading isn't what Gann was doing, yet every person in the world is claiming this is Gann's secret, especially all the 24 year olds from India, called 3 books astrologers. Gann was a long term researcher.

Maintaining Emotional Control When the Money is Real

People (including traders) like to believe that they are rational beings who have to deal with emotions.

Quantitative Approach

Being aware of one's surroundings is consciousness. This is what we believe our formula conveys. It presents market movement in the future ahead of market moving events. This also happens as markets approach Fibonacci numbers. We recognize this as a prequel to Fibonacci numbers overall.

Time will tell

The year 2022 was forecasted to take a turn for the better as we have forecasted already in May 2021, based on the Long term Time patterns we have calculated for the future and beyond.

What I Learned Trading Through Four Bear Markets

On Tuesday June 14, CNBC declared the Pandemic Bull dead and announced that a new Bear market has begun. Two questions came to mind.

The Human Factors of Trading and How To Control Them

Let me start by introducing myself. I am a full-time trader, trainer, and software developer in the futures markets.

How to Use Smart Momentum Like a Pro

In our last article of Trader's World (Issue 84), we covered ten key concepts using Momentum for trading. We also covered various definitions of trading Momentum and various general applications.

How Market Timing Gives You The Critical Edge

The Market Timing Report